It looks like you're new here. If you want to get involved, click one of these buttons!

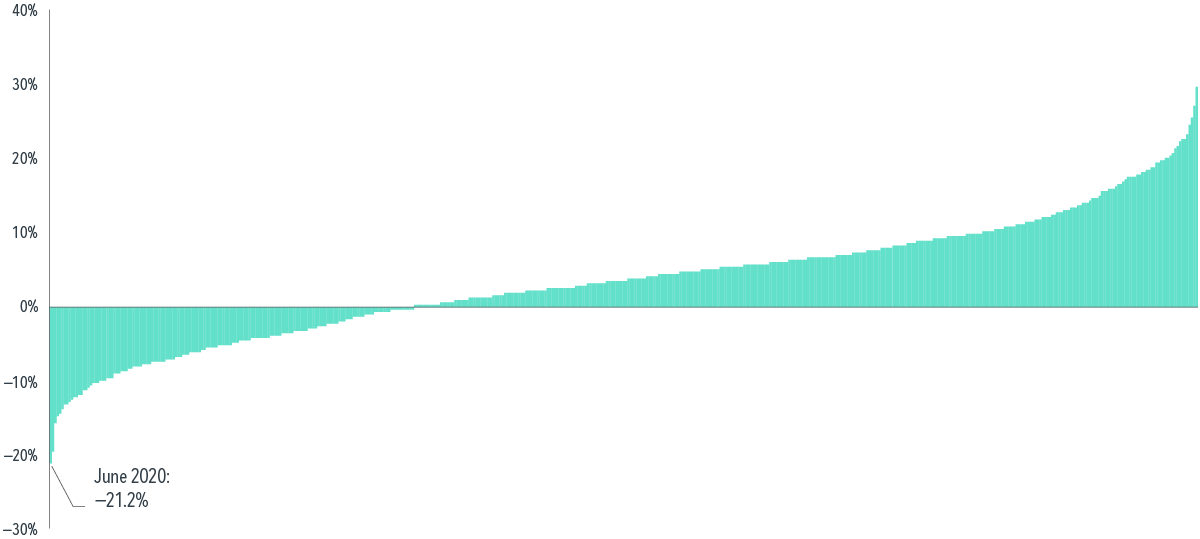

This three-year run [2017-2020] warrants further inspection—just how uncommon was this value premium magnitude? Literally unprecedented, as illustrated by the rolling three-year value premiums in Exhibit 2. Of the 1,093 rolling observations in US history, the three years ending in June 2020 ranked dead last. This is the very definition of an outlier.

ᴇxʜɪʙɪᴛ 2

Back of the Pack

Rolling 3-year annualized return differences for value versus growth,

US market, June 1929–June 2020

Thanks all. Very informative.

FWIW - the password (to a news site) that was “flagged” by Apple consisted of 8 lower case letters which comprised a first name and an initial. Think “denniso”. I’d imagine there’s hundreds of people using that one. :)

However, this has spurred me to rethink and beef-up password security across the wide spectrum of applications.

In his drive to create the world’s most efficient company, Jeff Bezos discovered what he thought was another inefficiency worth eliminating: hourly employees who spent years working for the same company.

Longtime employees expected to receive raises. They also became less enthusiastic about the work, Amazon’s data suggested. And they were a potential source of internal discontent.

Bezos came to believe that an entrenched blue-collar work force represented “a march to mediocrity,” as David Niekerk, a former Amazon executive who built the company’s warehouse human resources operations, told The Times, as part of an investigative project being published this morning. “What he would say is that our nature as humans is to expend as little energy as possible to get what we want or need.”

In response, Amazon encouraged employee turnover. After three years on the job, hourly workers no longer received automatic raises, and the company offered bonuses to people who quit. It also offered limited upward mobility for hourly workers, preferring to hire managers from the outside.

As is often the case with one of Amazon’s business strategies, it worked.

Turnover at Amazon is much higher than at many other companies — with an annual rate of roughly 150 percent for warehouse workers, The Times’s story discloses, which means that the number who leave the company over a full year is larger than the level of total warehouse employment. The churn is so high that it’s visible in the government’s statistics on turnover in the entire warehouse industry: When Amazon opens a new fulfillment center, local turnover often surges....

https://www.taxpolicycenter.org/briefing-book/what-difference-between-carryover-basis-and-step-basisThe Obama administration proposed repealing stepped-up basis subject to several exemptions, including a general exemption for the first $100,000 in accrued gains ($200,000 per couple). The US Department of the Treasury estimated that, together with raising the capital gains rate to 28 percent, this proposal would raise $210 billion over 10 years. Ninety-nine percent of the revenue raised would come from the top 1 percent of households ranked by income.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla