It looks like you're new here. If you want to get involved, click one of these buttons!

https://www.sec.gov/Archives/edgar/data/1260667/000116204420000277/ancora497202005.htmEffective as of May 1, 2020, Mr. Richard A. Barone will no longer serve as a portfolio manager of the Ancora Income Fund and Ancora Special Opportunity Fund. Accordingly, all references to Mr. Barone as portfolio manager in the Funds’ Prospectus, Summary Prospectus and SAI are hereby removed.

Also effective as of May 1, 2020, Mr. James Bernard, CFA, and Kevin Gale will serve as the new co-portfolio managers of the Ancora Income Fund, and John Micklitsch will serve as the new portfolio manager for the Ancora Special Opportunity Fund.

Happened to me when trading futures during my doctoral years. Made insane profits & hideous losses until I found what worked for me and my temperment, then I eeked out a slow steady profit for a while before quitting due to life changes. Now when I play (key word) with futures, which is rarely these days, it's in 1-2 lots only which is barely 1% of my trading account value - nothing extravagant.So I had learned 15 years back. Converted $50K to $75K in 2 months and then turned $75K to $40K in about 8 days. Closed my account and ran. It was a mistake.

This. A well known options hedge fund blew up a few years ago because they were selling Very OTM naked puts on various commodities (similar to what VF is doing on the SPY but I'm sure he's more rational/careful) ... which is a strategy that worked in most market conditions, until it didn't, and their positions experienced a multi-sigma move against them overnight, and BAM! Out of business.PS - There are too many people out there selling too many "strategies". Ignore. You need to know what your objective is. Speculating buying calls and puts? or earn income? mine is the latter. I might have said this before. 0.25% a week should be the target. 1% a month. 12% a year. Now lets say 0.10% a week, 0.4% a month, 4.8% a year. I'll still take it.

PRWCX is by far one of my favorite funds but VLAIX beats it from one month to 3 years and for 3 years is by 2% annually.

A very intriguing fund and seemingly well-allocated fund that I would consider adding to my portfolio -- though I have a hard time paying 1.07 a year for it when the performance (and some holdings) seems quite comparable to PRWCX, which I'm still quite happy with.

Nice to have but not necessary. Gundlach has a huge amount in DBLTX, I still don't own DBLTX for years, same with D&C shop...if I can find a better option.BenWP:Seems to be a fine fund. I’m wondering why only one of the managers has any skin in the game? Kind of surprising on the face of it.

@wxman123, The new baseline asset allocation can be found on The fund's Fact Sheet. As of 5-1-20 it is 50 percent. Under the old Fact Sheet it was 10 percent.

The 31 day trading rule is to prevent the fund from having wash sales. The fund's 31 day trading rule also prevents it from changing investment direction for 31 days from its last buy or sell transaction.

For years, commentators of a conspiratorial lean have half-jokingly suggested that humanity is living in a simulation, à la The Matrix. When it comes to economic activity and markets, that is no longer an absurd suggestion.

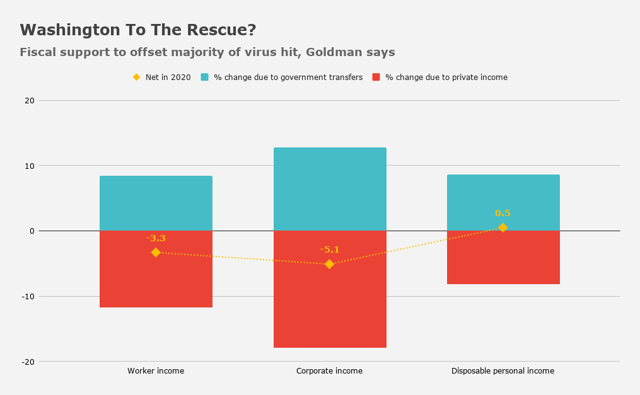

...around three-quarters of those laid-off workers "receive benefits that exceed their former wage," Goldman says.

Goldman's projections actually call for a small increase in disposable personal income.

But there is a problem related to living in a simulation:Again, we are living in a simulation.

Another thread of the article discussess Modern Monetary Theory and ties it into current Fed and Treasury activities. Here is a sample:The Treasury can make up for people’s lost wages, but people need the things wages buy. So replacing lost wages and revenues will not be enough for long: the economy has to produce goods and services.

Here is the link to the article:The US can always buy whatever there is to buy that's denominated in US dollars. It has no need to borrow dollars from anyone else because it is the issuer of those dollars. The US can spend too much, which risks stoking inflation, but the US does not, will not, and has never, needed to borrow dollars. Suggesting otherwise is to traffic in patent nonsense.

Why do governments sell bonds whenever they run deficits?...By selling bonds, they maintain the illusion of being financially constrained.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla