It looks like you're new here. If you want to get involved, click one of these buttons!

That sounds like an offer from Vito Corleone. Recommend people avoid the "lifetime" subscription.Interesting site.

I found this amusing...

What Do You Get With This (LIFETIME) Wall Street Journal Subscription?

10 years of uninterrupted, limitless, and personalized digital access for to the WSJ website.

Interesting site.I found Barron's & WSJ unresponsive and "sticky" in the past (difficult to cancel). Have had good luck with some of the resellers. Currently have a 1-year digital Barron's from top subscription deals. Have chosen not to link the site because it would pull up a page full of Ads. Savings may not be great. But you get a fixed term paid in full up front without automatic renewals. Works for me.

https://www.treasurydirect.gov/savings-bonds/ee-bonds/may-1997-through-april-2005/These EE bonds have 2 maturity dates

EE bonds that we issued from May 1997 through April 2005 have an original maturity date part way into the bond's 30-year life, as well as a final maturity date at the end of the bond's 30-year life.Issue date of EE bond Original maturity date

May 1, 1997 through May 1, 2003 17 years from issue date

June 1, 2003 through April 1, 2005 20 years from issue date

https://etf.wi.gov/boards/deferredcompensation/2025/06/05/dc10d5/directFor years, Will has been working alongside Jason, Asher, and the entire Equity division, sharing how he manages the Contrafund franchise, his investment philosophy and approach, and best practices and key learnings over different market cycles.

Jason and Asher have a long history of discussing stocks and collaborating with Will and the broader team. Will has worked with Jason for 34 years and with Asher for 17 years. Jason served as assistant portfolio manager with Will on Contrafund from 1994 to 1996. Jason and Asher have been serving as co-portfolio managers for more than seven years on Fidelity Advisor Equity Growth Fund and Fidelity Growth Discovery Fund. Additionally, they have co-managed Fidelity Capital Appreciation Fund together for over six years. This partnership provides strong continuity across the Contrafund strategies and the team. Their investment philosophy is highly aligned to Will’s approach.

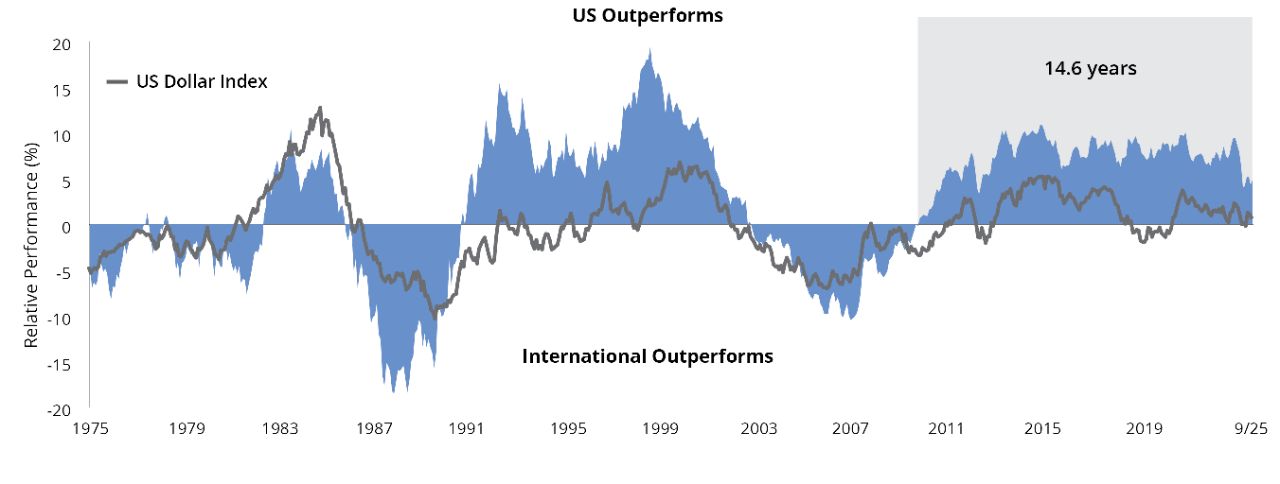

Dedicated exposure: EADOX. Broader mandates but heavily into EMs these days: APDPX, EAGMX, EGRAX. I haven't owned any of the etf/cef lineup for a long time; never had much luck with them, but then the dollar tanking is a relatively new phenomenon favoring all foreign assets, for the first time really in ~ 20 years during Bush II's reign.Bought a new position in EISIX and got to thinking about India like rforno posted. But haven't made that leap yet, being very heavy in EM already, though that's mostly in debt.

What are your go-tos for EM debt? I'm leaning towards EMD or FEMB at the moment.

Pretty funny.

Pelosi has been feeding her husband inside info for years, and how has he enriched them by millions? Why are both not in jail?@jafink63- The New York Times reports that Donald Trump has used his presidency to enrich himself and his family by $1,408,500,000 in just one year.

You have to give the man credit- a new high in presidential theft and gluttony.

I have been keeping many experts' quotes over decades.David_Snowball said:

Vanguard, and others, appear to believe that over the next 5 to 7 years you'll be able to make about as much money in the Total Bond market index as in the Total Stock Market index but with less volatility. Research Affiliates reaches pretty much the same conclusion and their asset allocation research isn't trash.

In my limited experience, 10 (about equally weighted) seems to be the minimum number of individual stocks to hold inside a portfolio basket / sleeve if you like sleeping at night. (Might even be higher). But the 6 I held for a couple months proved too volatile. Years past I got away with much higher allocations to particular stocks (occassionally over 5% of portfolio). Escaped without damage. But in hindsight it was foolish."Buy low, sell high."

I don't invest in individual stocks (except for one stock) but I would heed the following advice if I did.

Bolding was added for emphasis.

"Don't gamble; take all your savings and buy some good stock

and hold it till it goes up, then sell it. If it don't go up, don't buy it."

—Will Rogers

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla