Investors race back to U.S. bond funds Inflated Optimism?

Economic Overview:Week Ending January 20, 2017 © 2017 Payden & Rygel All rights reserved.

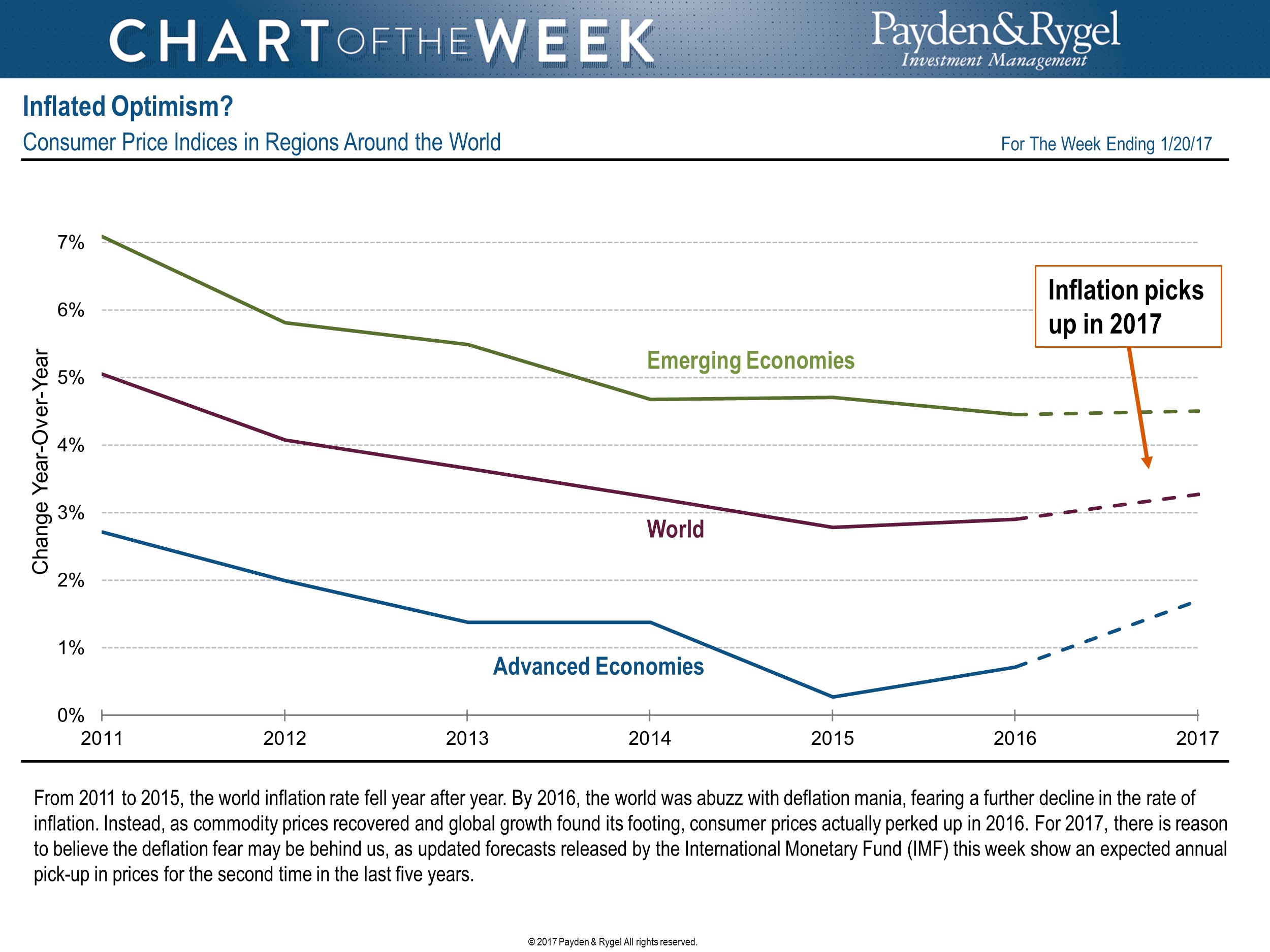

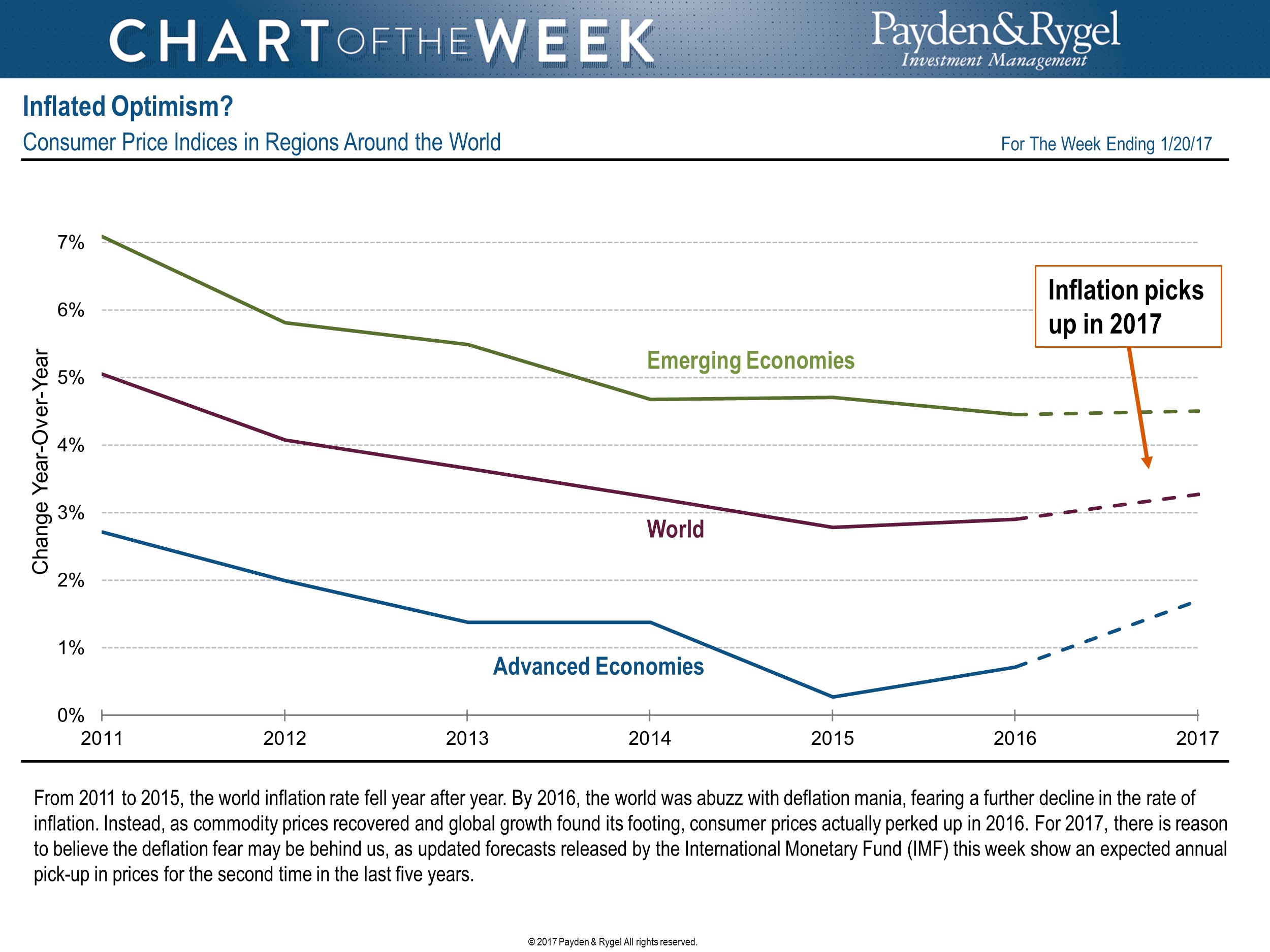

From 2011 to 2015, the world inflation rate fell year after year. By 2016, the world was abuzz with deflation mania, fearing a further decline in the rate of inflation. Instead, as commodity prices recovered and global growth found its footing, consumer prices perked up in 2016. For 2017, there is a reason to believe the deflation fear may be behind us, as updated forecasts released by the International Monetary Fund (IMF) this week show an expected annual pick-up in prices for the second time in the last five

years.

Highlights of the Week:Treasuries:

Highlights of the Week:Treasuries: Treasury markets absorbed stronger inflation and housing data this week. Yields ground higher every day in this holiday-shortened week. The icing on the cake was Yellen’s speech on Wednesday where no one anticipated any remarks with regards to monetary policy and received hawkish ones at that.

Securitized Products: The ABS market is following along with Ford auto receivables bringing a fully compliant ABS deal both regarding the 5% risk retention requirement and full loan level disclosure. The queue for next week is also full of issuers ready to hit the marketplace.

High Yield:In this environment, the market has room to compress further, particularly given low expected default rates. Prudent, valuation-conscious investors should be rewarded.

Emerging Markets: The latest activity

data from China was a reminder of the country’s adjustment from investment-led to consumption-driven growth. December industrial production and xed asset investment growth eased modestly to 6.0% year-over-year (y/y) and 8.1% y/y, respectively, while

retail sales came better than expected at 10.9% y/y.Municipals Municipal bond funds experienced a second consecutive week of in ows, taking in an additional $511.74 million. Investor demand has been strong, with $10 billion in new issuance well received and broad follow-through in secondary trading.

https://www.payden.com/weekly/wir012017.pdf

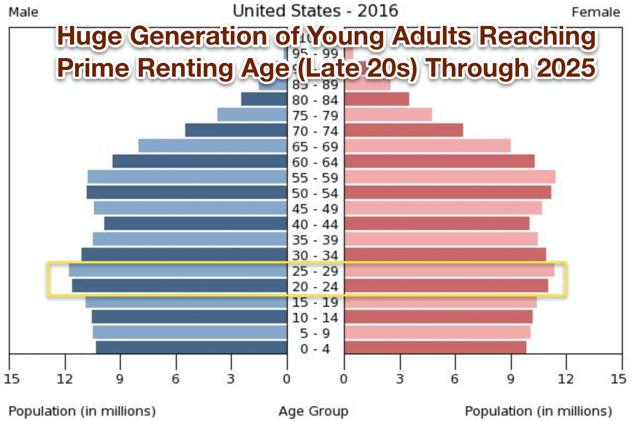

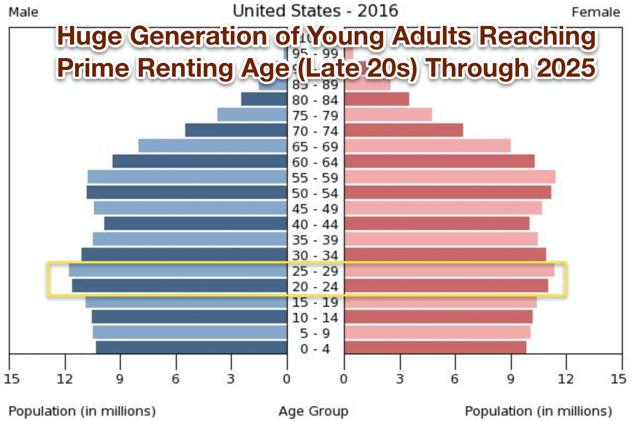

Honey. I think the kids are (finally ) leaving ! + We Look Back At Obama Years From Hoya Capital

...demographics over the next ten years are highly favorable to apartment demand. Rent growth data will certainly be interesting over the next several years: it will be a battle between high levels of supply and high levels of demand.

Real Estate Weekly: Trump Takes Office, We Look Back At Obama Years

Hoya Capital Real Estate Jan. 20, 2017

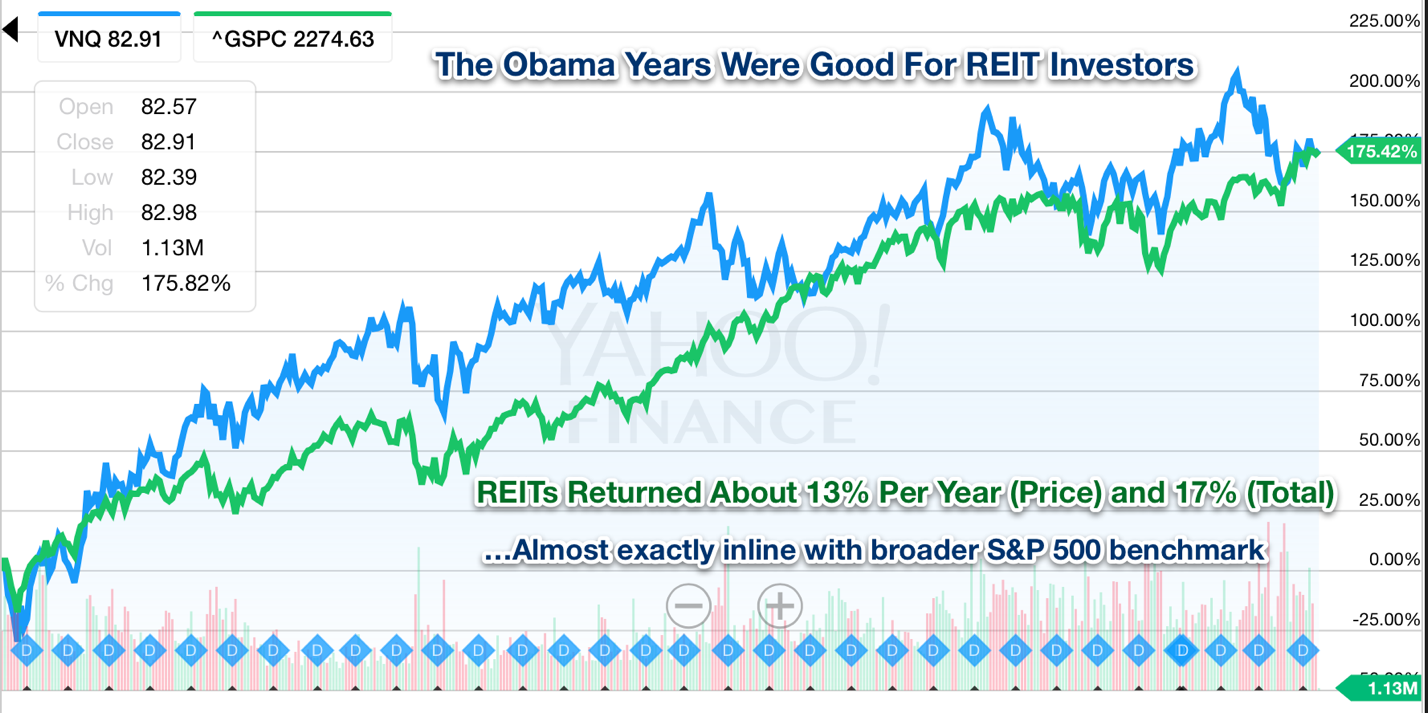

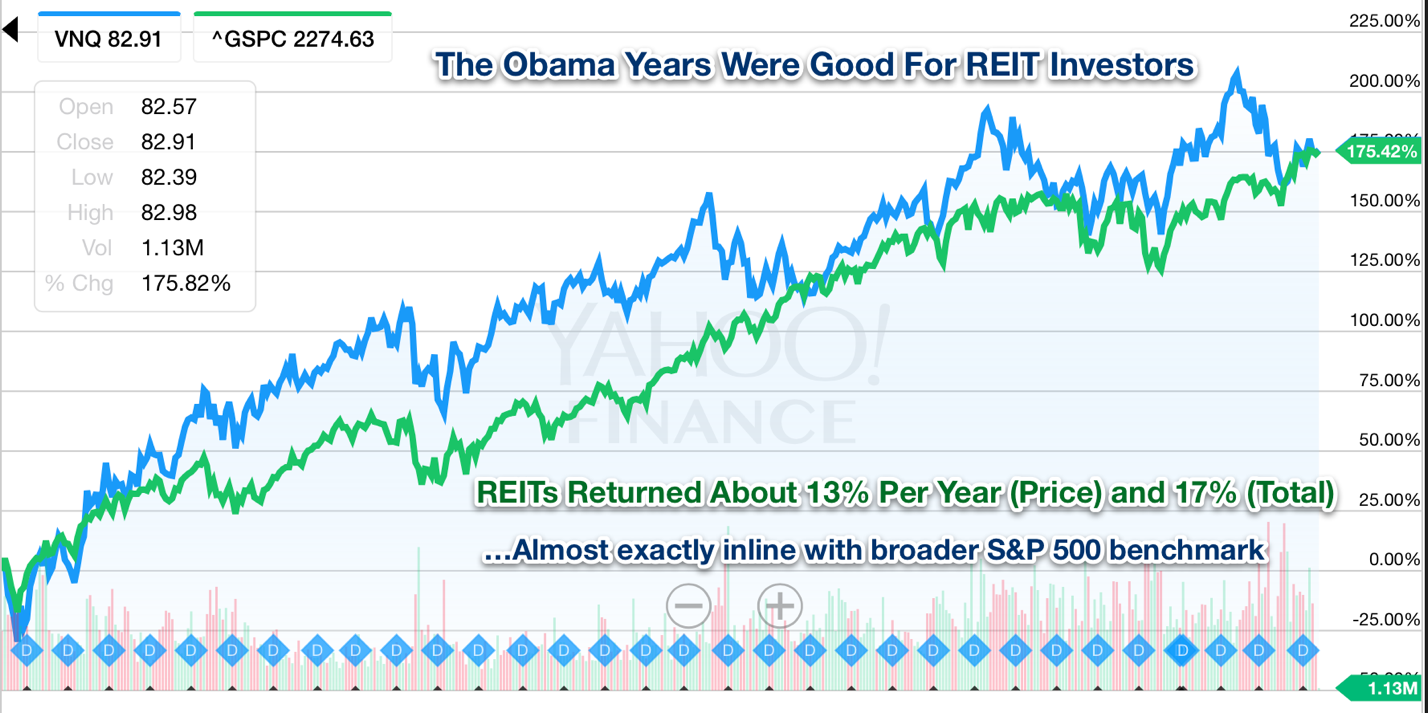

With Donald Trump taking office this week, we think it's interesting to look back at the performance of REITs under the Obama Administration.

REITs returned an average of 13% per year (price) and roughly 17% including dividends. Interesting, this 175% holding period return is almost exactly inline with the broader S&P 500 index.

It's important to note the context, though. Obama took office at almost the exact bottom of an 80% decline in REIT values over the preceding 18 months as the REIT ETF bottomed just a month after inauguration.

Bottom Line So how will real estate perform under Trump? Well, we can pretty confidently say that commercial real estate won't perform as well under Trump as they did under Obama, but that should be rather obvious. Trump enters office at a time that commercial real estate values are near record highs and valuations appear healthy. Based on prevailing cap rate and economic growth expectations, REIT investors should continue to expect a 5-8% average annual total return with plenty of annual volatility.

http://seekingalpha.com/article/4038310-real-estate-weekly-trump-takes-office-look-back-obama-years

Treasury yields are up since Election Day. The benchmark 10-year Treasury is currently trading at 2.47% (as of Jan. 19, based on daily data via Treasury.gov). That’s up from 1.90% on Election Day and close to the highest level in two years.

http://www.capitalspectator.com/moderate-us-growth-prevails-at-dawn-of-trump-era/

Lewis Braham: Vanguard's Climate-Change Dismissal "President Trump is committed to eliminating harmful and unnecessary policies such as the

Climate Action Plan and the

Waters of the U.S. rule. Lifting these restrictions will greatly help American workers, increasing wages by more than $30 billion over the next 7

years."

https://www.whitehouse.gov/america-first-energy(Embedded links to Climate Action Plan and WOTUS are mine, not in original.)

Assume for the sake of argument that the dollar figures are correct, and disregard any additional health care costs due to increased pollution. At 150M+ workers in the US, that comes out to $200/worker over seven

years, $28/year, 50c/week. $30B to workers sounds like a lot until you do the arithmetic.

Start following the real money (read: oil, coal, agribusiness).

European Value Mutual Fund When looking at MEURX returns, keep in mind that it regularly hedges currency. This has made it look especially good over the past few

years. I think it's a good low cost fund, but because of the hedging it behaves differently from most other funds.

As Vanguard points out, hedging involves additional costs. Although the increased operational costs are reflected in a fund's ER, the additional transaction costs (1-18 basis points) are not.

See text and Figure 2 on p. 4.

https://personal.vanguard.com/pdf/ISGCMC.pdfFWIW, I'm not a fan of hedging, but have invested in at least three different hedged funds I can recall, so it's not something I'm dogmatic about.

Lewis Braham: Vanguard's Climate-Change Dismissal Most people don't pay any attention to what they invest in through their 401k or even a broker. I tried for years to get my Austinite ex hippy sister to pay attention to the multiple large cap funds in her 401k... couldn't be bothered. My son believes in Tesla but won't ask his employer to add TIAA's socially conscious fund to their 401k.

We can add to Vanguard's insensitivity or ignorance ( depending on your fervor of belief in climate change) their opaqueness about their management process.... there may not be a familial dynasty behind the scenes but have you ever tried to figure out how you (supposedly a shareholder) can influence policy at Vanguard, or how mush their mangers are paid or even how they are paid? They don't get stock but there is a special "investment account" that they own shares of. I have tried but have been unsuccessful in finding an annual report or even balance sheet of the Vanguard Management group, even though as a shareholder they "work for me".

The same supposedly "independent" Board of Trustees at Vanguard oversees 198 separate funds, in addition to their day jobs. Obviously they spend little time on proposals that Vanguard management does not support or wants them to see

Perhaps increased pressure on those who are public figures (Amy Gutman head of U Penn) might have an effect... But given the amount of time she spends on Vanguard ( her Wikopedia page lists about 10 other commissions etc she is involved in) and the paltry ($230,000 ) compensation she gets, I doubt it

Investors race back to U.S. bond funds Perhaps this is part of rebalancing as equity has out paced bond sector last year. Also there are more people retiring in combing years and they depend on bond for their income.