It looks like you're new here. If you want to get involved, click one of these buttons!

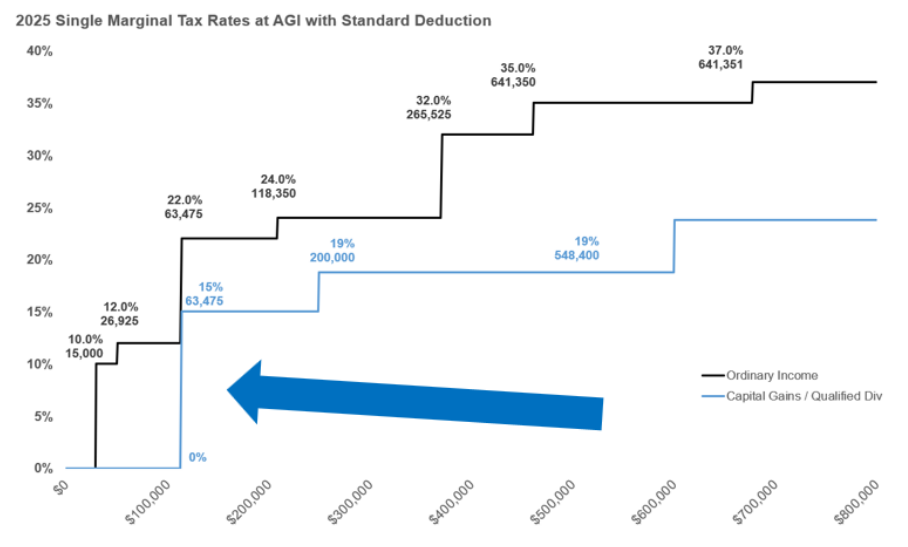

For 2024, individuals with taxable income below $47,025 ($94,050 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold you could effectively lock in tax-free long-term gains. The idea would be to realize just enough LTCG to stay within the 0% tax bracket. You also have to tack on the standard deduction which is $15,000 for individuals or $30,000 for a married couple. That means don’t have to pay federal income taxes on your long-term capital gains until your income exceeds a little more than $63,000 (single) or $126,000 (married couple). So you could realize more than $63,000 ($126,000) in capital gains and dividends without paying any federal income tax.

Unfortunately, that "above the line" deduction was temporary, it was only allowed in 2020 and 2021. There is a movement to restore it and make it permanent.I believe one can claim $300 on standard form. I"m probably wrong as I haven't done my Taxes in the last 7 or 8 years. I realize $300 isn't going to help much, but to some people every little bit saved is a plus.

Shorter for longer. :)Sold DODIX and invested in ICMUX with the funds. In October ‘24 I had thought DODIX would be an appropriate place to re-enter intermediate bonds in 2025. After the last few years in bond fund land, my patience is short (as will my bond fund duration).

Yeah, you seem to have missed my point. And other posters routinely missing my points is the primary reason why I don't post a lot. That said...

Seems to me to be two completely different skill sets-

• A): Insuring that numbers are being computed and accounted for properly, according to established accounting principles.

• B): Manipulating numbers in an attempt to increase their values and sums to the maximum extent possible, while also remaining reasonably consistent with safety.

And like most skill sets, there may be some degree of natural interest or aptitude involved, but education and training are the most important factors.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla