Bond mutual funds analysis act 2 !! Numbers as of 9/30/2020. Observations for one month as of 9/30/2020:Multi

Observations for one month as of 9/30/2020:Multi- Flat for the month but securitized shined with 1-2.9%/

HY Munis – Flat for the month but Nuveen (NHMAX,NVHAX) did better.

Inter term – (-0.1%) for the month. TGLMX (mostly securitized) did 0.4%.

Bank loans – up 0.3-4% for the month.

Uncontrain/Nontrad -0.2 for the month. Securitized(JASVX,DFLEX)

HY+EM – HY -0.9 and EM=-1.7% for the month with correlation to stocks.

Corp – down month. PIGIX -0.4%.

SP500(VFIAX)-Down monthth at -3.8, YTD=

5.

55%.

PCI-CEF huge upside at 7.1%. YTD still at -13.7%

My own portfolioI started the month with IOFIX+DFLEX and replaced DFLEX with JASVX+NHMAX. It’s pretty obvious that funds loaded with securitized bonds are doing well. HY Munis don’t have a momentum yet but I bought NHMAX because it’s in my taxable and it showed a better momentum than others but the last 2 days are down, I was too early but now I’m watching closely. It was another good month for me.

American Airlines Leaves Small Texas Company Holding The Bag On 1.7 Million Pounds Of Nuts An example of how Covid-19 effects continue to ripple through the economy.

Forbes“

In March ... American Airlines, without notice, cancelled its order for 1.35 million bags – or 1.7 million pounds – of mixed almonds, cashews, pecans and pistachios, the much-loved mix that it had been serving warm to its premium-class passengers for more than 30 years.“

-

Related : After posting the above, this more sobering story broke:

Fort Worth-Based American Airlines to Cut 19,000 Jobs CNBC The flowers died on fields of hope

All the way from east to west

Where the mighty winds will blow

I'll put my dreams to rest

This scary monster is very much alive

Like a hundred years ago From:

The World We Used to Know

"Off-Topic" previously "Off Limits"... now "back in service".

If you invest $750 every month for 20 years at a 7% return, how much it will be worth? The above report is from 2015. What happened to Median household income in the United States from 1990 to 2019? It went up very nicely from 2015 to 2019 under you know what president

Correlation is not causation.

One Fund for A Small IRA VLAAX has good recent performance and is catching the attention of many. I want to point out this fund holds a weight of 47 in the growth arena per M* which is much higher than an avg 50/70 fund with a yield much lower 0.38% than an average balanced fund. The P/B is also indicating higher than avg at 4.09. Not saying you should buy it and not saying you should not buy it. I am suggesting you understand what you own.

What's going on at the Matthews funds? Take a look at Fidelity Emerging asia. Provides exposure to China and other key Asian emerging markets like India but that is balanced out by holdings in Japan. The portfolio manager has a stong background as a technology analyst and thus both tech and communication services are well represented. What I really like is the consistency of the fund. It rates in the top 10% of its category for the past 1, 3 ,

5 and 10 year periods. I plan to add it right after the election. Here is the report from morningstar..

Fidelity® Emerging Asia (FSEAX) Performance | Morningstar

https://www.morningstar.com/funds/xnas/fseax/performance

One Fund for A Small IRA If I were making such an investment today I would choose MSFBX.

If you invest $750 every month for 20 years at a 7% return, how much it will be worth? The current U.S. minimum wage is $7.25 an hour. An 8-hour 5-day work week nets $290. A month’s work nets about $1160.00. Those $750 monthly contributions would consume 65% of the individual’s pay. (Hopefully, there’d be minimal payroll taxes.) After contributing the $750, the individual would have about $400 left over - or $100 per week to survive on.

Any suggestions for living on $100 weekly? In the early going I’d watch at groceries for the 50% clearance sales on hot dogs and other packaged meats when the marked date was about to expire. Still perfectly fine eating. For drinking? There’s Old Milwaukee in a pinch. Haven’t tasted it in years. Rough around the edges. But in this case, you’d be drinking to your eventual riches. Might make it more palatable.

BTW - Attempts to raise the minimum wage are met with admonition by some that the lower wage is better for workers because if they were paid more they’d be replaced by automation or a foreign worker. So the lower wage is being kept in place to benefit them. Chop-logic. Gotta love it!

Can You Relate? I'm more comfortable losing $1000 in a mutual that losing $500 in stocks. There is no logical explanation but that's how I'm wired and why I only trade stocks hours to days.

LOL. I am the same. I think I get annoyed at the work it takes to have conviction about one stock....then it doesn't work out.

One Fund for A Small IRA Is there a reason You need to move this fund to another? I show it has had a 35% return over the last year! I my opinion if it isn't broke don't fix it.

It also had a maximum drawdown of

58% in 2008-09 and took 6 years to recover. Time to take profits off the table and move it to something a bit less volatile.

One Fund for A Small IRA Is there a reason You need to move this fund to another? I show it has had a 35% return over the last year! I my opinion if it isn't broke don't fix it.

Can You Relate? I'm more comfortable losing $1000 in a mutual that losing $500 in stocks. There is no logical explanation but that's how I'm wired and why I only trade stocks hours to days.

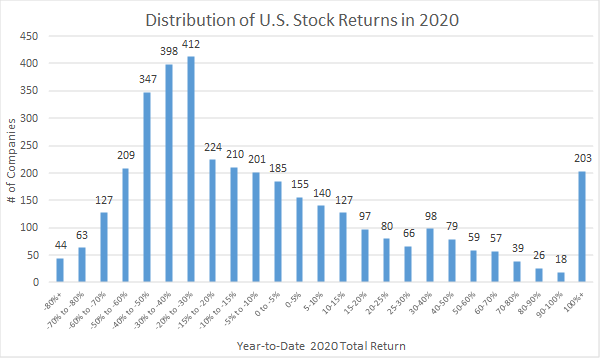

Distribution Of U.S. Stock Returns In 2020

Can You Relate? Yes - but only when the fund that “blew up” is held within my speculative sleeve (the equivalent of gambling). That represents anywhere from 0-15% of investments. One of the spec holds, PRLAX, has gotten shelled the past 3 or 4 sessions after rising in value for several months. WTF do I know about what’s currently going on in Brazil, Mexico or Argentina? ... Nothing!

Peter Lynch said to invest in things you understand. I went and did the opposite. :)

The torture process doesn’t carry over to the other 85-95% that’s held inside the static allocation. On any given day, some parts will shine while others fizzle. That’s an accepted part of being widely diversified.

If you invest $750 every month for 20 years at a 7% return, how much it will be worth? My point is that median income increase under the current president was driven more by the top than the middle and bottom. Also, it is evident that for most Americans $750 a month into the stock market is fantasyland.

If you invest $750 every month for 20 years at a 7% return, how much it will be worth? @LewisBraham My key point: Trump is the first president since 1998 to increase the median income significantly but I can't find it in the Lib media.You are absolutely correct about the gap. It started decades ago under both Dems+GOP presidents and will continue that way.

- Jobs in STEM will continue to make more while most others will not.

- CEOs now are making 2

50-300 times their average employee while they used to make about 30 times in the 80"

- We are in a global comparative world where goods/services have been going to cheaper places.

- Easier repetitive jobs are replaced by automations and robots. The scary thing, more complicated jobs have been replaced too and median jobs disappeared.

What are your 5 or 6 largest holdings? *Or where are the bulk of your holdings?* @FD1000; I'm guessing you bought in around 3/2

5/20 ?

Derf

Nope, I sold over 90% at the end of 02/2020 and the rest days later.

Made several good trades with QQQ+PCI in 03/2020.

Start investing back in bond funds to over 99+% in 04/2020.

I had a huge % in GWMEX for several months. I owned IOFIX only in the last several weeks.

I wish I was brave enough to buy IOFIX on 3/25/2020. It made over 50% since then.

How do you square owning IOFIX with your later comment in this string to avoid risky funds?

I'm a trader and don't recommend what I do to others. My posts are generic unless someone asks me specifically about my portfolio.

This thread isn't about avoiding risky funds. Please read the original posts "What are your

5 or 6 largest holdings? *Or where are the bulk of your holdings?"

BTW, I don't believe in just lower risk funds, I believe in great risk/reward funds. You should look for funds that have good performance but also good risk attributes(SD, Max Draw, Sharpe, Sortino).

For allocation my go 2 funds are:

Moderate=PRWCX. In the last several years VLAIX is good too.

Conservative=VWINX,VWIAX

One Fund for A Small IRA PLBBX is a balanced fund with no transaction fee at Fidelity.

That’s one that’s slipped below my radar but the downside capture of 12

5 gives me pause.

If you invest $750 every month for 20 years at a 7% return, how much it will be worth?

David Giroux, Finding Overlooked Opportunities in the COVID-19 Market From Giroux's article:

DG: One of our favorite sectors continues to be utilities. The equity market has yet to fully grasp just how attractive utilities are today relative to the past. The emergence of low-cost renewables is a game changer for the industry. This megatrend will likely continue for the next two decades to drive an elongated cycle for replacing coal, nuclear, and inefficient natural gas with wind, solar, and battery solutions that can drive mid- to high-single-digit rate base growth, mid-single-plus earnings per share growth with attractive dividends, only modest growth in customer bills, and a dramatic reduction in carbon emissions. Given this very attractive long-term outlook combined with this significant underperformance, we believe the long-term opportunity for utilities is compelling.

Utilities is the one sector in which higher taxes don’t negatively impact earnings, as taxes are a pass-through item from a regulatory standpoint. Utilities would also benefit from a likely extension, and potential expansion, of wind and solar tax credits for renewables.

Also discussed opportunities in fixed income.

https://troweprice.com/personal-investing/resources/insights/finding-overlooked-opportunities-in-the-covid-19-market.html?cid=PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009&bid=506188743&PlacementGUID=em_PI_PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009-PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009_20200929