It looks like you're new here. If you want to get involved, click one of these buttons!

The whole point was to show that bonds have different categories and managed flexible funds can have several categories where the managers can make changes between categories and the duration. Not all the funds I mentioned were intermediate bonds, Bank loan funds, such as EIFAX have very short term duration.he cites FED funds rate, but his examples are all over the board intermediate bonds.

I have been posting about investing for over 10 years. I have made many posts about investing from several weeks to several decades (comparing VWINX to VWELX since the early 70"). It all depends on the subject at hand.three years seems to be FD's go-to for making points. Anything can happen with bond funds (or stock funds) over a three year period.

Nit-picking, it's not about feeling or what you heard, that was a typical bilpek comment."bonds are doomed" does not express my feelings nor have I even heard it before. I hear a lot about bonds being a poor investment at low rates but no so much at higher rates.

mmm...My OP was generic. I can't find anything in it that talks about what I do or my style. I looked at a period where the Fed raised the rate the most in the last 10 years and it just happened within the that time.I think a good deal of the problem is that the OP is a trader, while most of us hold bond funds for stability and over longer periods than 3 years.

True the equity/bond asset allocations are a bit different. Still, the equity profiles are similar:The equity profiles are quite similar, .....Important to note significant differences between the two funds in equity holdings: VWINX 36% with HBLYX holding 44%.

https://dodgeandcox.com/pdf/shareholder_reports/dc_income_semi_annual_report.pdfIn the first six months of 2020, we established new positions in over a dozen corporate issuers at what we believe were exceptionally attractive valuations. These purchases, along with many additions to existing corporate issuers, increased the Fund’s Corporate sector weighting by 11 percentage points to 45%.

To fund these purchases, we sold certain Agency MBS and U.S. Treasuries, which now make up 31% and 8% of the Fund, respectively. We lengthened the Fund’s duration modestly through the aforementioned corporate bond purchases, though we remain defensively positioned with respect to interest rate risk.

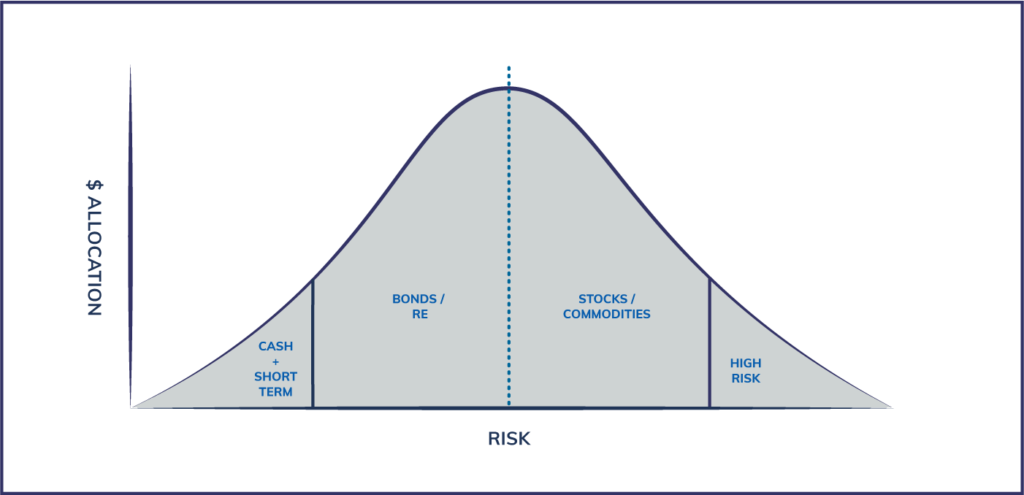

Are riskier-hedges-are-displacing-u-s-debtMany investors have no choice but to stick with Treasuries because of fund mandates, or they do so since they’re unconvinced it’s worth taking a chance on something else. Yet others are exploring riskier assets -- from options to currencies -- to supplement or fill the role of portfolio protection that U.S. government debt played for decades, a trend that highlights the dangers that the Fed’s rates policy can create.

and,

Options Hedge

Swan is a longtime skeptic of Modern Portfolio Theory, which was made famous by economist Harry Markowitz in the 1950s and is the thinking upon which the 60/40 mix is based. Two decades ago, Swan created a strategy of using long-term put options plus buy-and-hold positions in the S&P 500 to limit huge losses during economic downturns.

That approach has since been expanded to include positions in exchange-traded funds indexed to small cap stocks, and developed and emerging markets. It relies on constant allocations of 90% to equities and 10% to put options purchased on the underlying ETF portfolio.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla