Punch Bowl More than Half Full ?

Net flows into ETFs totaled $52.6B in July, according to FactSet, with just about every asset class seeing fresh money, particularly U.S. equities, which drew in $30.1B.

U.S. fixed-income saw a robust $11.6B of inflows - a possible source of concern for some analysts, noting high demand for both "risk-on" and "risk-off" assets. It wasn't just Treasurys though, as the data shows plenty of demand last month for investment-grade corporate paper, emerging-market bonds, and high-yield debt.

http://seekingalpha.com/news/3198724-etf-inflows-soar-julyGraphics from

@Ted's original article from MarketWatch

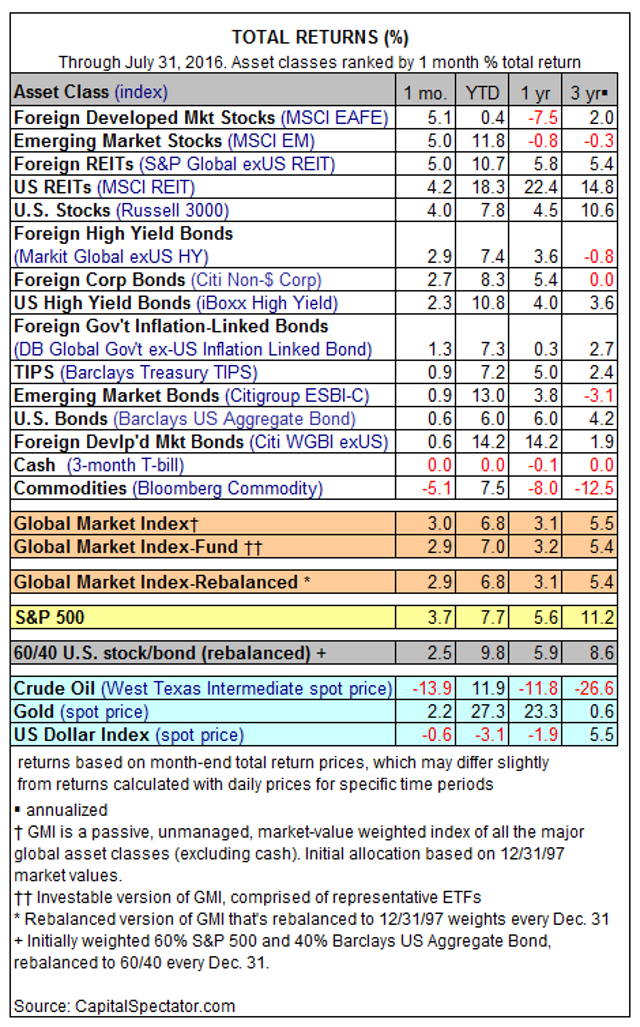

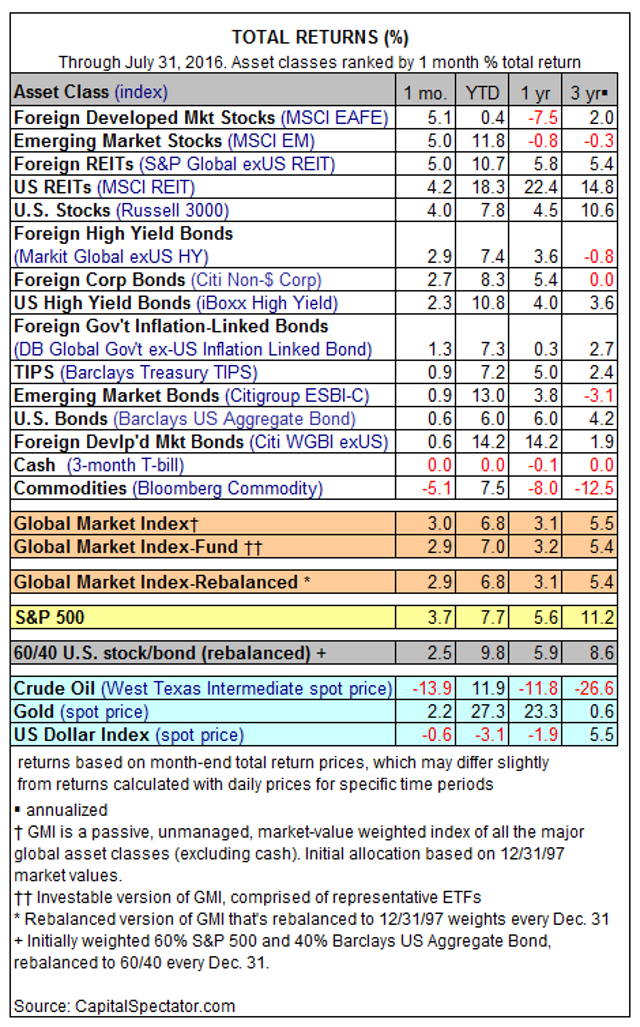

http://seekingalpha.com/article/3994368-major-asset-classes-july-2016-performance-review

http://seekingalpha.com/article/3994368-major-asset-classes-july-2016-performance-reviewBEIJING (Reuters) - A raft of global risks that could adversely affect the United States remains on the horizon and requires close monitoring, Dallas Federal Reserve Bank President Robert Kaplan said on Tuesday.

Kaplan, along with several other Fed policymakers, has urged renewed caution in trying to lift rates again...

"I am closely monitoring how slowing growth, high levels of overcapacity and high levels of debt to GDP in major economies outside the U.S. might be impacting economic conditions in the U.S.," Kaplan said at an event in Beijing.

In his second appearance within a week, Kaplan, a centrist at the U.S. central bank, repeated that he continues to back tightening monetary policy in a gradual and patient manner.

Chief among his concerns is sluggish U.S. growth exacerbated by a changing world in which economies are more globally interconnected.

"It's going to take many years and maybe decades for China to manage through overcapacity and high levels of debt to GDP," Kaplan added. "I think sudden jarring traumas ... may make that adjustment more challenging."

On Monday New York Fed President William Dudley, a permanent voter on the Fed's rate-setting committee, said that while it was "premature" to rule out a rate increase this year,

negative economic shocks were more likely than positive ones.https://www.yahoo.com/news/feds-kaplan-urges-patience-raising-rates-points-global-115047772--business.html?ref=gsA Brief Note From G M O's Ben Inkster in their 2nd Quater Newsletter

"So what can we do to protect portfolios ..."

"a deeper analysis of what led returns to be disappointing for

the asset classes that have lagged may help investors avoid the error of abandoning decent assets just when their time may be about to come."

This is the nature of the discount-rate-driven gains for asset classes such as equities, bonds, and real

estate. Beyond the discount rate change, it is still true that US equities have done surprisingly well,

emerging equities surprisingly badly, and so on. But even if those “surprises” are permanent (and

our guess is that for the most part they are not) the fact that the valuation of US equities has risen

guarantees that the future returns to US equities from here will be lower than they would have been

otherwise, and the same is true for all of the long-duration assets whose discount rates have fallen

over the period.

The most shocking hole that will be blown through people’s portfolios is if discount rates rise again

fairly quickly. Even if the circumstance is one in which the global economy is doing well, the impact

of a 1.

5% increase in the discount rate on equities from here is a fall of over 30%, which would

almost certainly be enough to swamp the earnings impact of the decent growth. For bonds, of course,

there would be no possible counter to the discount rate effect. For a portfolio that is fully invested in

long-duration assets (i.e., consists of a combination of stocks, bonds, real estate, and private equity),

the possible performance implication is on the order of the falls experienced in the financial crisis –

perhaps a 20-33% fall depending on the weightings – despite the fact that the global economy was doing just fine.

So what can we do to protect portfolios against this possibility? One answer would be to hold cash, which, as a zero-duration asset, would be a beneficiary of rising discount rates. The trouble with cash, of course, is that if the discount rates do not rise, it is doomed to deliver little or nothing. What

we would ideally like is to hold a short-duration risk asset – one where if nothing changes we are getting paid a decent return but where a rising discount rate will not destroy multiple years’ worth of

returns.

We believe alternatives fit the bill pretty well. If things hold together, we should expect to

make money from activities such as merger arbitrage or exploiting carry trades or global macro. If the

world does surprisingly well and causes investors to raise their expectations for discount rates, these

strategies should be largely unaffected and could still make money. If we head into a severe recession

or financial crisis, they will presumably lose money, as we saw in 2008, but that is no different from

other risk assets. To be clear, I’m not arguing that the returns to alternatives are likely to be a lot

higher than we have seen since 2009-10. Alternatives have been mildly disappointing since 2009, doing almost 1% worse than one might have expected. The more sobering truth is that the 4.2% return they have achieved since then simply looks pretty good given the other choices on offer, and

their lack of vulnerability to rising discount rates is a comfort in a world where almost everything in

a traditional portfolio is acutely vulnerable to discount rate rises should they happen.

Today does not look like a great opportunity to reach for risk, despite the temptation in the face of unprecedentedly unattractive yields on government debt.....

The charm of alternatives today is that we believe they should perform similarly in either the

temporary or permanent shift scenario, and there are almost no other assets with expected returns

above cash for which that is the case. The problem with alternatives is that they are more complicated

to manage than traditional assets, generally have higher fees associated with them, and require more

oversight. Normally, those problems are enough to make them less appealing than traditional risk

assets such as equities and credit. Today, however, they seem well worth the extra effort. Their

generally disappointing performance over recent years, rather than a sign to dump them once and for

all, should probably be recognized as a signal of their potential utility in the market environment we face in the coming years.

There is no panacea for the low returns implied by asset valuations today. Anyone suggesting

differently is either fooling themselves or trying to fool you. But piling into the assets that have been the biggest help to portfolios over the past several years, as tempting as it may be, is probably an even worse idea than it usually is. And a deeper analysis of what led returns to be disappointing for

the asset classes that have lagged may help investors avoid the error of abandoning decent assets just when their time may be about to come.

https://www.gmo.com/docs/default-source/public-commentary/gmo-quarterly-letter.pdf?sfvrsn=30A Q R funds

http://quicktake.morningstar.com/fundfamily/aqr-funds/0C000021ZL/fund-list.aspxArbitrage funds

http://quicktake.morningstar.com/fundfamily/arbitrage-fund/0C00001YYL/snapshot.aspxLong-Short Equity: Total Returns

http://news.morningstar.com/fund-category-returns/long-short-equity/$FOCA$LO.aspxMultialternative: Total Returns

http://news.morningstar.com/fund-category-returns/multialternative/$FOCA$GY.aspx