What's shocking about the table is that they would not only cherry pick data, but double and triple count it. And not even label entries the same as in the study. And did you notice that this list of top ten costs has eleven items (see #8)? Makes one wonder about the basic arithmetic in the study.

#6, "Total medical out-of-pocket costs". In the study, that's called "Total medical expenses, not including premiums." Either way, one would naturally expect that to represent, well, everything that a "typical" senior paid for health care (doctors, hospitals, pharmaceuticals, durable (and not so durable) medical equipment, etc.). Everything outside of insurance premiums; at least that's what "out-of-pocket" usually means.

So many things are wrong with this line:

- If this counts all medical expenses other than premiums, then including line 1, "prescription drug ... out-of-pocket" is a double count.

- In reality, this line supposedly represents how much the government pays for Medicare expenses. So it's what seniors don't pay. According to the study, these figures come from the 2020 Medicare Trustee report, Table V.D1, p. 118 (pdf p.124). Further, while the 2020 figure matches the Trustee report, the 2000 figure doesn't quite.

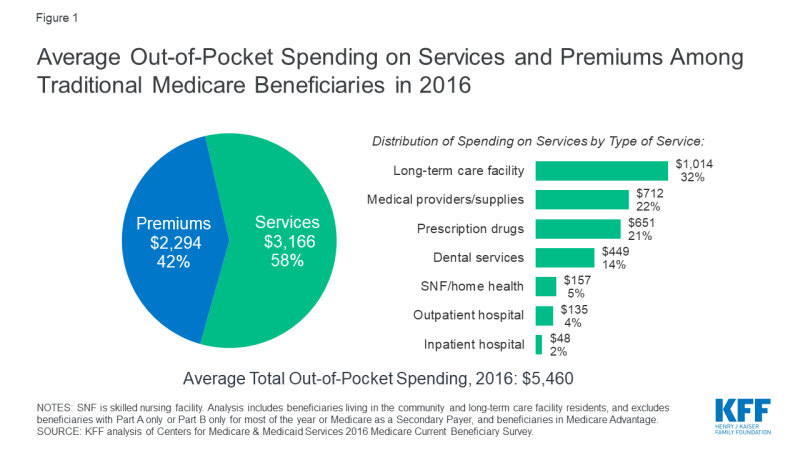

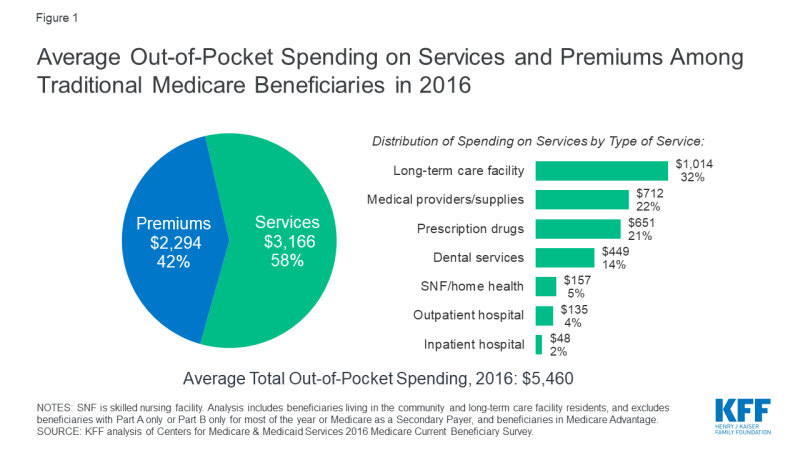

- If one really compares Medicare out-of-pocket costs with Medicare premiums, they're much closer to 1-to-1 (2-1 if one excludes Medigap) than the 10-to-1 suggested by lines 2 and 6 in the top ten table). Here's a KFF graph from 2016 with a pie chart comparing the two. I doubt the ratios have shifted radically since then, especially given the way premiums are set.

https://www.kff.org/medicare/issue-brief/how-much-do-medicare-beneficiaries-spend-out-of-pocket-on-health-care/

I'll take KFF any day over an advocacy group that doesn't explain how it comes up with its numbers and misrepresents what they mean.

In their supposed

methodology document, the Senior Citizens League does not provide the criteria for selecting the 39 "typical" categories.

In saying that it "uses somewhat similar weightings" to CPI-E, it fails to explain why it deviates from the CPI-E weightings, let alone how it calculates the deviations. While it gives you broad categories weightings (e.g. it weights medical 14.1% vs. CPI-E's 12.2%), it doesn't give you a breakdown of weights for the various medical components like the aforementioned lines #2 (Part B premiums) and #1 (prescription drugs), or its several other "typical" medical categories.

But the worst part, the very worst, is that it prices 10 pound of potatoes (line item #7) at Sam's Club in Charlottesville Virginia. Now I ask you, how many seniors belong to Sam's Club and buy 10 pound sacks of potatoes at at time? :-)