>> The Ulcer Index is about half of the S&P 500 meaning half as risky.

Is that what UI means / is supposed to mean?

IMHO the answers are: no (it doesn't mean this) and yes (it is supposed to mean this).

Leaving aside what "risk" even means, I've never been a fan of using second moments (roughly, squares) to compute numeric values that supposedly quantify risk. (For anyone who has taken Physics I and forgotten second moments, here's a

refresher on moment of inertia.)

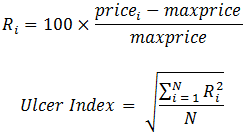

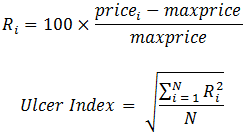

Why square the drawdowns (retracements) before summing? The

original writing defining ulcer index gives this explanation:

A better method [than merely summing] is to add the squares of the retracements, in order to penalize large retracements proportionately more than small ones.

If drawdown A is twice that of drawdown B, it is already being penalized twice as much by simply using its magnitude. Squaring that figure distorts this. And what is magical about squaring, as opposed to, say cubing, or taking the retracements to the 1.

5 power? (These are all positive numbers we're using.) Why is squaring the appropriate "penalty"?

Over a four month period, consider a fund that loses 10% in the first month, but immediately recovers in month 2 and is flat for the remaining two months. Compare that with a fund that loses

5% in the first month, but stays down

5% over the full four month period.

These funds have the same ulcer index, but do they have the same "risk"?

In the calculation below, I dropped month 0 that established the maxprice for simplicity.

SQRT[(10^2 + 0 + 0 + 0)/4] =

5 = SQRT [ (

5 ^ 2 +

5^ 2 +

5^2 +

5*2)/4]

The first fund had twice the drawdown, but for only 1/4 of the time. We can debate whether it presents exactly half the risk (twice as deep, 1/4 as wide). But ISTM that this fund presents less risk than the second fund, where you're sure to lose money no matter when you sell during this four month period. The amount at risk (i.e. risk of loss) is only half as much, so we do have to account for that as well.

Next, consider two funds, each of which recovers 1%/month. One has a 10% drawdown (so it takes 10 months to recover); the other has a

5% drawdown (taking

5 months to recover). The first fund plunges twice as deep and takes twice as long to recover.

My intuition or if you prefer, sense of risk, consequently says that the risk of the first fund is 4x the risk of the second. We can see this geometrically.

Think about it as triangles, where height is the drawdown and the horizontal axis is the month.

One triangle has a height of 10 (initial drawdown) and takes 10 months to decline to zero. The other triangle has a height of

5 (initial drawdown) and takes

5 months to decline to zero, after which the fund's performance is zero (flat).

I'm guessing that this is somewhat similar to what

@lynnbolin2021 had in mind when writing:

The Ulcer Index measures the length and duration of the maximum drawdown over a period of timeBut I could simply be projecting my own interpretation on top of this writing.

("Maximum" drawdown may have been a misstatement since UI uses actual drawdowns, not maximum. The original writing on UI offers this comment: "Some investors prefer to use the maximum retracement rather than an average. This reveals the worst experience over the test period, but it emphasizes a single event to the exclusion of all others.")

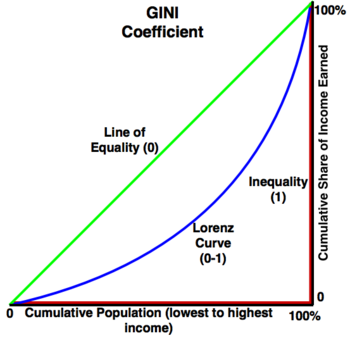

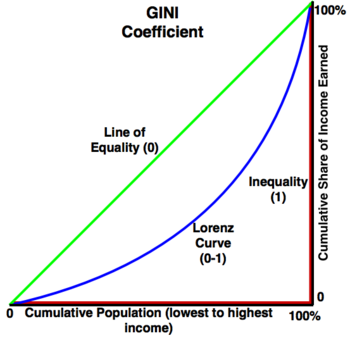

If one is familiar with the

Gini coefficient, one is familiar with another metric that is calculated using area. Here, the cumulative amount of inequality is graphed. and the measure of societal inequality is taken as the area between perfect equality (the green line in the graph below) and the actual cumulative disparity (the blue line). Computationally similar to measuring the area of the triangles above - the area between the ideal (no drawdown) and the actual drawdown month by month.