It looks like you're new here. If you want to get involved, click one of these buttons!

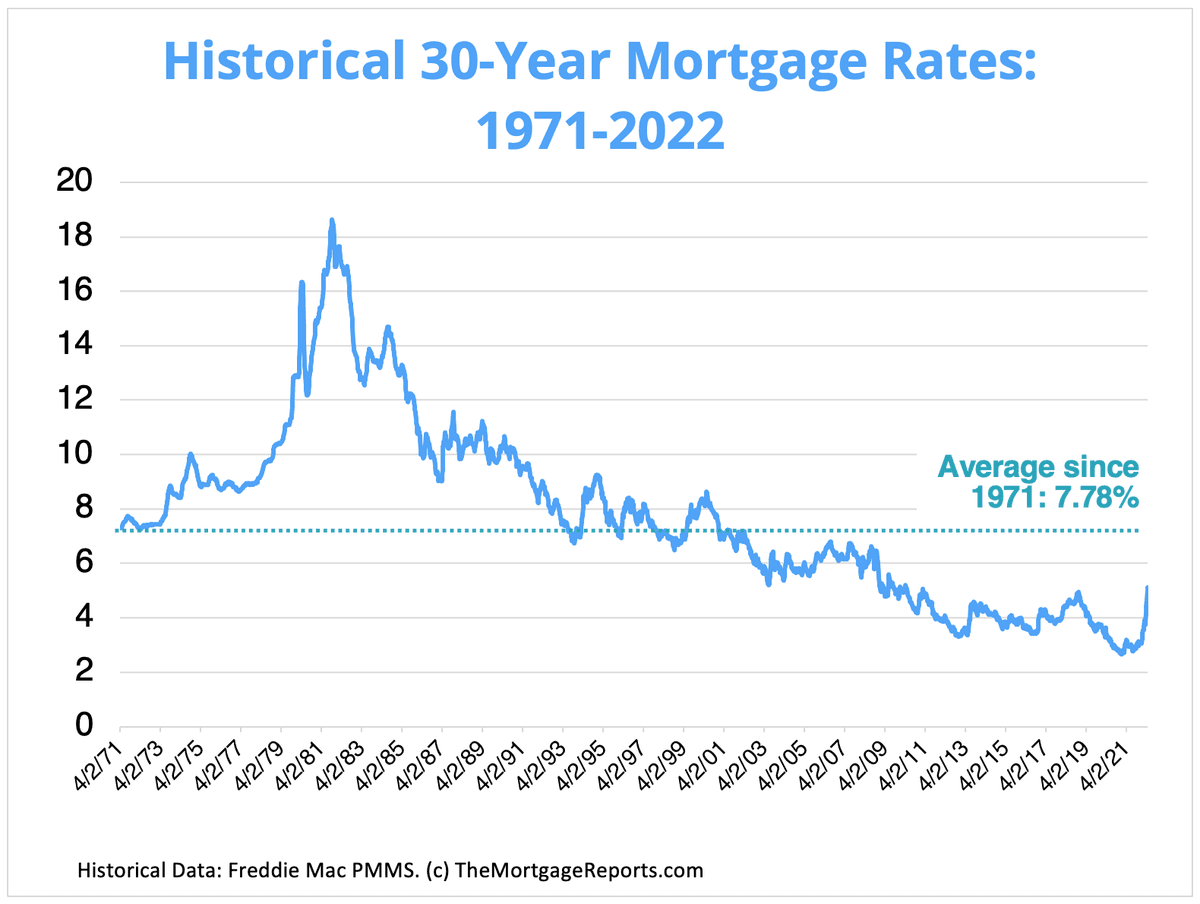

You may be conflating two periods - 1974± and 1980±Those of us who can remember Dreyfus Liquid Assets Money Market fund paying 12%, CPI at 14% treasuries at 16% and mortgages at 18% suspect it could worse.

The DJI was 600

California-based Intuit Inc. will suspend TurboTax's "free, free, free" ad campaign and pay restitution to nearly 4.4 million taxpayers ...

Under the agreement, Intuit will provide restitution to consumers who started using the commercial TurboTax Free Edition for tax years 2016 through 2018 and were told that they had to pay to file even though they were eligible for the version of TurboTax offered as part of the IRS Free File program.

Consumers are expected to receive a direct payment of approximately $30 for each year that they were deceived into paying for filing services, [NY State Attorney General] James said. They will automatically receive notices and checks by mail.

☞ Free link to NPR Article

Crude prices jumped on Wednesday after the European Union proposed a ban on oil imports from Russia as part of a new round of sanctions targeting the country after its invasion of Ukraine. The details are still being hammered out, and the proposal needs to be unanimously agreed upon by the 27 members of the bloc before going into effect.

Brent crude, the global benchmark for oil, jumped more than 4% on the news and was trading at around $110 a barrel.

Europe is hugely dependent on Russian oil imports. It gets about a quarter of its oil from Russia, by far the biggest single source of oil imports into the continent. Ultimately it's expected that an EU ban on Russian oil imports will result in a loss of 2 million barrels a day from Russia.

When the price of oil spiked following Russia's invasion of Ukraine, the average price of gasoline in the U.S. shot up above $4 a gallon and has remained there since, according to data from the American Automobile Association.

However, the emergency release of about a million barrels a day from the strategy oil reserve has tempered gas prices. If it hadn't been for the emergency oil release, gasoline prices would have jumped even higher than they already are. But there are obvious big question marks about what happens after the U.S. reaches its planned 180 million barrel limit. A lot will depend on the conditions in crude markets at the time.

The oil cartel OPEC+ is in the best position to make up for lost supply, but that's unlikely. Russia is a member of OPEC+, and moves against Russia risk jeopardizing the alliance that has long been important to stabilizing the global price of oil. A bigger concern is that some members of OPEC+ are struggling to meet their current quotas due to political strife and underinvestment.

OPEC+ has been gradually increasing production by about 430,000 barrels per day since last summer, in a steady effort to get back to pre-pandemic production levels. OPEC+ meets on Thursday and is expected to maintain its current plans to increase production only gradually.

The U.S. is the world's biggest producer of oil, but most of that oil is consumed domestically. Drilling more is a lot easier said than done. It takes months for even the fastest producers to build a new well. And labor challenges and supply chain problems are lengthening that timeline. Oil companies are still proceeding cautiously- they lost a great deal of money in the oil crash at the beginning of the pandemic, and growing concerns about environmental impact are making them hesitant to invest further.

The U.S. Energy Information Administration forecasts that U.S. producers will increase output by an average of 800,000 barrels a day this year. But it's hard to go faster than that, and that simply doesn't make up for the expected loss of Russian oil.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla