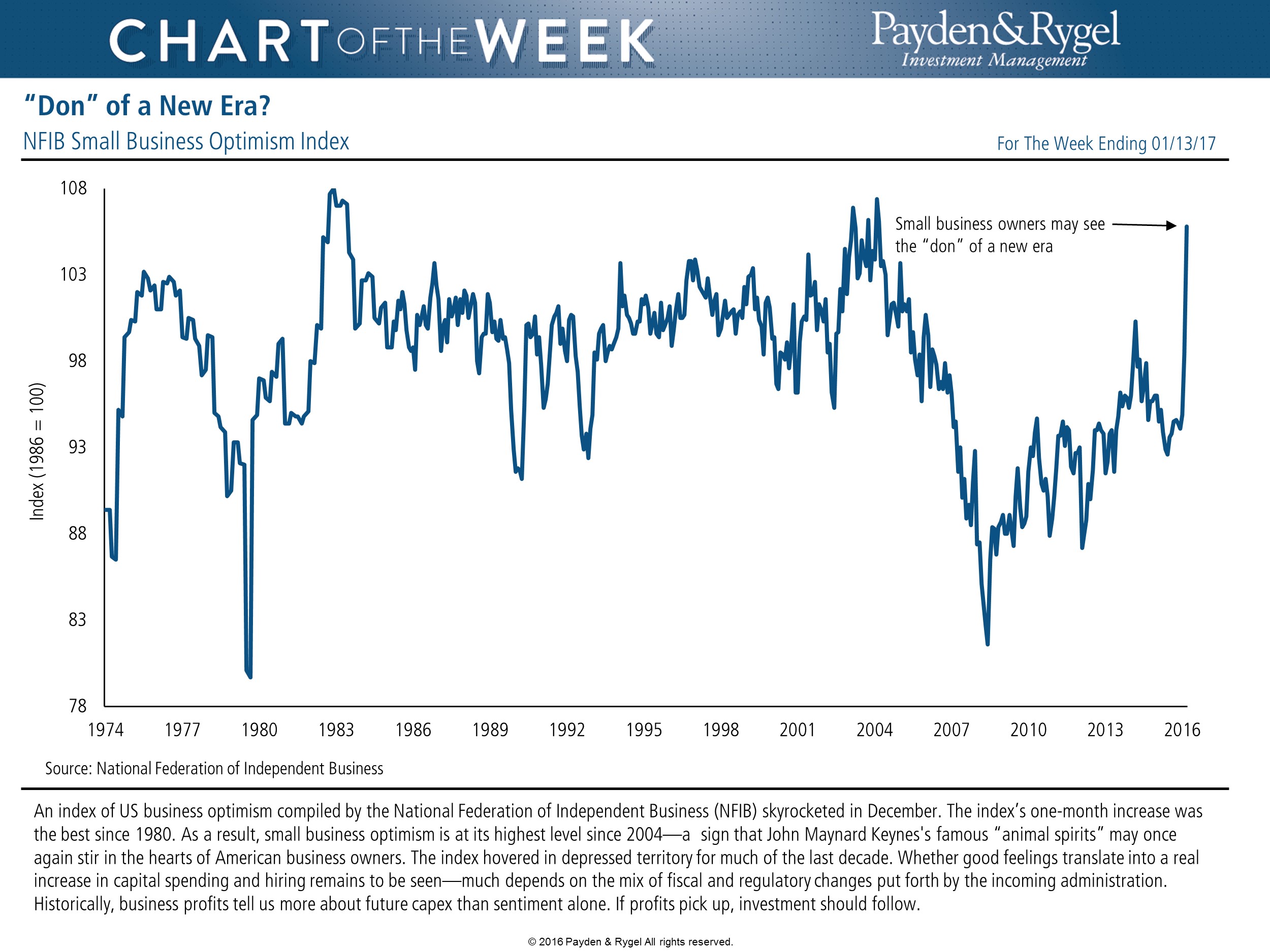

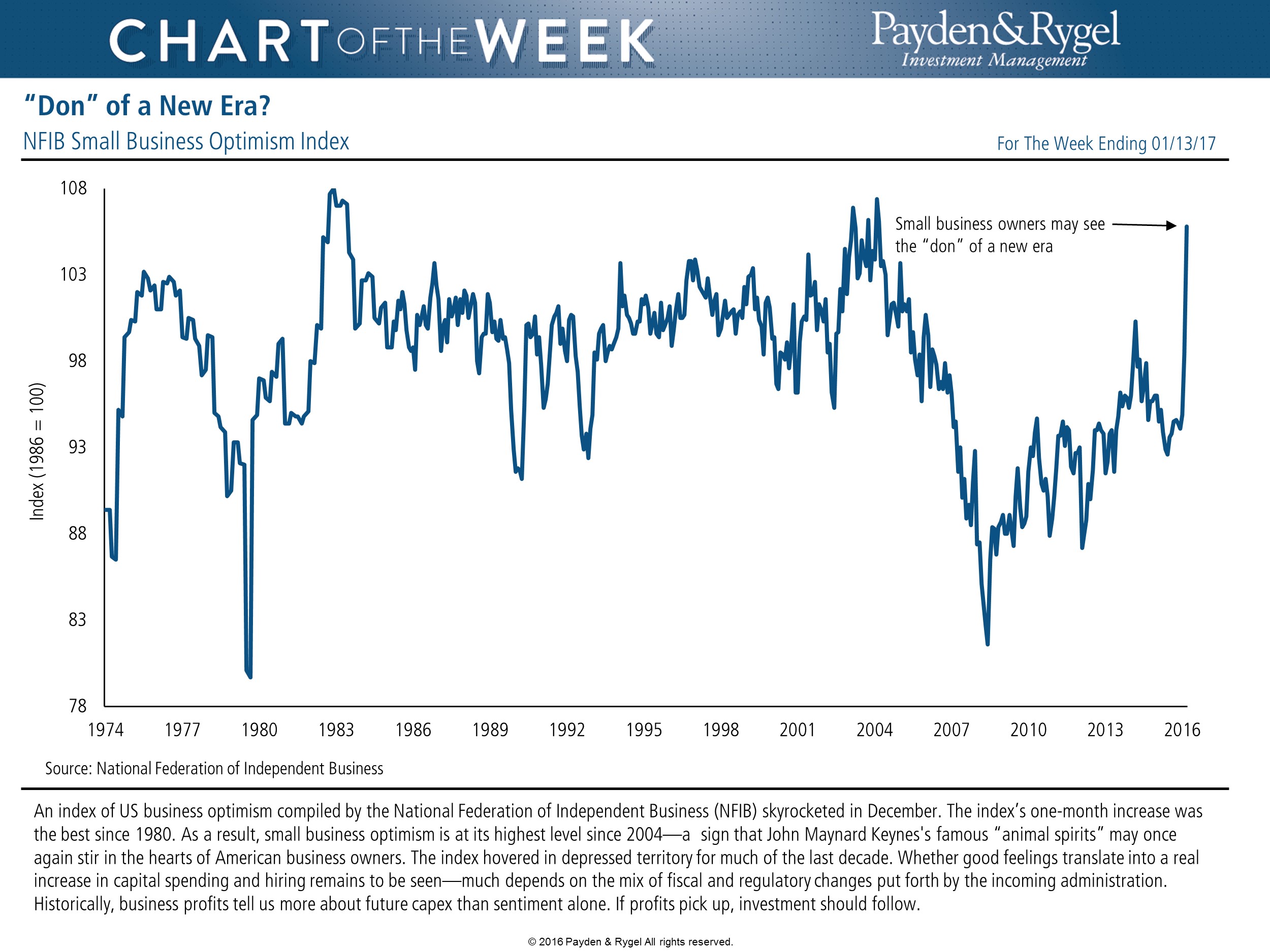

“Don” of a New Era?Economic Overview:

Week Ending January 13, 2017

An index of US business optimism compiled by the National Federation of Independent Business (NFIB) skyrocketed in December. The index’s one- month increase was the best since 1980. As a result, small business optimism is at its highest level since 2004—a sign that John Maynard Keynes’s famous “animal spirits” may once again stir in the hearts of American business owners. The index hovered in depressed territory for much of the last decade. Whether good feelings translate into a real increase in capital spending and hiring remains to be seen—much depends on the mix of scal and regulatory changes put forth by the incoming administration. Historically, business profits tell us more about future capital expenditure than sentiment alone. If profits pick up, investment should follow.

Rate hike probabilities

Rate hike probabilities remain stable at 37% for March and 71% for June.

High Yield: High Yield held up better than equities this week as investors reconsidered the likelihood that the incoming Trump administration could execute on a range of campaign promises, from ACA-repeal to corporate tax reform, in 2017. High yield should continue to provide a measure of downside protection while generating attractive carry in the 5% context.

Municipals: Municipal funds registered net in ows this week, reversing a trend of eight consecutive weeks of out ows dating back to the Presidential election. Municipal ratios have tightened dramatically across the yield curve, with all key-rate ratios now below 100%. The market marched higher again this week, with new issues oversubscribed for and the secondary market benefiting from robust demand.

https://www.payden.com/weekly/wir011317.pdfNorth Dakota Gov. Burgum tells Reuters that he believes the Dakota Access Pipeline eventually will be built, and asks protesters at the site to help clean up their camp before spring floodwaters arrive.

"The world's going to change dramatically" when Trump moves into the White House as far as resolving the pipeline," Burgum says. "I would expect that [Energy Transfer Partners (ETE, ETP)] will get its easement and it will go through."

http://seekingalpha.com/news/3235302-governor-sees-dakota-pipeline-built-campsite-harm-environmentOPTIMISTIC"We are very optimistic about the future, optimistic about new policies which could spur growth," Bank of America Chief Executive Brian Moynihan said.

Jamie Dimon was slightly more circumspect, but said he was comforted by the fact that Trump was selecting people with experience to join his team.

Dimon also cited several positive economic trends that suggest the global economy is headed in the right direction, which will help buoy bank earnings.

"The economy is getting a little bit better," he said. "Interest rates help and looking forward, you probably have a better political, legal and regulatory environment."

The idea that banks will benefit from lighter regulation, rising interest rates and lower taxes under Trump has driven bank stocks up nearly 25 percent since the election.

Nearly all the executives commented on the enthusiasm evident in markets, but were hesitant to fully endorse it.

Dimon noted that it may take a full year for the new government in Washington to decide exactly how it will tackle complex issues like corporate tax reform.

"We've all heard that the new administration in Washington supports tax reform, regulatory relief and other pro-growth policies," said PNC Chief Executive Bill Demchak.

"But, so far, a move in interest rates is the only thing that has actually happened."http://www.reuters.com/article/us-usa-banks-results-idUSKBN14X215