Emerald Small Cap Value Fund change in liquidation date https://www.sec.gov/Archives/edgar/data/915802/000139834421000510/fp0061082_497.htm497 1 fp0061082_497.htm

FINANCIAL INVESTORS TRUST

Emerald Small Cap Value Fund

(the “Fund”)

Supplement dated January 11, 2021

to the Fund’s

Prospectus and Statement of Additional Information

dated August 31, 2020, as supplemented

As previously disclosed, on December 8, 2020, the Board of Trustees (the “Board”) of Financial Investors Trust (the “Trust”), based upon the recommendation of Emerald Mutual Fund Advisers Trust (the “Adviser”), the investment adviser to the Fund, a series of the Trust, determined to close and liquidate the Fund on or about January 11, 2021. The date for such liquidation is now expected to be on or about January 29, 2021 (the “Liquidation Date”).

If the Fund has not received your redemption request or other instruction prior to the close of business on the Liquidation Date, your shares will be redeemed, and you will receive proceeds representing your proportionate interest in the net assets of the Fund as of the Liquidation Date, subject to any required withholdings. As is the case with any redemption of fund shares, these liquidation proceeds will generally be subject to federal and, as applicable, state and local income taxes if the redeemed shares are held in a taxable account and the liquidation proceeds exceed your adjusted basis in the shares redeemed. If the redeemed shares are held in a qualified retirement account such as an IRA, the liquidation proceeds may not be subject to current income taxation under certain conditions. You should consult with your tax adviser for further information regarding the federal, state and/or local income tax consequences of this liquidation that are relevant to your specific situation.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

Waiting for the Last Dance -- Jeremy Grantham @JonGatIII, Be mindful of the risk going forward. I survived both the tech bubble in 2000 and financial crisis in 2008 through my risk-adverse asset allocation. Even then it took years to fully recover the loss. It was a humbling experience and the black swan events will come again. It is a simple question of when and not if.

2020 was an aberration event with the Fed being part of the market as

@davfor pointeded out by buying stocks and bonds while reducing interest rates to near zero. Without the Fed the stock market would be still in red as the country is in deep recession. There are consequence to these Fed's action such as higher inflation, devaluation of USD, lower bond yields and etc. While you have the luxury of time, it is helpful to learn to become better informed investors.

Well isn't this special........D.C.

The sad fact appears to be that for most of those who have sufficient financial resources to be interested in a forum such as MFO, wealth is more important than the attempted overthrow of the United States democracy.

I disagree, Old_ Joe . Interest in this forum is just as likely to be because one has *insufficient* financial resources and is wishing to learn how to invest more effectively. I have not commented in this thread until now, not because wealth is more important to me than democracy (it isn't) but because this forum is not where I want to discuss yesterday's coup (or whatever it was) or to discuss how and why it happened. I have discussed yesterday's unfortunate events elsewhere and at length. I don't think my decision to not also discuss it here is a "sad fact".

Well isn't this special........D.C. Above, to answer a question put by David Moran, I posted the following:

[The OT section] no longer draws much participation from those posters who use MFO primarily for strictly financial matters, and who are not particularly interested in discussing the many underlying social and political factors.

The accuracy of that observation is illustrated by the general lack of interest in

this thread, other than by "the usual suspects".

The sad fact appears to be that for most of those who have sufficient financial resources to be interested in a forum such as MFO, wealth is more important than the attempted overthrow of the United States democracy.

Stimulus checks Short answer: the credit is what it is; you get to keep it all.

You don't have to pay back your stimulus check, because it's a refundable tax credit

Your stimulus payment is technically a refundable tax credit, which reduces your 2020 tax bill on a dollar-for-dollar basis. It's like having store credit at your favorite clothing shop: When you apply it to your total bill, it reduces what you owe. In this case, even if you have no tax liability, the government is "refunding" your credit back to you as a cash payment.

https://www.businessinsider.com/personal-finance/will-we-have-to-pay-back-stimulus-check-2020-4

What Is a Tax Credit?Subtract tax credits from the amount of tax you owe. There are two types of tax credits:

- A nonrefundable tax credit means you get a refund only up to the amount you owe.

- A refundable tax credit means you get a refund, even if it's more than what you owe.

https://www.irs.gov/credits-deductions-for-individualsIf it's a gift, it's a per capita gift that

nearly everyone (84%) gets. It's a gift like Medicare Part B, where

most (92%) participants pay only 1/4 of the true cost and they are gifted the other 3/4 out of general tax revenue (see

Medicare Financial Status: In Brief, p. 5, pdf p. 7).

Well isn't this special........D.C. Catch22 has given his reasons for the choice of posting venues:

"The subject matter was placed in "fund discussions" as to the potential fallout implications into all areas of the investment markets; from the events of Jan. 6, at the Capitol building."

The MFO administrators have been very reluctant to directly intervene in any aspect of posting standards. They have provided separate venues for the posting of different topics, and simply requested posters to observe those distinctions.

Objections and protests regarding the posting of certain types of subject matter have not come from the administrators, but rather from a significant number of MFO posters themselves. The administrators reacted to that user input, primarily by modifying the nature of the Off-Topic venue so as to be less visible to those who are not interested in (or even offended by) the topics sometimes discussed there.

Unfortunately, at least from my perspective, that's resulted in a much less lively and interesting OT section. It no longer draws much participation from those posters who use MFO primarily for strictly financial matters, and who are not particularly interested in discussing the many underlying social and political factors. I do think that something valuable has been lost here, but not because of any heavy-handed administration.

Waiting for the Last Dance -- Jeremy Grantham For those with an interest....Grantham's "epic bubble" market call and current investment suggestions...

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent. This is completely without precedent and may even be a better measure of speculative intensity than any SPAC.

investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely.

This has in theory a similar effect to assuming peak economic performance forever: it can be used to justify much lower yields on all assets and therefore correspondingly higher asset prices. But neither perfect economic conditions nor perfect financial conditions can last forever, and there’s the rub.

I expect once again for my bubble call to meet my modest definition of success: at some future date, whenever that may be, it will have paid for you to have ducked from midsummer of 2020. But few professional or individual investors will have been able to have ducked.....we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks that your career and business risk will allow.

https://gmo.com/americas/research-library/waiting-for-the-last-dance/

Brexit The (only) land border affected is Ireland/Northern Ireland, and an exception was made to make sure things flow freely there--- after all the deliberations and efforts at cooperation between Stormont and Dublin, ever since the Good Friday Accords in the 1990s... Otherwise, I think there's a sigh of relief, because there was NOT a no-deal Brexit, after all. The British fisherman got screwed. And the "deal" that was agreed to contained precious little about how the financial sector will work things out. Direct, simple access to the EU's banks and such is no more. A unified Europe is a step further away, now. The Brits never did adopt the euro. There are one or two others who "joined" without adopting the euro, too. Anyhow, it's hard for me to imagine Europe at war with itself, AGAIN. When I was back visiting Ireland in 2009, the euro was killing me at $1.51. But look at it, now, eh? There will be no more tension in the air about the prospect of a no-deal exit. That, at least is something. A near-term consideration.

disconnect analyses I think an increase in individual investors was also a factor. Betting on stocks when sports weren’t available. -

WSJ article, open for some reason“ 2020 will be known as the year that individual investors dove into financial markets and doubled down, ....Driving the interest was a combination of factors that started with an industrywide shift to commission-free trading in 2019 but swelled as market volatility grew. As the coronavirus rolled across the U.S., millions of new investors found themselves stuck at home, some with extra time on their hands to learn about the markets. Others, unable to bet on sports or visit casinos, found the stock market’s outsize swings presented the perfect outlet to make bets.”

And as posted earlier this week: Market Edges Toward Euphoria, Despite Pandemic’s Toll

https://www.nytimes.com/2020/12/26/business/investors-bull-market-pandemic.html?referringSource=articleShare“ The appetite of individual investors has been an unexpected byproduct of the pandemic. For many, trading stocks started as a way to indulge their speculative itch when other avenues, such as sports gambling, were effectively shuttered.”

The Psychology of Money “'You can plan for every risk,' he says, 'except the things that are too crazy to cross your mind.' For that reason, 'the most important part of every plan is planning on your plan not going according to plan.' In other words, plan as if another 2020 might happen this year—or in any given year.""As a result, we all have biases—sometimes conscious but usually not—in how we think about money. Of course, there’s nothing you can do to change your own history. What you can do, though, is to try to be aware of these unconscious biases. That, in turn, may help you to be as objective as possible in making financial decisions."Link

Investing at the All Time Highs In VFINX @Mark,

thanks

A very experienced financial writer friend whom I freelance with sometimes quickly fixed Uppaluri's comical regurgitation:

The fund's concept is to track the total return of the Russell 1000 Index while having less of that return consist of income. It invests in a representative sample of stocks in the index, favoring those with low or no dividends, and also minimizes capital gains in two ways: by managing how they're offset by losses and by keeping turnover low. In recent performance the fund's total return has been well within its target [+/- tktk] limit, while on average trading only 14% of holdings a year.

I am losing my patience with TBGVX ?

Even though, as I read in Al Jazeera: four-fifths of UK GDP is in the financial sector. And the "deal" includes absolutely zero content about financials. So, free and easy access to the continent's financial sector will END for the UK on January 1st. So, as I'm fond of stating here: "ORK!" What sort of "deal" is THAT????? Politicians just lying to us all again. What a f*****g surprise, eh?

I just looked at this

WSJ article But it’s far from clear. It states:” This will provide many U.K. service suppliers with legal guarantees that they will not face barriers to trade when selling into the EU and will support the mobility of U.K. professionals who will continue to do business across the EU," according to the document.“

The article ends with: “EU Officials are watching the U.K. closely for signals that their former partner will become too much of a competitor....[currently(?)] More than 90% of euro-denominated interest-rate derivatives and 84% of foreign-exchange trading in the EU take place in the U.K., according to New Financial.”

I am losing my patience with TBGVX ? Just my two cents, but I doubt most of these int'l value funds will ever beat the S&P over the long run. Corporate culture is different here in the US; more greed, leading to more production, profits. Think Pfizer, Apple, Amazon, etc.

Those words are truer than you might know! Gordon Gecko: "Greed is good." Yes, these days, it's not easy to see VALUE, domestic or foreign, having another "day in the sun" anytime soon. But as for international GROWTH: I'm interested to see the extent of any positive jump in Europe and the UK bourses, in response--- finally--- to a Brexit deal. Even though, as I read in Al Jazeera: four-fifths of UK GDP is in the financial sector. And the "deal" includes absolutely

zero content about financials. So, free and easy access to the continent's financial sector will END for the UK on January 1st. So, as I'm fond of stating here: "ORK!" What sort of "deal" is THAT????? Politicians just lying to us all again.

What a f*****g surprise, eh?

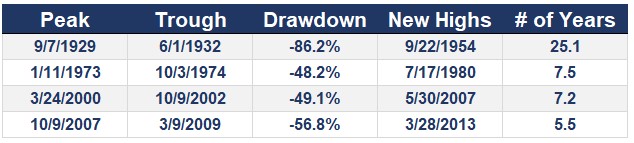

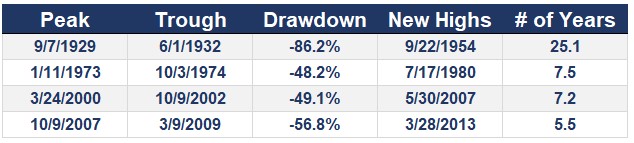

Investing at the All Time Highs In VFINX It's funny how most studies on market performance ignore the Great Depression as if it never happened, yet the first article does reference it:

The author does mention that this price performance ignores dividends so the recovery rate would've been sooner than 25 years with that, but I wonder how many people during the Great Depression would have had the stomach or the financial wherewithal with 25% unemployment to hold on and reinvest their dividends as the market went into free-fall.

It All Goes Back in the Box Yes, that article really spoke to me, too.

@msf makes great points here. "If one has the resources, or projected future earnings, to take more time for oneself, definitely go for it. But for far more people than his figures suggest, being able to do so is only a dream."

Sadly true. What will it take for constructive, purposeful financial literacy to happen in the schools? Is "youth wasted on the young," as they say? Are high-schoolers constitutionally unable to fathom the vital truth about

compounding over time, for instance? Or has it "just not been tried?"