It looks like you're new here. If you want to get involved, click one of these buttons!

...the latest move may well turbo-charge the departure from ratings-defined investment processes, especially the cliff-edge division between high-yield and high-grade debt.

“What active managers have been doing since the financial crisis is increasing the flexibility of their mandates,” said James Vokins, head of investment-grade UK credit at Aviva Investors.

...central bank support could be a powerful impetus for more flexibility, especially as yields, or returns, on high-grade debt tumble further and junk markets swell...

https://www.barrons.com/articles/mortgage-backed-securities-get-hammered-feds-move-may-not-be-enough-51584980932The $2.3 billion mortgage-focused AlphaCentric Income Opportunities Fund (IOFIX) lost 31% last week alone, and reportedly put $1 billion of securities up for sale on Sunday.

The fund focused on lower-rated tranches of residential mortgage-backed securities, with about 60% of its holdings rated BBB or lower, according to Morningstar, which had a five-star rating on the fund.

It was also said to have relatively high exposure to “credit risk transfer securities,” or CRTs, a type of mortgage-backed security introduced after the financial crisis. Those CRTs face especially high risk for losses tied to loan modifications. For example, if a distressed borrower negotiates a lower interest rate with an agency, that interest reduction would be passed along to the CRT holder at a loss, according to Goldman Sachs.

AlphaCentric said in a statement that “like many other funds, [the income opportunities fund] is moving expeditiously to address the unprecedented market conditions. With the lack of liquidity in the marketplace, the most effective way to obtain favorable prices is to offer a wider range of securities for bid instead of a smaller number of specific securities. This broadens the potential universe of buyers to try and obtain the most favorable prices.”

From the April 23, 2020 Schwab Managed Account Services™ Disclosure Brochure:The Institutional Shares are available for investment through a USAA discretionary managed account program and through certain advisory programs sponsored by financial intermediaries, such as brokerage firms, investment advisors, financial planners, third-party administrators, and insurance companies.

We've seen this sturm und drang before. When PIMCO did away with its D class shares, there was much handwringing about how investors would have to pay loads for PIMCO's A shares.NTF funds used in the UMP [legacy USAA Managed Portfolios] Program include USAA Victory Mutual Funds, managed by Victory Capital, from which Schwab may also receive shareholder servicing fees.

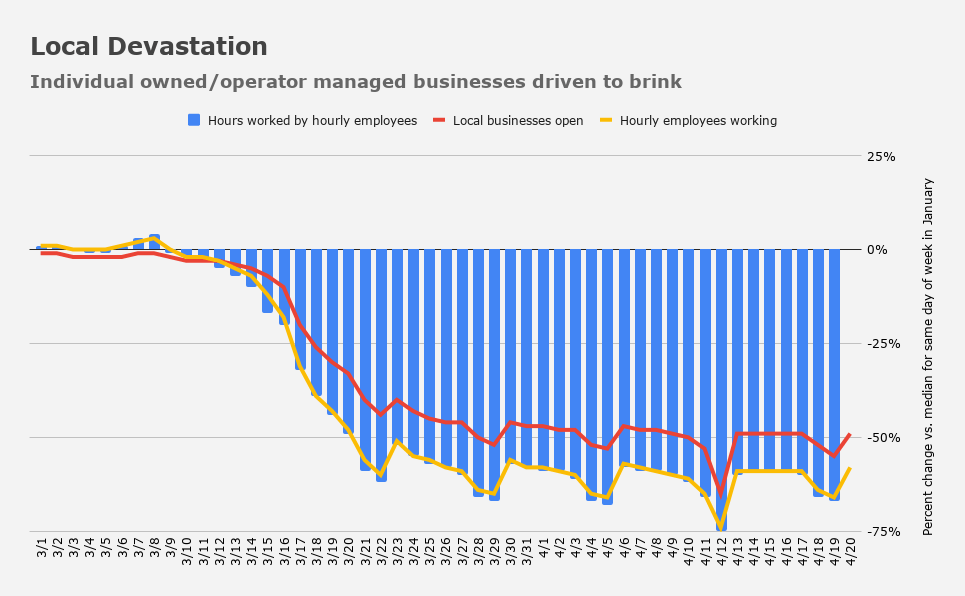

The manufacturing sector hasn't completely rolled over yet, but the services sector simply ceased to exist starting late last month.....The message is clear: Main Street isn't just hurting, it is disappearing in a very literal sense. As Atlanta Fed boss Raphael Bostic warned earlier this month, "May is going to loom large, in terms of the transition of concern from this being a liquidity issue… to this perhaps translating and transferring into a solvency issue, and whether companies can exist at all."

.(...from Homebase, a scheduling and time tracking tool used by more than 100,000 local businesses covering 1 million hourly employees.)

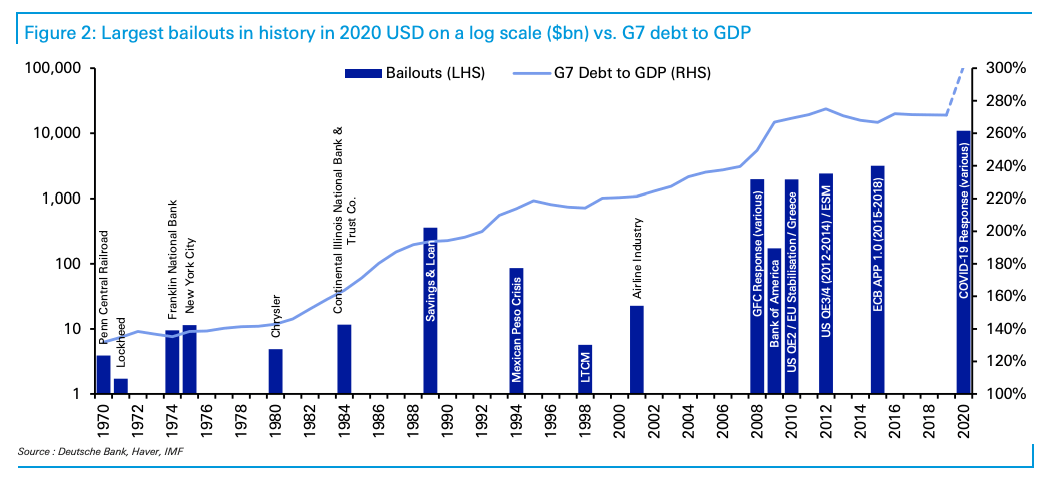

Deutsche Bank rolled up the fiscal and monetary support programs announced and implemented in the US and Europe into a single "bailout" figure. The sheer size of the COVID-19 response necessitated a log scale (on the left axis) in order to help "better identify the earlier bailouts and get a rough feel visually for the numbers," as the bank put it. ....."Obviously we won’t know how much will be used until much further down the road," the bank cautioned, in the course of presenting the numbers and accompanying visuals.

https://seekingalpha.com/article/4340027-dystopia-now

....policymakers have been deliberately suppressing volatility, compressing risk premia, tamping down credit spreads and keeping the market wide-open for borrowers for the better part of a decade....

Deutsche Bank's George Saravelos.....At the extreme, central banks could become permanent command economy agents administering equity and credit prices, aggressively subduing financial shocks. With unlimited capacity to print money, central banks have unlimited capacity to intervene in asset markets too. Put simply, a central bank that pegs bond, credit and equity markets is highly likely to stabilize portfolio flows as well.

I don't subscribe but for some reason the link worked for me.....The economists Milton Friedman and Anna Jacobson Schwartz demonstrated in “A Monetary History of the United States” that a collapse in the quantity of money was the main cause of the Great Depression. Hoping to avoid a repeat, the Federal Reserve in recent weeks has poured money into the economy at the fastest rate in the past 200 years. Unfortunately, this overreaction could turn out just as poorly; history suggests the U.S. will soon see an inflation boom.

Excluding the years immediately after the Revolutionary War, the past few weeks have seen by far the highest rate of monetary expansion in U.S. history. The Fed might defend itself by saying that its “shock and awe” tactics have given financial markets confidence that the coronavirus won’t cause a long and deep recession. And its massive bond purchases—more than $500 billion between March 11 and April 1—surely won’t continue at the same rate for the rest of the year.

It’s reasonable to assume that by spring 2021 the quantity of money will have increased by 15% and possibly by as much as 20%. That wouldn’t quite match the peak rates of expansion seen during and immediately after the two world wars of the 20th century, but it could surpass peacetime records, outpacing the previous peaks in the inflationary 1970s.

As in wartime, federal expenditures are rising sharply while tax revenues are being hit by the lockdown. Both World War I and World War II—and, indeed, the Vietnam War—were followed by nasty bouts of inflation.

Mr. Congdon CBE is chairman of the Institute of International Monetary Research at the University of Buckingham, England.

https://bizjournals.com/baltimore/news/2020/04/21/bill-miller-this-is-one-of-the-5-greatest-buying.html?ana=yahoo&yptr=yahooMiller said only four other times have stocks have been as attractive: In 1973-1974 when the Vietnam War was going on and Richard Nixon had resigned as president; in 1982 after Mexico defaulted on its debt; in 1987 following Black Monday; and in 2008-09 during the last financial crisis. "If you missed the other four great buying opportunities, the fifth one is now front and center," wrote Miller, who is now the chief investment officer and founder of Miller Value Partners in Baltimore.

Justin Thomson, a chief investment officer for T. Rowe Price Group Inc. (NASDAQ: TROW) who oversees international equities, also offered some guidance to help investors thrive.....he sees a buying opportunity...."I should emphasize that truly great companies are rare," Thomson wrote in a white paper. "Opportunities to buy great companies at great prices are even rarer. We are currently at one of those moments."

My main point is that you can't make your assumption on others. If an investor meets their goals then it's that simple. I know a guy that sold his company for millions of dollars years ago and wants low volatility and invested over 90% in Munis and it worked great for him over 20 years. Another one retired with a pension + his SS covers his expenses and all his money is in stocks. Another guy uses only CEFs and trade them with good results. They all met their needs, there is no right or wrong answer, the problem is trying to put someone in a box that you don't like."...I can say that if you are not a buy and hold forever (Bogle style) then you are not an investor...."

I come here to learn. Reading many of the interchanges between others here and FD1000, it's clear that he/she has an unreasonable need to win all the time. Reminds me of conversations with my nephew. Reminds me of the Orange Abortion in the White House.

....... When I was a younger man and doing comunity organizing, our leader reminded us very early about a Cardinal Rule: if you control the terminology and definitions and can get the ones on the other side of the issue to start believing and using your definitions and terminology, then you've all but WON the issue.

********************************************

I'm not interested in embroidery nor competition in here. You've got info worth sharing? Share it, by all means.

The above has nothing to do with your post "The price of blue chip stocks declined, but there was more pain in small-cap and speculative stocks, many of which declared bankruptcy and were delisted from the market. It was not until Nov. 23, 1954, that the Dow reached its previous peak of 381.17."@FD1000 That "Large Cap Blend" category data is also wrong for that period of history because it can not include survivor bias of all the funds that went out of business that far back and there were many. Of the ones that did survive__ MFS Massachusetts Investors Fund (MITTX) 1924.

Putnam Investors Fund (PINVX) 1925.

Pioneer Fund (PIODX) 1928.

Century Shares Fund (CENSX) 1928.--I suspect they must have had bonds in their portfolio for that. Dividends I'm sure helped but who would have the mental fortitude amd/or financial wherewithal to reinvest in the market when it falls like that? In other words, the data you're providing shows large-cap blend funds falling about 55% when the market fell 89%. That cannot be correct for a pure stock portfolio even if you factor in dividends, which I believe peaked at 14% during the Depression.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla