It looks like you're new here. If you want to get involved, click one of these buttons!

Ah, c'mon man!@stillers, you seem to have quite an anger problem. Bottom line is I never once said a CD ladder wasn't a good idea. I tried to covey that bond funds also may be turning the corner and starting to give decent returns - for anyone who chooses that investment path. Even at your dismay and scorn.

One solution to this crisis would be that, if the bonds magically went back to being worth 100 cents on the dollar, the banks would mostly be fine again. That seems improbable, though I guess one interesting mechanism would be if the banking crisis caused enough of a recession to drive long-term interest rates back to where they were in 2020. Then the bonds would be fine, though probably the banks would have credit losses.• 1) Banks bought a lot of Treasury bonds and other US government-backed securities when interest rates were low, paying roughly 100 cents on the dollar for them.

• 2) Interest rates went up a lot, driving the prices of those bonds down to, say, 85 cents on the dollar.

• 3) Banks had big losses on those bonds, eating through a lot of their capital.

• 4) People noticed, stocks went down, deposits fled, some banks failed and others have looked shaky.

The FDIC has spent billions of dollars on its bank rescues — which is also a transfer of losses from banks to the government to make the banking system more solvent — but it is getting the money back by charging a special assessment to be paid by about 113 big banks. If the banks pay the assessment with Treasuries that are worth 90 cents on the dollar, but that count for 100 cents on the dollar, then they get a little discount on the assessment and get to move unpleasant assets off their balance sheets.Banks have spent the past week or so testing what would be a clever gambit: Paying billions of dollars they collectively owe to replenish a federal deposit insurance fund using Treasurys instead of cash.

The idea—floated to regulators and lawmakers by PNC Financial Services Group and supported by others—could allow banks to take securities that are currently worth, say, 90 cents on the dollar, and give them to the Federal Deposit Insurance Corp. at full price. That would effectively shift losses clogging the banks’ balance sheets to the FDIC, according to people familiar with the proposal. ...

Proponents say nothing in the law says FDIC fees have to be paid in cash, so the agency could change its rules. They say the move, if greenlighted by the FDIC, would help the banking system address the way rising rates over the past year have saddled lenders with billions in losses on their portfolios of bonds. Those losses helped sink Silicon Valley Bank in March, sparking turmoil across the banking sector. …

Supporters say the government would hold the securities until maturity, allowing them to recover principal and interest on the debt. The government would suffer no losses, they say.

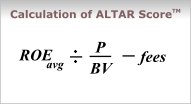

Here is the graphic they mention . . .For equities, we calculate the ALTAR Score™ using the formula on the right—itself a derivation of the old Dividend Discount Model—where:

Avg. ROE is the average return on equity of firms in the fund for the five (5) years up to and including the current forecast year

P/BV is the forward price-to-book value based on current market prices

fees is the annual expense ratio of the ETF

The relationship between Return on Equity and Price-to-Book Value multiples is well established in the academic literature. This formula is designed to forecast the likely internal rate of return to business owners. It is important to note that it is not a target price, and there are no timing or momentum components to it.

https://www.govexec.com/oversight/2020/01/irs-reforms-free-file-program-drops-agreement-not-compete-turbotax/162167/The IRS announced significant changes Monday [Dec 30, 2019] to its deal with the tax prep software industry. Now companies are barred from hiding their free products from search engines [as reported in the ProPublica piece] such as Google, and a years-old prohibition on the IRS creating its own online filing system has been scrapped.

Worth noting who made the original proposal, given thatThe program was founded as a gambit by the tax prep industry, led by Intuit, after the George W. Bush administration proposed that the IRS create a free online filing option for taxpayers.

https://www.politico.com/news/2023/05/16/irs-free-online-filing-system-00097198Republicans are already lining up against the plan, fearing it could eventually lead to a system where the IRS fills out people’s returns for them, which they say is a conflict of interest since the agency also enforces tax laws.

Intuit will vigorously oppose plans from the IRS to offer free tax filing.

[snip]

BTW, IRS is setting up online tax filing for free. If they can make the user interface similar to that ofTurboTax, that would be very helpful for those with straightforward tax filing.

s-l-o-w-l-y? I don't know how one writes slowly, but if you're asking for gory details, I'm happy to oblige.s-l-o-w-l-y try to explain why an investor, going forward, should invest in either taxable or municipal bond funds in their portfolio's fixed income sleeve instead of say, 5-yr, 4.50%, non-callable CDs.

But please leave out the widely understood part about past performance being no guarantee of future results. Got that part.

Thank you, but I want not to be using more than a single broker for simplicity and consolidation, and I'm already with TRP. It has its faults. I inquired once, and FEES were mentioned. Don't need fees.Crash, If you have a Fidelity account, you can choose from hundreds of new-issue CDs, many with yields exceeding 5%. I have constructed two CD ladders extending up to 5 years with total yields about 5.1%. Similar options are available at Schwab and other investment sites.

https://www.fidelity.com/managed-accounts/fidelity-go/investment-account-faqsFidelity Flex® funds are a lineup of Fidelity mutual funds that have zero expense ratios, and include proprietary active and passive funds. Flex funds are currently available only to certain fee-based accounts offered by Fidelity, like Fidelity Go®. Unlike many other mutual funds, the Flex funds do not charge management fees or, with limited exceptions, fund expenses. Instead, a portion of the advisory fee you pay is allocated to access the Flex funds in which your account will be invested.

So much has changed at Vanguard post-pandemic, and their phone service has declined. I still recall being the Voyager Select and Flagship customers. I will give them a call later in the evening 8am - 8 pm, EST) and report back.I didn't mention specific financial planning because this particular service was discontinued years ago and I don't know whether a service like this is integrated into Vanguard's current service offering.

Anyone who actually spent a few minutes of time on the links I posted would have likely seen that the results are just as bad for the bond fund universe over the past 10 years.But please leave out the widely understood part about past performance being no guarantee of future results. Got that part.

Ok, but that's exactly what you based your whole argument on. Past 3-5 year performance.

I do agree with everyone else though that with CD's at 5%, it's hard to take on more risk to get 6, 7 or 8% as rates plateau or start to come down. But it may be close to that time IMHO. I do believe the next 3-5 years will not look like the past 3-5 years. Extrapolate YTD returns on some of these funds now and it shows returns growing greater than 5% for the year.

...

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla