It looks like you're new here. If you want to get involved, click one of these buttons!

That works. Excluding no load funds hasn't worked since they launched, how many years ago? Same for minimum investment. They still give you the Admiral funds even if you specify a lower limit. And then, some part of the beginning of every month they're not going to give you other fund families. I'm probably forgetting something.Fido Screener is quite good. It is the only screener I know that combines mutual funds and ETFs

Ironically enough, if one can find Vanguard's screener, the first criterion shown (as a radio button) is Product Type:But it's missing a lot of other criteria, like M* ratings.

- Mutual funds

- Exchange-traded funds (ETFs)

- Both

Thanks. I own both GQEIX and GQHIX and so the info you included is of interest to me. Under Parent tab, M* shows total net assets at $11B but it is possible M* did not include assets under separately managed accounts and other vehicles. It would be great if you are able to share a link or a source of the $91B you mentioned. Thanks.Rajiv Jain is a very experienced fund manager who has delivered excellent long-term performance using a "quality growth" approach. His departure from GQG Partners would be a huge setback for the firm and represents substantial key-man risk. Another potential concern is that GQG Partners amassed over $91B AUM (as of 12/31/2021) in less than 6 years.

Fidelity does not have a comprehensive too either. Perhaps you will have better luck with Schwab.

Yeah, there definitely is a herd mentality over there. I've complained loudly about their sensational breathless reporting of everything Saint Cathie of ARKK would do or say, and how their 'Why did ABC move up/down today?' headlines being nothing more than Motley-Fool clickbait-class nonsense, but who am I to be listened to.If I read another headline about the latest "undiscovered safe" stock or fund with a yield of 10% I will throw up.

All you have to do is look at ATT. What good was the 6% dividend when the stock is down 20 to 30% in the last 3 to 5 years?

https://www.technologyreview.com/2022/05/23/1052627/deepmind-gato-ai-model-hype/Earlier this month, DeepMind [s subsidiary of Alphabet (GOOGL)] presented a new “generalist” AI model called Gato. ...

One of DeepMind’s top researchers and a coauthor of the Gato paper, Nando de Freitas, couldn’t contain his excitement. “The game is over!” he tweeted, suggesting that there is now a clear path from Gato to artificial general intelligence, or AGI, a vague concept of human- or superhuman-level AI. ...

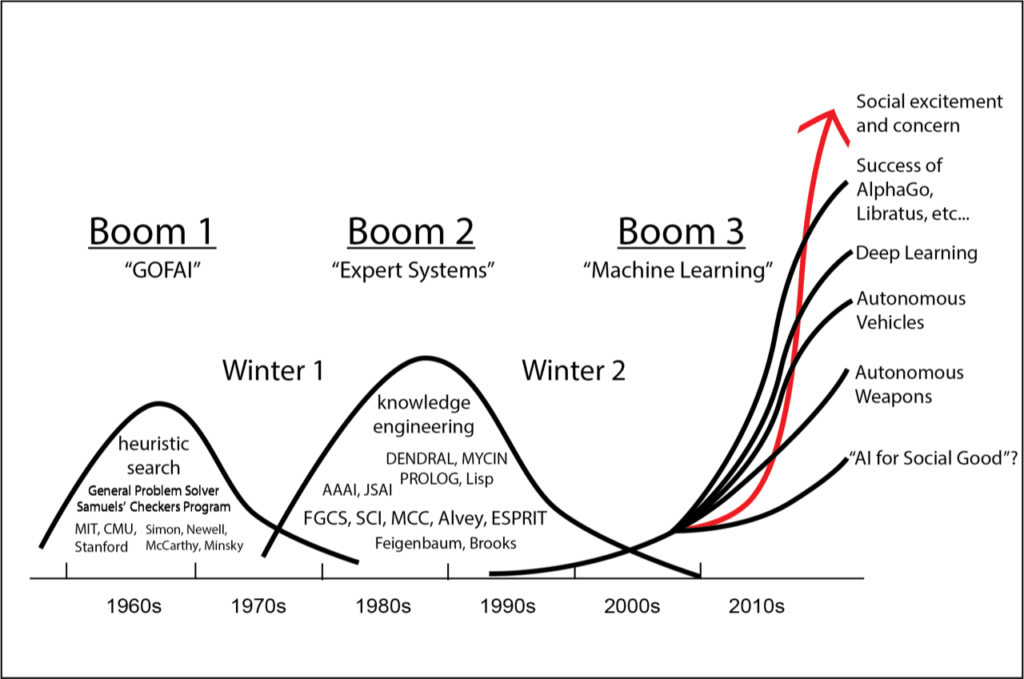

Unsurprisingly, de Freitas’s announcement triggered breathless press coverage that DeepMind is “on the verge” of human-level artificial intelligence. This is not the first time hype has outstripped reality. ...

Some technologists, including some at DeepMind, think that one day humans will develop “broader” AI systems that will be able to function as well as or even better than humans. Though some call this artificial general intelligence, others say it is like "belief in magic.“ Many top researchers, such as Meta’s chief AI scientist Yann LeCun, question whether it is even possible at all.

https://sitn.hms.harvard.edu/flash/2017/history-artificial-intelligence/In 1970 Marvin Minsky told Life Magazine, “from three to eight years we will have a machine with the general intelligence of an average human being.”

Cathie Wood

@CathieDWood

.@ARKInvest

must share more of our research about #artificialgeneralintelligence (AGI) and how it is likely to transform the way the world works. Within 6-12 years, breakthroughs in AGI could a accelerate growth in GDP from 3-5% per year to 30-50% per year. New DNA will win!

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla