It looks like you're new here. If you want to get involved, click one of these buttons!

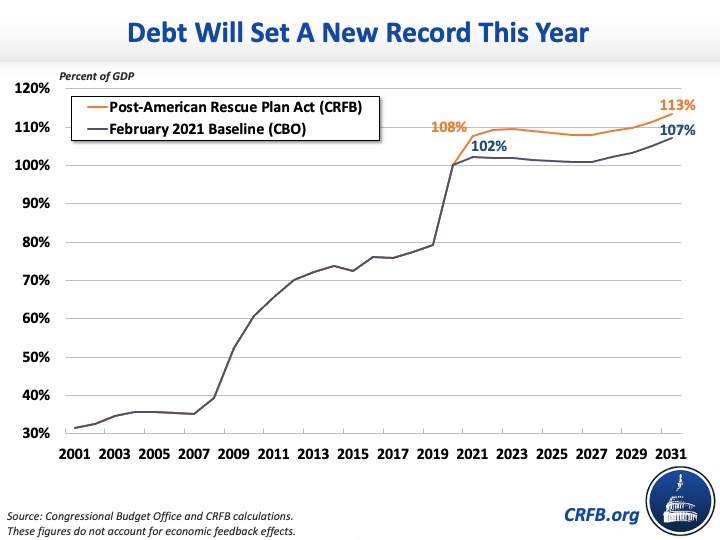

https://www.nytimes.com/2019/01/09/opinion/melting-snowballs-and-the-winter-of-debt.htmlAnd the dollar value of G.D.P. normally grows over time, due to both growth and inflation. Other things equal, this gradually melts the [debt] snowball: even if debt is rising in dollar terms, it will shrink as a percentage of G.D.P. if deficits aren’t too large.

Not sure, but your last comment appears to be in reference to fred495 who on Monday on armchairinvesting stated,I have been following the various discussions about OSTIX on various investment forums (MFO, Armchair, Big Bang). I have done some additional due diligence on this fund recently, just to see if I have some renewed interest in possibly owning it. I have concluded that I am not interested in purchasing this fund. I simply can find better alternatives, that offers similar total return, with lower risk metrics. Just owning it because if offers "dedicated HY Bond" exposure, is not enough of a reason to own it for me. I own several bond oefs from the multisector and nontraditional bond categories, that offers significant exposure to HY bonds, and find no compelling reason to own it, just because it is a dedicated sector HY bond fund. So, I will pass on it.

https://reuters.com/world/china/chinas-tal-education-expects-hit-new-private-tutoring-rules-2021-07-25/EDUCATION BURDEN

Goldman Sachs said in a research note its one year price targets on the listed tutoring stocks would be cut by 78% on average. The impact, the note said, would be mostly due to the ban on weekend and winter and summer holiday tutoring, which brought in up to 80% of the firms' revenue.

China's for-profit education sector has been under scrutiny as part of Beijing's push to ease pressure on school children and reduce a cost burden on parents that has contributed to a drop in birth rates.

More than 75% of students aged from around 6 to 18 in China attended after-school tutoring classes in 2016, according to the most recent figures from the Chinese Society of Education, and anecdotal evidence suggests that percentage has risen over recent years.

"In the long run, it is definitely good news for the children as they don’t have to immerse themselves in endless homework," said Zhu Li, a Chinese parent in Haidian District in Beijing.

"But on the other hand, it might not be so good if they fail to enter a good university."

OJ,I don't understand why this is considered a "silly question, silly answer". It's a question that I've asked myself many, many times over the last couple of years as I've watched the equity market continually rack up gains.

I had to think about this - and I read YouTube comments, they are all cryptic - at best. Anyway, could this be real? They are 100% stocks & they are considering going to 0% stocks, 0% bonds & zero annuities. All Peter the Planner can offer is: “ Talk to a licensed professional about your options. But yes, you can absolutely stop subjecting your nest egg to investment markets.”What stillers said.

OP --- silly question, silly answer, rich-enough couple writes in ... why? Mattress sale?

Otherwise clickbait --- nobody learns anything new, only confirmation of whatever.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla