It looks like you're new here. If you want to get involved, click one of these buttons!

The above will not show you how much and how long leveraged was used over the years. The managers can change it anytime.I would like to know how I can find out how much leverage is used in a fund. I use the Schwab platform. Tkx!

FD takes EVERYTHING personally. I just pointed out the FACTS about his posts on this topic.

He "Introduced" this fund to the world (sic) on two forums recently BUT had to be informed by other posters that it was highly leveraged. Read this full thread and his parallel thread on armchairinvesting and it's pretty clear that's the case.

That's all.

No reason to take it personally or claim after the fact that he actually knew it was leveraged. He did NOT know that, or at least he forgot to note that critical point (sic) in any of his posts about it until AFTER other posters pointed it out to him.

Hey, we ALL make mistakes and most of us freely admit them. Some though try to drag tired old stories into every discussion as though they provide absolution or are relevant to the topic at hand.

Fact check. I did post on the sites above but the same person Big Tom = BT2020 = Stalker made the same arguments in both places.FD takes EVERYTHING personally. I just pointed out the FACTS about his posts on this topic.

He "Introduced" this fund to the world (sic) on two forums recently BUT had to be informed by other posters that it was highly leveraged. Read this full thread and his parallel thread on armchairinvesting and it's pretty clear that's the case.

That's all.

No reason to take it personally or claim after the fact that he actually knew it was leveraged. He did NOT know that, or at least he forgot to note that critical point (sic) in any of his posts about it until AFTER other posters pointed it out to him.

Hey, we ALL make mistakes and most of us freely admit them. Some though try to drag tired old stories into every discussion as though they provide absolution or are relevant to the topic at hand.

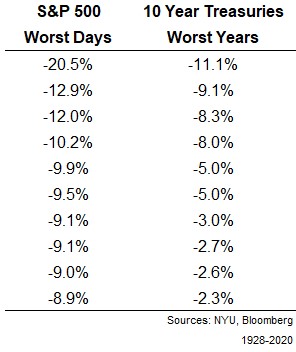

Historical market data can’t help you predict the future but I still find it useful as a way to understand the potential risks and rewards you can see as an investor.

Stock, Bond & Cash Returns: 1928-2020Looking through 93 years of returns for stocks, bonds and cash won’t help you predict future returns for these asset classes.

But it can give you a better sense of the risk involved in these asset classes since risk is much easier to predict than returns.

Maybe you need a lesson on leverage.

BT2020: What FD is missing here is the leverage is HIGHER now then earlier in the year.

With HIGHER leverage and the corresponding INCREASE in treasury rates, interest costs and the associated risk for the leverage has increased then earlier in the year.

Maybe you are the one who missed my main 2 points. Please reread it.

It means you can't predict where the leverage will be next week or in 4 weeks. Leverage was used years ago. Example: the 10 year treasury is around 1.1%, in 2018 it was over 3% and in 2019 over 2%...mmm...are we anything close to that?

In fact, in 2017-2019 the 10 year was higher than 2%.

Thanks for the info. The chart in the link above is worth watching and see how SVARX compared to PIMIX and other bond fundsThe April 2020 quarterly newsletter describes the SVARX active management approach over the preceding two years. The chart provides a good visual description. Scroll down to the Active Management section of the newsletter. (Reviewing the 12/31/19 and and 3/31/20 portfolio composition in the table above that section is also instructive.)

THE FULL SPECTRUM - April 2020

Yes, this is a open secret that occasionally comes up here. I used this loophole by transferring part of a small 401k to TRP and opening a Rollover IRA in PRWCX a couple of years ago.I did find out an interesting tid-bit though, not all closed funds are really closed funds. He told me that if the amount is large enough for moving 401k funds in, that they could be deposited into currently closed funds. I've been looking at PRWCX Capital Appreciation and was told I could open an account and actually deposit funds into it if it's the right amount. Does this sound right?

Maybe you are the one who missed my main 2 points. Please reread it.

BT2020: What FD is missing here is the leverage is HIGHER now then earlier in the year.

With HIGHER leverage and the corresponding INCREASE in treasury rates, interest costs and the associated risk for the leverage has increased then earlier in the year.

Absolutely do your own diligence. First, we don't know how long or how high the leverage has been. Second, the 10 year was much higher years ago and the fund did OK too. Third, the manager has been using short positions too. Per M* fund holdings I can see 2 positions at -10.03% and -9.89

What FD is missing here is the leverage is HIGHER now then earlier in the year.

With HIGHER leverage and the corresponding INCREASE in treasury rates, interest costs and the associated risk for the leverage has increased then earlier in the year.

Sectors Fund % Cat %QQQ

Basic Materials 2.42 2.61

Consumer Cyclical 12.66 11.17

Financial Services 13.90 13.42

Real Estate 2.29 2.47

Communication Services 10.26 10.21

Energy 2.60 1.90

Industrials 8.83 10.11

Technology 23.82 22.81

Consumer Defensive 6.78 7.99

Healthcare 13.77 14.76

Utilities 2.67 2.54

Information Technology 47.90%Industry exposure:

Consumer Discretionary 19.29%

Communication Services 18.22%

Health Care 6.39%

Consumer Staples 5.15%

Industrials 1.88%

Utilities 0.96%

Software 15.27%

Semiconductors & Semiconductor Equipment 13.96%

Technology Hardware, Storage & Peripherals 12.37%

Internet & Direct Marketing Retail 11.95%

Interactive Media & Services 10.35%

IT Services 4.59%

Automobiles 4.43%

Biotechnology 3.98%

Media 3.39%

Entertainment 3.11%

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla