It looks like you're new here. If you want to get involved, click one of these buttons!

True, perhaps, but in order to use TAIL as protection to your portfolio as a whole you would need to own a ton of it, and it simply is not a great long-term holding IMO. It has suffered a 14.27% drawdown and TAIL's webpage itself notes that "Cambria expects the fund to produce negative returns in the most years with rising markets or declining volatility." The only way I personally could see TAIL being a sensible choice is as part of a market-timing strategy, and that mostly doesn't work. For the core of my portfolio I'd much prefer to ride the market and limit losses with SWAN or even MNWAX.SWAN might minimize its losses on its own but it’s not going to provide protection to existing positions like TAIL will.

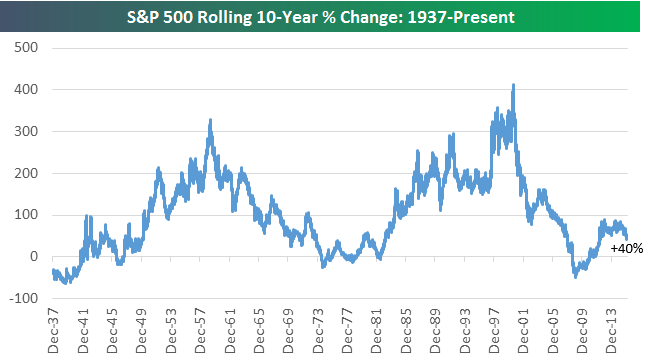

Source:There are two major takeaways from the chart below:

1. Historically, once the long-term mean has been breached on the up-side, annualized returns have remained elevated above the mean for an average of almost 18 years.

2. Historically, once the long-term mean has been breached on the down-side, annualized returns have remained subdued below the mean for an average of almost 10 years. This is significantly lower relative to the time-frame on above mean returns.

Without liquidating or otherwise monetizing their homes (if any) many people have virtually no assets to live on.The median respondent that died in their 60s had about $3,000 in liquid investments within two years of their passing, which increased to $10,000 for respondents that died in their 70s and $15,000 for those that died in their 80s.

https://news.mit.edu/2012/end-of-life-financial-study-0803Indeed, about 46 percent of senior citizens in the United States have less than $10,000 in financial assets when they die. Most of these people rely almost totally on Social Security payments as their only formal means of support

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla