It looks like you're new here. If you want to get involved, click one of these buttons!

Okay.I don't see any reason to own BRK.A

SPY beat it easily for 1-3-5-10 years and with lower voltility.

why-housing-could-be-one-of-the-best-performing-asset-classes-of-the-2020sThere is a real possibility real estate could be one of the dominant assets of the 2020s. Here are some reasons why:

Millennials. Young people are settling down later in life because they are going to school for longer, had to deal with a housing bust, and graduated in and around the Great Financial Crisis. But millennials were going to begin doing adult things eventually.

That means buying houses, even if it comes later in life than it did for their parents. Millennials are now the biggest demographic in the country and will dominate the most common ages in the country for years to come:

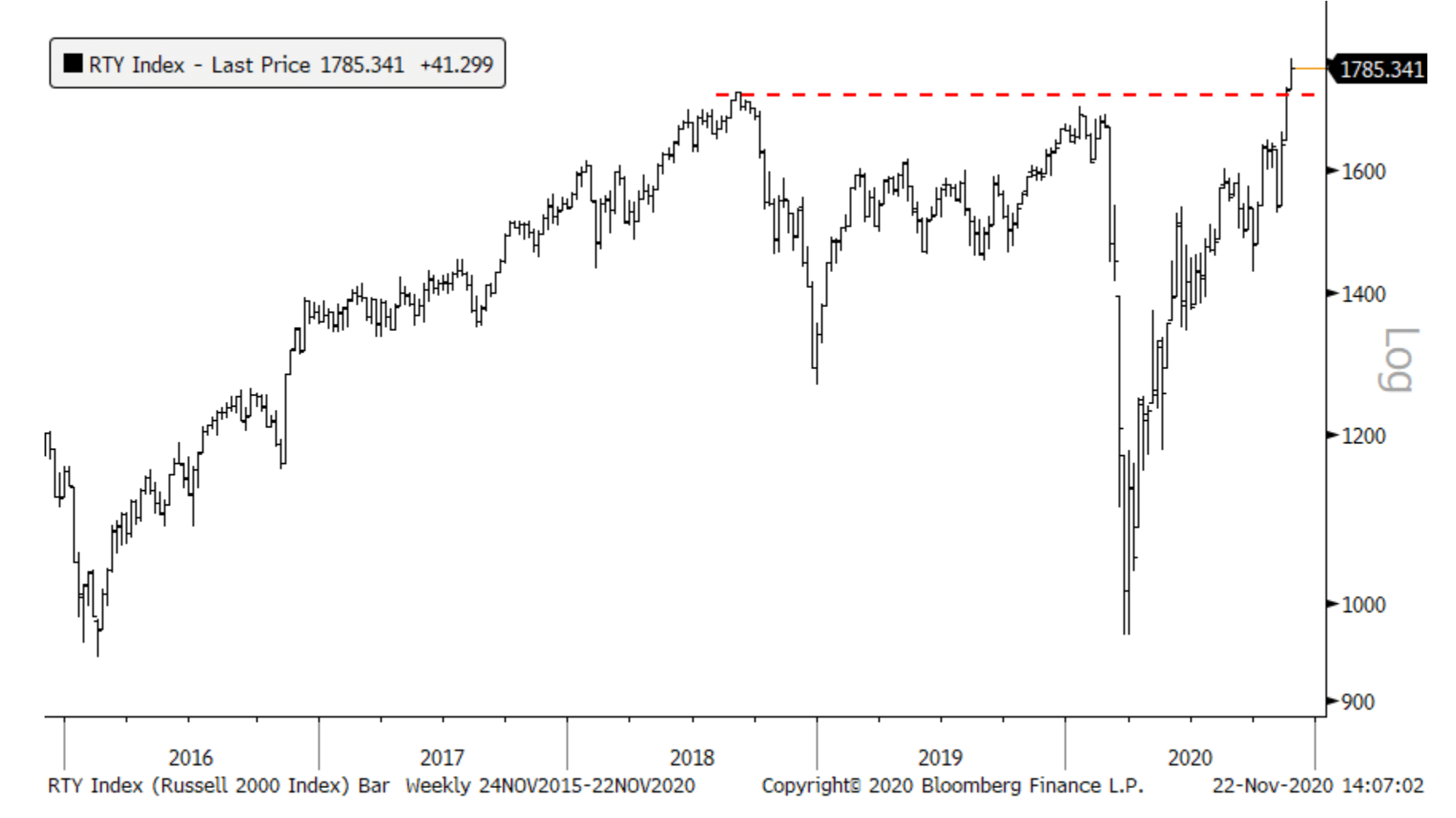

small-caps-break-out-of-two-year-consolidationAccording to Jon Krinsky at Baycrest, 83% of the Russell 3k names got back above their 200-day moving averages last week, a record going back seven years to 2013. It wasn’t bearish then and it’s not likely to be bearish now.

https://securitiesce.com/series-6/understand-mutual-funds/The main difference between an open-end company and a closed-end company is how the shares are purchased and sold. An open-end company offer new shares to any investor who wants to invest. This is known as a continuous primary offering. Because the offering of new shares is continuous, the capitalization of the open-end fund is unlimited. Stated another way, an open-end fund may raise as much money as investors are willing to put in. An open-end fund must repurchase its own shares from investors who want to redeem them. A closed-end fund offers common shares to investors through an initial public offering (IPO) just like a stock. Its capitalization is limited to hte number of authorized shares that have been approved for sale. Shares of the closed-end fund will trade in the secondary market in investor-to-investor transactions on an exchange or in the over-the-counter market (OTC), just like common shares.

Will any of this matter 10 years from now? Probably not. In the short term, anyone who's been paying attention already bought in March. You want more? Sure, buy more.Looks like JASSX is available at FIDO with $2500 min, but a $49.95 fee. JASVX is available NTF at ETRADE, $250 min.

The time to pick the low hanging fruit was 8 months ago (says Captain Hindsight). So do you still buy/add to these higher risk funds now, after the big bounce?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla