It looks like you're new here. If you want to get involved, click one of these buttons!

Thanks for the info. 3 of the 4 fund managers of DINDX, who have only been with the fund since May of this year, are also the same fund managers for ESIIX (which I mentioned earlier in the thread and is one of my favorite bond funds). It will be nice to have this in an ETF format, and it would be interesting to see how closely it might track ESIIX.Mentioned above is a global bond fund. DINDX is a Morgan Stanley Global Fixed Income Opportunity Fund with a long track record. It is classified as multi sector bond.

In November this mutual fund will be converted to an Eaton Vance ETF. Hopefully with a lower expense ratio. Over the years have had good success with Eaton Vance and Morgan Stanley bond funds.

https://www.gov.ca.gov/2025/07/31/nearly-all-national-guard-soldiers-in-los-angeles-are-demobilizing-governor-newsom-demands-those-remaining-be-released/the number of people reporting to work in the private sector in California decreased by 3.1% — a downturn only recently matched by the period when people stayed home from work during the COVID-19 lockdown.

... a ripple effect – the state’s economy is likely to contract later this year due to fallout from global tariffs and immigration raids in Los Angeles and other cities that have rattled key sectors, including construction, hospitality, and agriculture, according to a UCLA Anderson forecast.

Mass arrests, detentions and deportations in California could slash $275 billion from the state’s economy and eliminate $23 billion in annual tax revenue. The loss of immigrant workers, undocumented and those losing lawful status under the Trump administration, would delay projects (including rebuilding Los Angeles after the wildfires), reduce food supply, and drive up costs. Undocumented immigrants contributed $8.5 billion in state and local taxes in 2022 — a number that would rise to $10.3 billion if these taxpayers could apply to work lawfully.

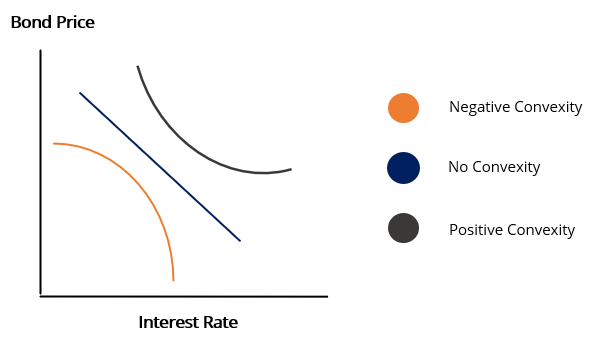

Thank you for the link. Yet another reason I try to minimize exposure to securitized debt is because I don't understand things like the following from the link cited:Here's a BrandywineGlobal paper from 1½ years ago discussing convexity and securitized debt, along with market conditions at the time and risks involved in four types of securitized debt.

Riding the Convexity Wave in Securitized Credit

"Fast deleveraging of the deal structure" sounds like Repo Man II: The Action Movie to me. But I know I don't know what I'm talking about. :).Risks: If the job market worsens significantly along with a hard landing, subprime auto ABS bond defaults may increase sharply. However, we believe the potential credit losses should be absorbed by the cushion provided by credit enhancements and the fast deleveraging of the deal structure.

Good observation. I normally don’t look further than 5 years (and place more emphasis on 3 year returns), and don’t look at individual quarters that far back. so I probably would have missed that. That is also something to consider.Just be aware with securitized (MBS) funds.....SYFFX lost -31% in 1Q 2020, as many of these funds were crushed at the time. That's why I don't hold more HOSIX.

It's not that history will repeat, but it can.

Not Observant, but I also used to own RCTIX. It underwent manager changes a few years ago, the performance started to suffer, and there seemed to be some uncertainty. So I sold it. It later improved and recovered. The fund is 55% securitized. When I was thinking about getting back into the fund, I saw that SYFFX, a securitized fund, was outperforming RCTIX. SYFFX outperforms RCTIX at every trailing period I look at. So if I when considering RCTIX, which has more than 50% exposure to the securitized sector (a sector I was underexposed to), I thought that I might as well go with a dedicated securitized fund that has performed better.@Observant1, why did you sell River Canyon Total Return Bond Fund RCTIC?

The Financial Times recently published their Business Book of the Year 2025—the longlist.[snip]

According to an article in today's NYT, "The Democratic Party is hemorrhaging voters long before they even go to the polls.

Of the 30 states that track voter registration by political party, Democrats lost ground to Republicans in every single one between the 2020 and 2024 elections — and often by a lot.

That four-year swing toward the Republicans adds up to 4.5 million voters, a deep political hole that could take years for Democrats to climb out from. The stampede away from the Democratic Party is occurring in battleground states, the bluest states and the reddest states, too ..."

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla