It looks like you're new here. If you want to get involved, click one of these buttons!

While the January 2019 Pew survey did show that, the same page he linked to notes that a November 2018 Pew survey found that "Most Americans said they’d like to see cooperation between Trump and Congress."A reluctance towards establishing a common ground is already widespread in America. According to a 2019 survey, 70% of Democrats believed their party’s leaders should “stand up” to President Trump, even if less gets done in Washington. Conversely, 51% of Republicans believed that Trump should “stand up” to Democrats.

@wxman123, The new baseline asset allocation can be found on The fund's Fact Sheet. As of 5-1-20 it is 50 percent. Under the old Fact Sheet it was 10 percent.

The 31 day trading rule is to prevent the fund from having wash sales. The fund's 31 day trading rule also prevents it from changing investment direction for 31 days from its last buy or sell transaction.

For years, commentators of a conspiratorial lean have half-jokingly suggested that humanity is living in a simulation, à la The Matrix. When it comes to economic activity and markets, that is no longer an absurd suggestion.

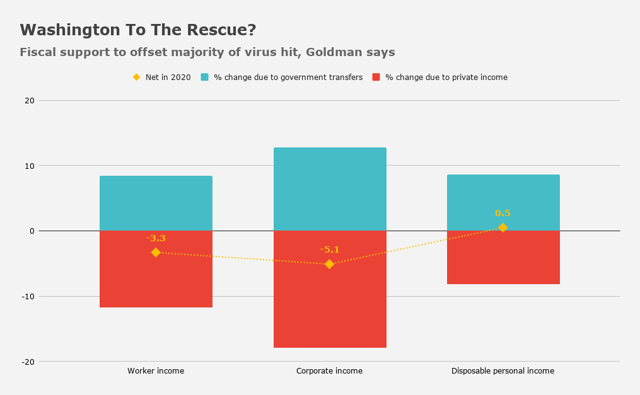

...around three-quarters of those laid-off workers "receive benefits that exceed their former wage," Goldman says.

Goldman's projections actually call for a small increase in disposable personal income.

But there is a problem related to living in a simulation:Again, we are living in a simulation.

Another thread of the article discussess Modern Monetary Theory and ties it into current Fed and Treasury activities. Here is a sample:The Treasury can make up for people’s lost wages, but people need the things wages buy. So replacing lost wages and revenues will not be enough for long: the economy has to produce goods and services.

Here is the link to the article:The US can always buy whatever there is to buy that's denominated in US dollars. It has no need to borrow dollars from anyone else because it is the issuer of those dollars. The US can spend too much, which risks stoking inflation, but the US does not, will not, and has never, needed to borrow dollars. Suggesting otherwise is to traffic in patent nonsense.

Why do governments sell bonds whenever they run deficits?...By selling bonds, they maintain the illusion of being financially constrained.

Unusual but not unique. WHGHX "has a neutral allocation of 80% of its total assets in debt securities and 20% of its total assets in equity securities."Kinda tough placing a standard HY fund against FAGIX for a compare. Over the period of FAGIX existence, the fund usually has an equity exposure of 15-20%. A unique HY fund.

https://nytimes.com/2020/05/10/health/coronavirus-plague-pandemic-history.htmlWhen will the Covid-19 pandemic end? And how?

According to historians, pandemics typically have two types of endings: the medical, which occurs when the incidence and death rates plummet, and the social, when the epidemic of fear about the disease wanes.

“When people ask, ‘When will this end?,’ they are asking about the social ending,” said Dr. Jeremy Greene, a historian of medicine at Johns Hopkins.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla