ARKK: one number and one target 1 -

1 -

1The last profitable day for initiating a buy-and-hold position in ARK Innovation was one year, one month and one day ago. Somewhere in the mid-day. Good news, I guess, is that any purchase made after that day is a candidate for tax-loss harvesting.

64.9%

The amount by which ARK will have to rise for get positions established in early February 202

1 out of the red. The fund saw huge inflows in the fourth quarter of 2020 and most of the first quarter of 202

1 as investors rushed to buy the previous five years' returns. Which is to say, almost all of ARKK's investors are likely underwater.

- - - - -

There's an interesting (somewhat semi-pro) piece on Wood's long term record at

the anonymous InvestmentWatch blog. The author's takeaway is

almost all of Cathie’s major outperforming years come during special periods in the market cycle, particularly in the periods following a market crash ... Outside of those special events, Cathie’s funds generally underperform equivalent style peers on a year-by-year basis. She has a history of leaving a fund during or following a period of underperformance, then “rebooting” in another fund. This includes a short stint in a hedge fund that lost over 80% of it’s AUM.

That last caveat shouldn't apply now, but the others are useful reminders.

For what that's worth, David

When good transactions go bad - T. Rowe Price + Vanguard FWIW...I just completed an DB plan rollover to my exiting TRP IRA Rollover (Brokerage). It was seemless and I had no need to interact with TRP.

A few years ago, when changing jobs, I tried rolling my 401k at former employer into Fido (new 401k at new employer) and had issues with a small amount of the proceeds considered 'after tax' money from the sale of company stock. Fido wouldn't process rollover so I switched to tRP. They obliged and asked for a Letter stating what to do with after tax $$$...simple fix!!! TRP received my proceeds because Fido couldn't accomodate me...

When good transactions go bad - T. Rowe Price + Vanguard I think that TRP allows 401k/403b transfers into its closed TRP funds. But you ran into problems because you tried to move VG IRA funds into closed TRP funds. I am surprised that this didn't come up before hand in your talks with TRP.

But, all's well that ends well.

REMIX lost -5% today Standpoint fund management explains the poor November performance in this quite detailed accounting of its long and short positions.

https://www.standpointfunds.com/fund/documents/under-the-hood-november-2021As some here opined recently, the fund was long oil and petroleum products at the time the Omicron news hit. It appears that the bets on oil have been closed out. I found it somewhat soothing to know that the fund is betting on the price of coffee; I contribute ever so slightly to the demand by regularly ordering 5 pounds of organic dark roast Honduran Marcala elixir.

PRWCX +1.

data set for bonds going back to 1978? Hi Randy.

In

MFO Premium MultiSearch tool, there are four Display (evaluation) Periods that target periods of rising interest rates:

Normalization - 20

160

1 To 20

18

12

Rising Rates - 200406 To 200702

40-Year Bond Bear -

19400

1 To

198

105

20-Year Bond Bear -

19600

1 To

198

105

USBond (US aggregate) index dates back to

1960.

LGovBnd (US long bonds) index dates back to

1926.

For all the Display Periods available, check-out

Definitions page.

And, this commentary piece:

New MultiSearch Screens To Help Analyze Impact of Rising Rates.

Happy to do a Zoom call to walk you through. Let me know.

Charles

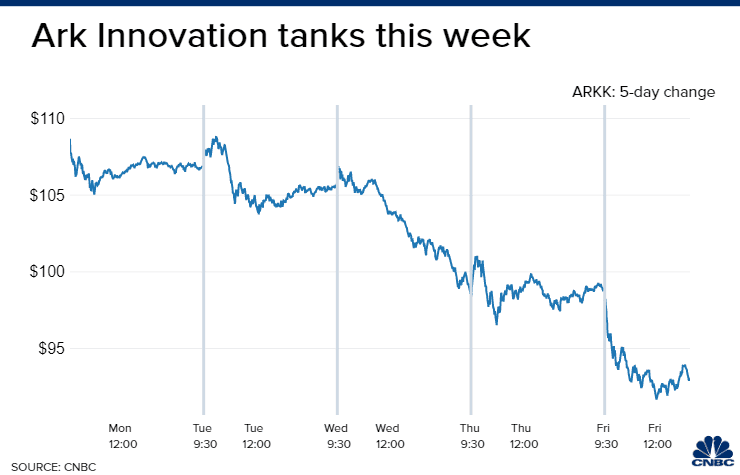

This New ETF (SARK) is Betting Against Cathie Wood and ARK “All of the Stocks in Cathie Wood’s Ark Innovation Fund Are In a Bear Market Except 2”CNBC

Is China a bear market opportunity? It sure seems like Cathy was on to something. FSEAX (-12.92%) and ARTYX (-10.96%) have been real downers YTD.

On the FSEAX front, the fund manager had a contrarian opinion in October (Fidelity Commentary)

“Yet I continue to be bullish on the outlook of China over the medium to long run,” Zhao says. “I’m seeing some attractive stock prices in many of the new-economy segments in China following the recent market pullback, and I welcome the correction caused by short-term concerns, which I find are great times to build long-term positions.”

He believes increased regulations on China’s internet companies and concerns among China’s leaders regarding wealth distribution in the country are not anti-capitalistic and not meant to stifle entrepreneurship. The regulations, he says, are in fact beneficial for the long-term growth and stability of the whole economy.”

At this point, I’d like to know what Zhao’s definition of medium to long run is.

This New ETF (SARK) is Betting Against Cathie Wood and ARK +1 You gotta take profits when you can !

data set for bonds going back to 1978? Most of my data sets go back to 1988, but I'd like to push my analysis of bonds back to 1978. Do you know of any bond mutual funds, or any other data sets of bond portfolios that go back to 1978, and where I can download them from? Thx!

I'd like to see what happened to bond investments when the fed raised interest rates in the early 1980s.

PRWCX Wasn’t a very far reaching or in-depth interview. It opened with the CNBC interviewer plugging a book Giroux’s written, although Giroux didn’t comment on his book. Interview was only 4 or 5 minutes long. Giroux plugged Amazon, GE and one utility (Ameren?) - all of which the fund owns, of course. No mention of bonds or fixed income. Says he won’t buy more equities until “there’s blood in the streets”. And, not enough blood yet. (But I suspect he’s done some recent buying.)

The book Digital (Kindle) Edition

$39.99 / Hard Cover

$60570 pages

Link

PRWCX +1 Guess I’ll set my DVR to record.

Umm … Wonder what he’ll say?

- Avoid bonds?

- Utilities still look good?

- He’s added to equities on recent down-drafts?

This New ETF (SARK) is Betting Against Cathie Wood and ARK Well, that didn’t last long. Friday I bought a little bit of DKNG @ around $28.50. Saturday Barron’s published a “Buy” recommendation on the stock attributed to a company called “Benchmark”. They predicted it would soon reach $50. Today, predictably, it bounced 8% + by mid-day. I sold all, locking in a 7% + overnight gain. Hate to “day trade.” OTOH - I have no control over what Barron’s publishes. Current price: $30.72 at 1:00 PM.

PS - This was inside the Roth, so no tax consequences.

Bitcoin Buyers Flock to Investment Clubs to Learn Rules of the Road / WSJ

“

Shalair Armstrong has a busy life. She runs two chiropractic offices in Boston. She has a teenage son. Still, every weekday morning she makes time to buy some bitcoin within earshot of hundreds of strangers. … ‘WakeUp With Bitcoin’ is part of the Black Bitcoin Billionaires group on Clubhouse that has swollen to 136,000 investors in about a year.

“The crush of people flooding into crypto has left a large information void, especially for individual investors. Every time bitcoin rallies, a new wave of buyers enters the market. A survey by the exchange Crypto.com estimated there were 221 million crypto holders in June 2021, more than double the number in January. Social-media sites like Reddit, TikTok, Instagram and Telegram have become popular platforms for getting information.“

*From WSJ / Saturday, December 4, 202

1What I’m wondering is whether a lot of small and inexperienced investors will loose their shirts with this before it’s all over?

*Can’t find a good link. This one brings up only the photo and a few opening words, plus a link to subscription based WSJ.

https://thenyledger.com/markets/bitcoin-buyers-flock-to-investment-clubs-to-learn-rules-of-the-road/

That other type of inflation that I'll never experience at this time point in my life @BenWP - Size 265/65R-

18 - Japanese off-brand. They ship UPS in 3 days. Yes, I have a local dealer who’s happy to mount & balance them, for a fee of course. These are a mud & snow tire suitable for both winter and summer driving. Have had good luck with Tire Rack over the years.

Building a Portfolio - Charles Lynn Bolin @lynnbolin2021, thank you for sharing your expertise on mutual funds and ETFs with everyone here on this board. I will be following your writing in Seeking Alpha.

Best wishes and be safe,

Sven

Best Biotech Fund? Biotech stocks resemble a landscape filled with craters. The two ETFs that cover the sector, IBB and FBT, are hurting badly, YTD, 1yr or 3yr. FBIOX is down about 15% YTD while broader-based HC funds have not kept up with the stock market as a whole. I owned CELG until it was bought up by BMY which I kept for a while. The stock rose to nearly $70, but it now trades for about $53. At one time it was a M* 5 star pick, but it turned out to be a value trap. I feel lucky to have exited when I did. For a pure growth HC fund, BHCFX has impressed, but it’s volatile.

Building a Portfolio - Charles Lynn Bolin I found the post by Bolin “Building a Multi Strategy Portfolio” very instructive.

https://www.mutualfundobserver.com/2021/12/building-a-multi-strategy-portfolio-fidelity-traditional-ira/It was so detailed and included his criteria for including certain funds. That post is so rich with info. I keep re-reading it and really appreciate the outline of his process to create the portfolio. The use of MFO to create the watchlist and Ferguson and Reamer … new to me. While this portfolio is just one of his- the “Fidelity Traditional IRA”… I found myself wondering about one sentence he mentioned “ a Bucket for a more aggressive Roth IRA managed by Fidelity” … What funds might be in that Roth?

Posting this just to say thanks but also to recognize how valuable it is to see someone’s portfolio and most importantly how it was constructed for the intended purpose. Agree with

@golub1 comment.

Hi

@JonGaltII,

@MileM, and

@Derf,

Since the MFO newsletter will be closing in January, my last article will be a great thank you to Professor Snowball and the wonderful team at MFO, and a description of the Managed Accounts at Fidelity as a final part of my Multi-strategy portfolio.

Best Regards and Thanks for Reading,

Lynn Bolin