It looks like you're new here. If you want to get involved, click one of these buttons!

so you keep reminding us; bully for youYou can't take a big hit when you are at 99.5+% in a money market :-)

Each month the index ranks 11 sectors based on a modified CAPE® ratio and 12-month price momentum factor. The index selects five US sectors with the lowest modified CAPE® ratio or undervalued based on the ratio. The sector with the least favorable 12-month price momentum is rejected and the Index is comprised of the remaining four sectors for the given month.

Communication Services 25.77%

Industrials 24.67%

Materials 24.87%

Technology 25.01%

Total 100.00%

A crisis in credit markets deepened on Sunday as a cluster of funds that own mortgage bonds sought to sell billions in assets to meet investor redemptions, sparking pleas for government intervention.

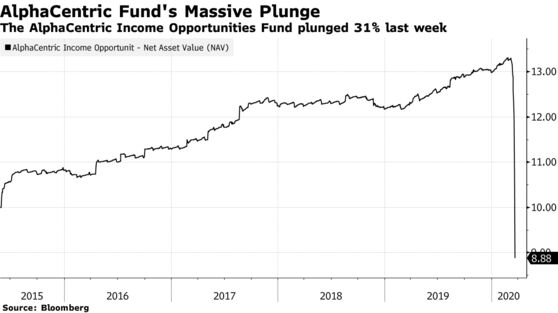

The sales included at least $1.25 billion of securities being listed by the AlphaCentric Income Opportunities Fund on Sunday, according to people with knowledge of the sales. It sought buyers for a swath of bonds backed primarily by private-label mortgages as it sought to raise cash, said the people, who asked not to be identified discussing the private offerings. The fund plunged 17% on Friday, bringing its total decline for the week to 31%.

“The coronavirus has resulted in severe market dislocations and liquidity issues for most segments of the bond market,” AlphaCentric’s Jerry Szilagyi said in an emailed statement on Sunday. “The Fund is not immune to these dislocations” and “like many other funds, is moving expeditiously to address the unprecedented market conditions.”

The best way to obtain favorable prices is to offer a wider range of securities for bid, Szilagyi said. He declined to discuss the amount of securities the fund put up for sale.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla