It looks like you're new here. If you want to get involved, click one of these buttons!

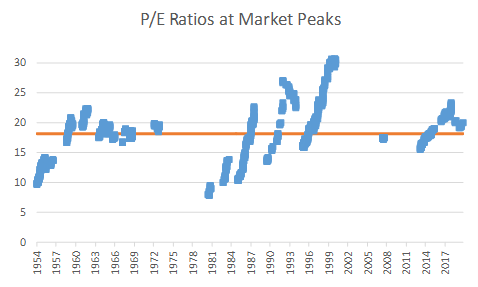

https://seekingalpha.com/article/4299923-p-e-ratios-market-peaksTo me, this analysis suggests that the current earnings multiple with the market at an all-time high is fair to slightly elevated. Given still low rates and monetary accommodation and political capital being spent to forestall an economic downturn, the economy may once again manage to extend its historic expansion. High equity multiples, low interest rates, and perhaps slower earnings growth all suggest lower forward returns on average. I would expect market participants to continue to reprice the stage of the business cycle, which will create episodic volatility.

Fund 15 year 2008 (Q4) 3Q2015 4Q2018JAMCX https://connect.rightprospectus.com/JPMorgan/TADF/339128308/P?site=JPMorgan

FLPSX 9.14% -36.17% (-20.73%) -6.20% -13.54%

ACMVX 10.45% -24.49% (-18.96%) -6.34% -14.96%

JAMCX 8.95% -33.24% (-21.70%) -7.38% -14.88%

VETAX 10.84% -33.10% (aprox-19%) -4.44% -15.29%

Note that there is absolutely no way to redeem the savings bonds in less than a year.You can redeem them after one year, costing you three months of interest. Or redeem them after five years and pay no penalty, or just hold them for 30 years and cash out.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla