It looks like you're new here. If you want to get involved, click one of these buttons!

I added your comment into this thread:A recent AAII article showed that beginning with equal investments in the S&P 500 sectors and rebalancing yearly from the best performing sectors to the lesser performing ones increased one's returns substantially over time. However that must be taken with the willingness to go through all the watching and rebalancing efforts required. Your choice.

Interesting food for thought:...2020 looks like it could go down in history as the worst intra-year drawdown that finished the year with a positive return. And the fact that those gains are now in double-digit territory is not something many (any?) people saw coming. The S&P is now up well over 60% since bottoming in late-March.

the-biggest-stock-market-reversal-in-historySitting on your hands and not panicking, even when stocks are down big, remains one of the best investment strategies on the planet.

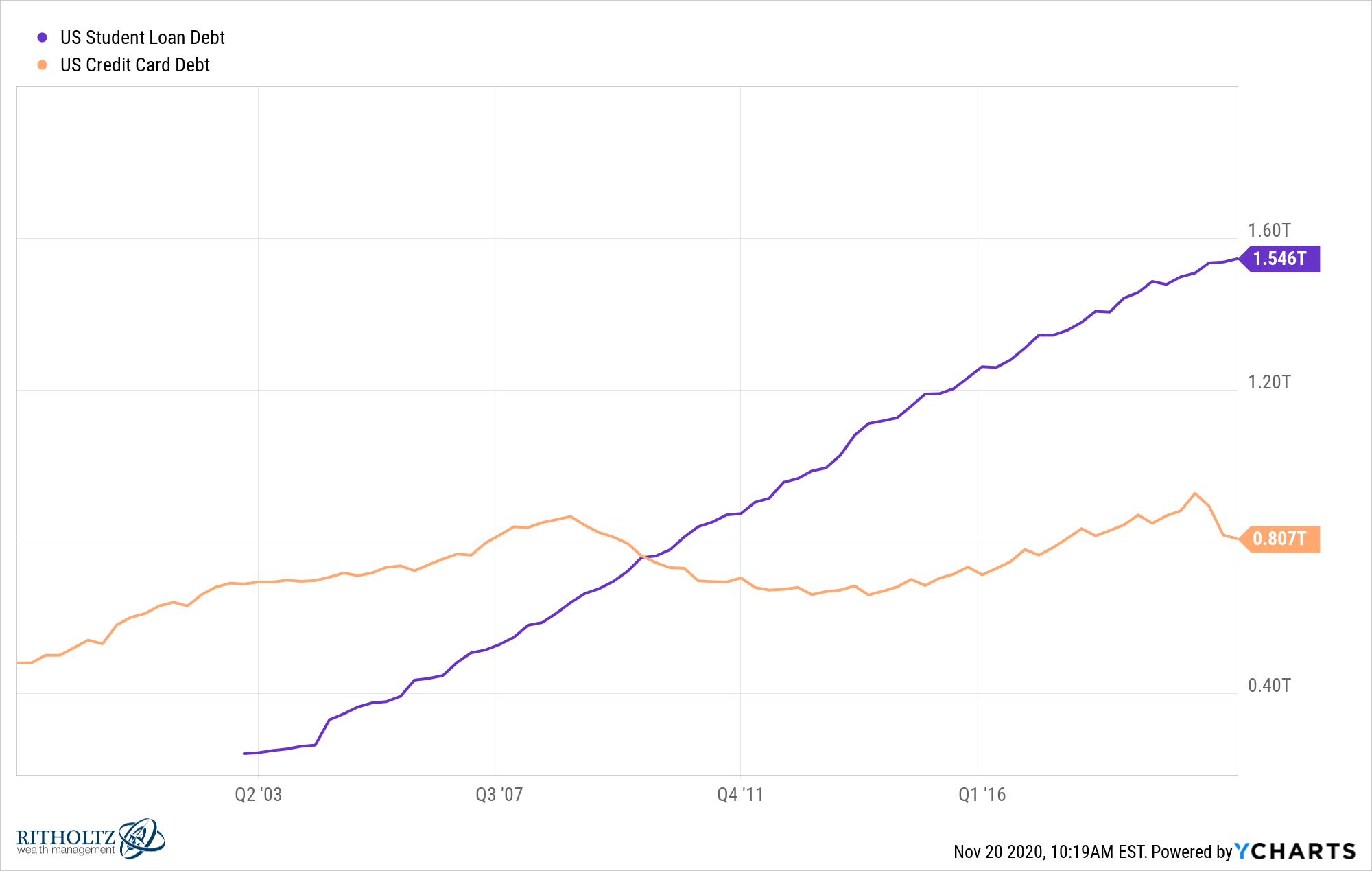

This discussion did get me thinking about which type of debt is a bigger problem for the economy. Here are the outstanding debt levels for both student loans and credit card debt:

analysis-with-end-of-crisis-programs-fed-faces-tricky-post-pandemic-transitionThe possible arrival of a coronavirus vaccine in the coming weeks means the Federal Reserve may soon have to lay out its plans for helping the economy navigate the potentially choppy transition to a post-pandemic world.

https://finance.yahoo.com/news/stock-market-valuations-not-mean-reverting-morning-brief-110134302.html...rich valuations alone are no reason to avoid or dump stocks. And they’ve historically revealed almost nothing about what stocks do in the next 12 months.

Indeed, much of the gains you see in the stock market have been achieved while valuations appeared expensive.

Will any of this matter 10 years from now? Probably not. In the short term, anyone who's been paying attention already bought in March. You want more? Sure, buy more.Looks like JASSX is available at FIDO with $2500 min, but a $49.95 fee. JASVX is available NTF at ETRADE, $250 min.

The time to pick the low hanging fruit was 8 months ago (says Captain Hindsight). So do you still buy/add to these higher risk funds now, after the big bounce?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla