It looks like you're new here. If you want to get involved, click one of these buttons!

Contrast that with PRWBX's prospectus:The fund may invest up to 35% of its net assets in corporate bonds, bank loans, and other debt instruments that are rated below investment grade (below BBB-, or an equivalent rating), commonly known as high yield instruments, by each of the rating agencies that have assigned a rating to the security or, if unrated, deemed by T. Rowe Price to be below investment grade. The fund may invest in securities issued by both U.S. and non-U.S. issuers, including issuers in emerging market countries.

The fund will only purchase securities that are rated within one of the four highest credit categories at the time of purchase by at least one major credit rating agency or, if unrated, deemed to be of comparable quality by T. Rowe Price

Thanks @bee. I would never in a million years remembered till I saw it in your link. Back in those days I was Dateliner. Those were the days and datelining was the closest thing ever to a free lunch on Wall Street.Here's a taste dating back to 2001:

web.archive.org/web/20011205080443/http://64.45.57.12/wwwboard/wwwboard.html

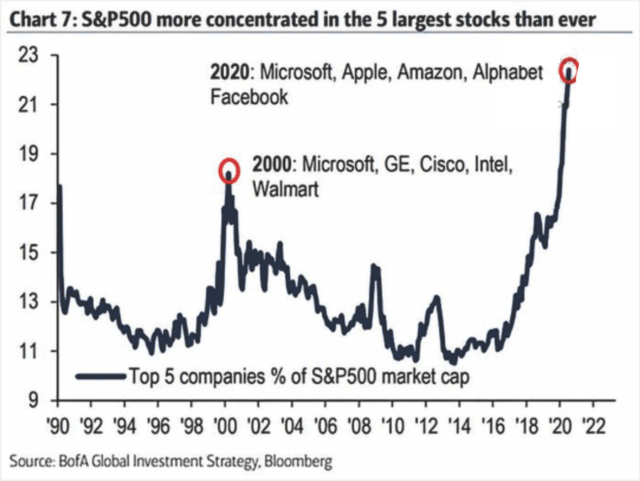

"It seems like we have dodged a bullet, yet a look under the surface reveals a much sicker market....the S&P 500 is still down 1.88%, but TPA's BIGTECH Index (the top 8 stock in the NASDAQ 100 by market cap) is up an astonishing 48.99% year to date (YTD)....these 8 stocks represent $8 trillion in market cap, which is 29% of the market cap of the S&P 500 ($27.3 trillion). TPA ran the numbers to see just what effect these 8 stocks have had on an index of 500 stocks. The BIGTECH effect has been to add 8.71% of performance to the S&P 500 YTD.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla