It looks like you're new here. If you want to get involved, click one of these buttons!

Good thinking Dex. Although I hope if you do go into junk corps it is with an open end and not an ETF. My latest foray into junk corps was a bust. Sold down to 8% which will be zero at the close. Back to 65% in the junk munis and may go higher today. Actually, it is the CA munis which are leading in 2016. While I may be in the black YTD, still have made several bonehead moves.High Yield Corps - need to see how stocks behave - still a risky trade to me

They have actually bottomed before stocks YTD. At 36% going into today and will be 41% after the close. My friend here who trades like me is much higher. In the past I would have been a lot higher being that we now have had two 9 to 1+ days in one week. Age must be catching up with me Either that or I keep thinking there is another shoe to drop in high yield. But as I have said in the past, I never make money with my thinking.

The dividend yield on HYG for example, and link to stocks risk reward ratio just doesn't work for me at this time.

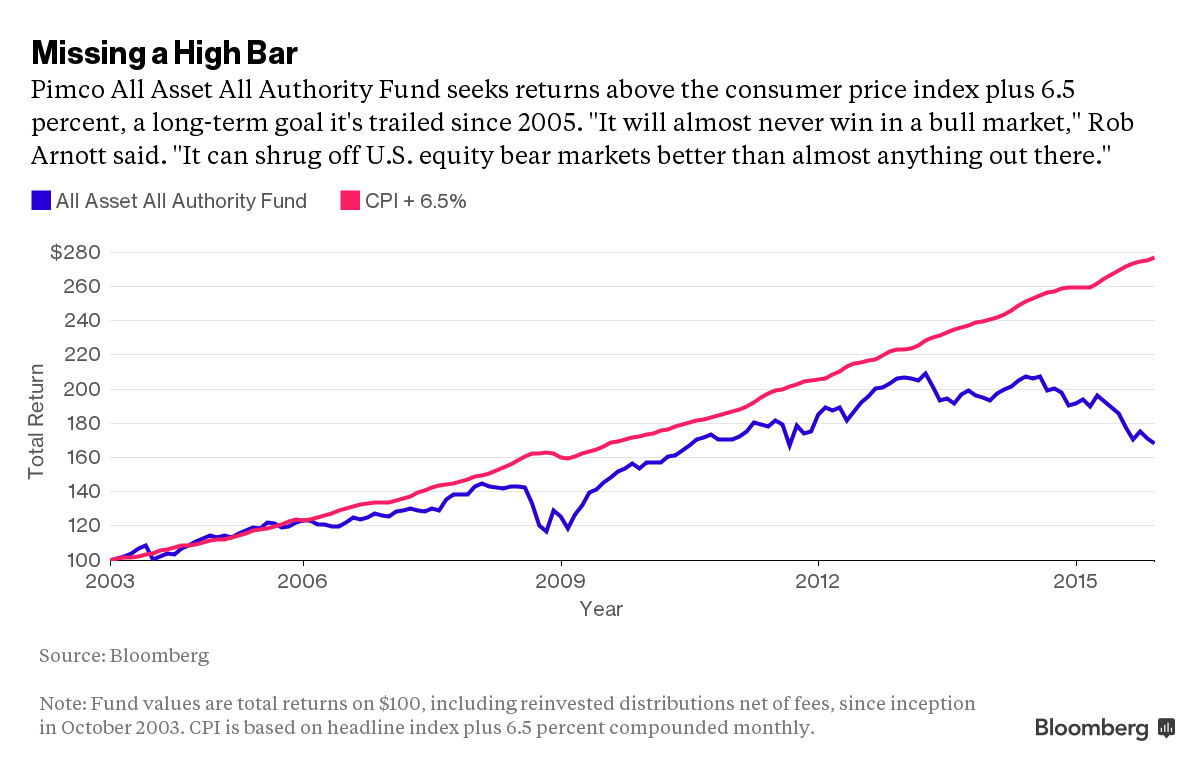

"Investors last year pulled a combined $15.8 billion from two mutual funds run by 61-year-old Rob Arnott -- Pimco All Asset and All Asset All Authority-- as their returns trailed most peers for the third straight year. They had Pimco’s most redemptions in 2015 except for Gross’s old fund, the Pimco Total Return Bond Fund, with $54.6 billion in withdrawals."

http://www.bloomberg.com/news/articles/2016-02-05/bill-gross-investors-aren-t-the-only-ones-pulling-pimco-money"Redemptions from All Asset All Authority surpass even Pimco Total Return in percentage terms when looking at their peaks. All Asset All Authority assets are down 76 percent from their 2013 high, to $8.6 billion, compared with Total Return’s 70 percent drop from its all-time high the same year."

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla