welcome to the discussion a/k/a help board for MFO's premium tools Yeah, that's kinda what I see.

Most LC funds have volatility measured by STDEV, DSDEV, or Ulcer Index similar to S&P 500 (specifically between 75 and 125% of S&P500).

Pretty broad, I know.

I suppose we could up Risk Group rankings to 1 thru 10, just at time did not want to make it too precise...you know, like measuring a marshmallow with a micrometer.

But, maybe not.

welcome to the discussion a/k/a help board for MFO's premium tools >> most large cap equity funds have risk (volatility) close to s&p 500, which by our definition gets a 4.

Not following. Is SP500 less risky than any funds w a 3 rating? Always? Never? Or to put it the other way, no longterm LC mutual fund is less risky than SP500 by these criteria?

Sorry to be dense, but this seems unbelievable.

welcome to the discussion a/k/a help board for MFO's premium tools @daivdmoran.

No mistake on your part! I look for moderate risk equity funds all the time...just hard to find.

Which leads to the conclusion that SP

500 is actually less risky than

any LC fund the last decade or two? Seriously? To get any funds to look at I need to go risk 4? Wow.

Basically, since the s&p

500 is mostly large caps, most large cap equity funds have risk (volatility) close to s&p

500, which by our definition gets a 4.

Just the way it is.

c

welcome to the discussion a/k/a help board for MFO's premium tools Which leads to the conclusion that SP500 is actually less risky than any LC fund the last decade or two? Seriously? To get any funds to look at I need to go risk 4? Wow.

welcome to the discussion a/k/a help board for MFO's premium tools The reason David is that all 40 funds meeting the previous criteria are in Risk Group 4 and 5.

If you just look at 3 lc fund categories of moderate risk or less, you'll find...14 funds, but with either higher er or shorter life or tenure than you specified.

Hope that helps.

c

welcome to the discussion a/k/a help board for MFO's premium tools ok. last step...mfo risk group 1, 2, 3, which translates to very conservative, conservative, and moderate funds, which is based on volatility relative to overall s&p

500...

which yields...

none

just like you said...

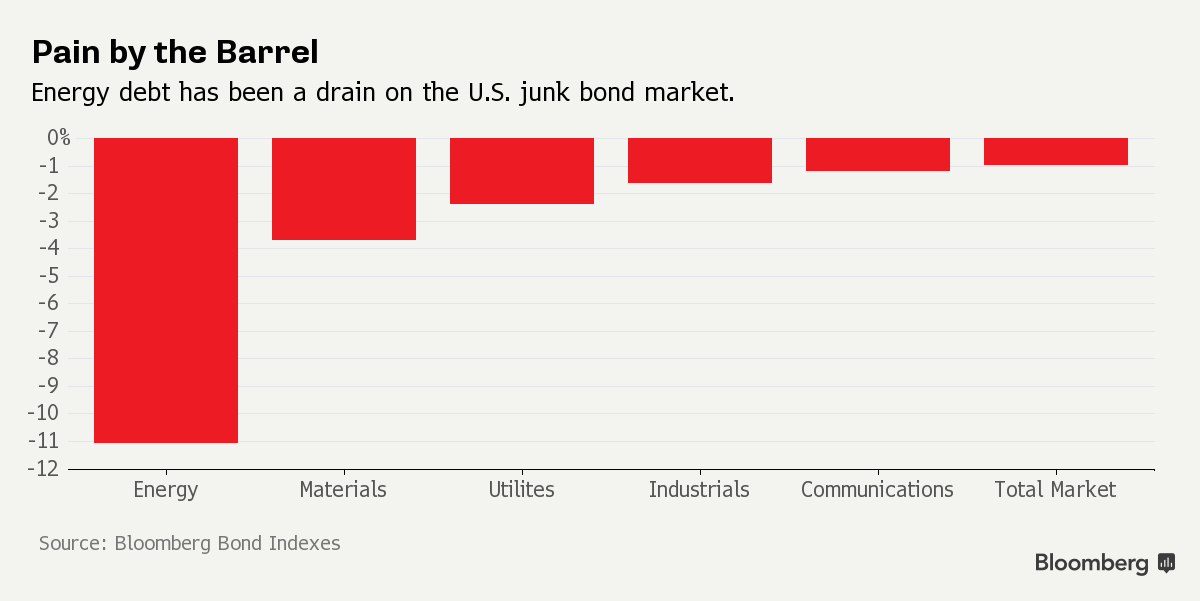

High Yield Munis holding up well versus High Yield Corp Bonds Holding up well a bit misleading as they are more than just holding up. They are beating most all the equity index and category returns as well as leading the pack in Bondville. Some of the better managed open end junk munis are up 4% to 5% YTD. And that is on top of last year's gain in the high teens. The junk corporates (ex short term junk) are down around 2.5% through today with several down more than 4%. Hope the pain in the corporates gets much, much worse because they will be setting up for a double digit annual gain somewhere down the road. How far down that road I haven't a clue.

welcome to the discussion a/k/a help board for MFO's premium tools ok, now 3 lc funds, 1

5 years or older age and tenure, and 1% er or less...

yields 40 funds...

welcome to the discussion a/k/a help board for MFO's premium tools now, 3 lc funds, 1

5 years or more with manager tenure 1

5 years or more...

yields 77 funds...

welcome to the discussion a/k/a help board for MFO's premium tools now, 3 lc funds age 1

5 years or more...

yields 326 funds...

welcome to the discussion a/k/a help board for MFO's premium tools ok...

3 lcs...

yields 634 funds through nov '1

5...

The Best Mutual Funds To Buy Right Now!

vanguard fund distributions On Vanguard site there is a note indicating "updated and expanded estimates" will be provided on 12/11/2015

vanguard fund distributions There's no mention of any equity index fund, as is to be expected:

"Note: Funds not listed do not expect, as of October 31, 2015, to distribute capital gains in December."

A quick check on M*'s page shows no cap gains in 2013 or 2014 either.

welcome to the discussion a/k/a help board for MFO's premium tools Putting in LC x 3 (meaning all types), 15y for age and tenure, 1% ER or lower, Risk 1,2,3, and everything else No or Any.

Getting no results.

Must be misunderstanding something here.