@Junkster.Only presented the S A link as a primer for high yield options and comparisons.

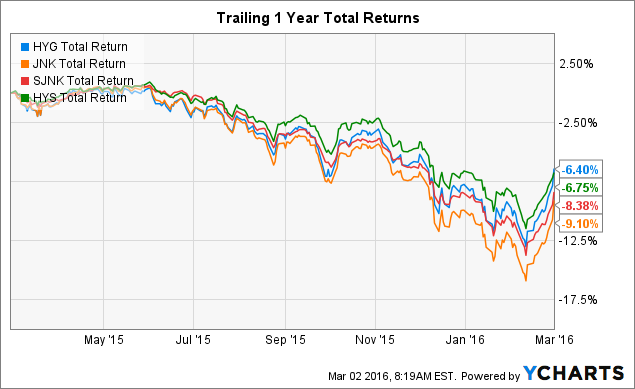

Here is another chart from the S A article that clearly shows your call of a bottom on February

11th.Even the much maligned FPACX is up 7.69% since then !

also

@Junkster Risk-off to continue ? More for your perusal.

MLPs had another

ripping week as higher oil prices and E&P equity issuance attracted new capital propelling the benchmark index higher +7.2

1%, and a -8.72% YTD loss. Crude rose

10.2% for the week as lower production numbers were reported by EIA (table below) which seemed to trump the higher crude storage reported, along with more cooperative comments from OPEC members and Russia. The reality of lower crude production has been good news for MLP's, despite what those lower volumes may mean for some midstream assets

http://mlpdata.com/mlp_newsevents/article_details?article_id=282&mbTrackingId=1"If you are Exxon, you have to be looking around at all of the

wreckage in the energy sector these days and feel like a kid in a candy store,” said Spencer Cutter, an analyst at Bloomberg Intelligence. The debt offer is a sign that Exxon may "start picking up great assets at fire-sale prices" and "take advantage of the downturn and start shopping," he said.

http://www.bloomberg.com/news/articles/2016-02-29/exxon-said-to-plan-bond-offering-after-rating-downgrade-threatOil jumps as traders close short positions, U.S. producers cut rig count

http://news.yahoo.com/oil-rises-traders-close-short-positions-u-producers-015805943--finance.htmlhttp://www.tradingeconomics.com/commoditiesAsian shares hit two-month highs on Monday, extending sharp gains from last week, following upbeat U.S. jobs data and a rebound in oil and commodity prices.

http://news.yahoo.com/asian-shares-hit-two-month-high-solid-u-004607584--business.htmlAdd 3/07 Latest From Otter Creek L/S Fund

-2.32% since Feb

11th

On the Bearish Side .From OTCRX March 7th posting of Feb Fact Sheet

Market Commentary

We continue to be mindful of both credit growth and credit conditions. Financial conditions remain tighter than several months ago and access to the high yield

market has become more challenging since last year. In addition, despite the rise in equity markets recently, the spread on the 2 year and

10 year treasuries is

the lowest since 2008 which does not bode well for future credit growth. We believe these dynamics are worth monitoring closely.

Equity market valuations remain relatively unattractive, in our view. We estimate the S&P 500 is trading at approximately

16x-

17x earnings – modestly above its

historical average – despite fairly tepid sales and earnings growth. Given the ongoing deterioration in global growth trends, we see more downside than upside

to earnings near-term. We are closely monitoring the potential for consumer spending to accelerate on the back of an improved labor market, better wage

growth and low gas prices. A potential acceleration in consumer spending coupled with a further stabilization in the dollar and commodities could help drive

improved earnings growth later in the year.

Our long portfolio is structured around owning high quality companies benefiting from secular tailwinds, idiosyncratic ideas that should perform well regardless of

the market environment, and special situations. Our short portfolio is structured to take advantage of companies overearning due to ultra-low interest rates and

companies with a high likelihood of missing sales forecasts due to a weaker macro environment.

As we enter March, we have approximately 20% of the Fund in cash. Considering the rise in equity markets over the past several weeks and the collapse in

volatility, we have taken the opportunity to add to our highest conviction ideas by adding both common stock shorts and out of the money puts

http://www.ottercreekfunds.com/media/pdfs/OCL_Factsheet.pdf