Bloomberg has

a decent article on the reasoning behind the SEC's liquidity management proposal.

When you sell your fund shares, you're supposed to get the day-end NAV and the fund's supposed to cut you a check within a week. In recent years, funds have seen the challenge of earning

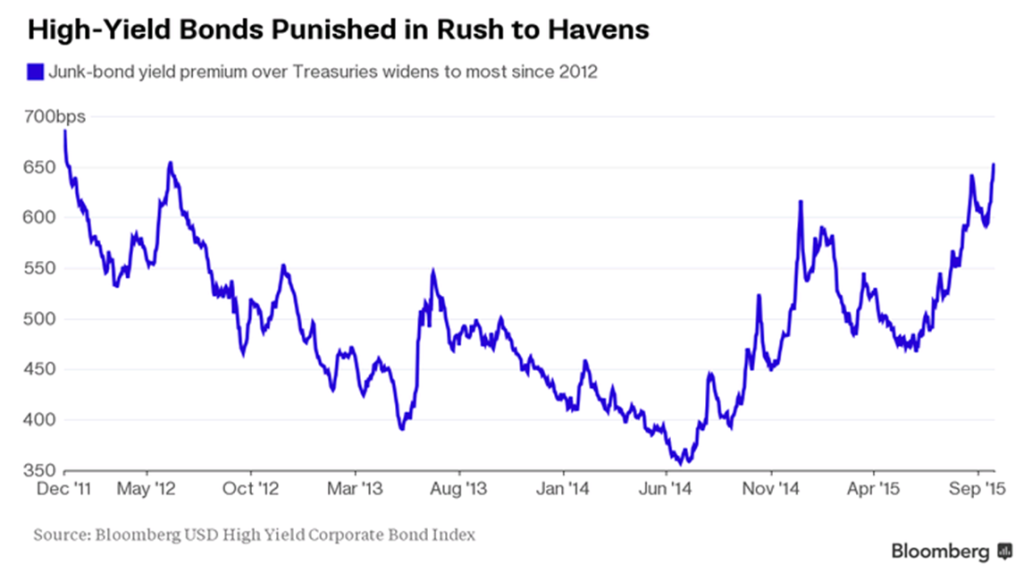

something as greater than the challenge of remaining fully liquid. As a result, more funds have moved into investments that might turn into roach motels: each to get into, impossible to get out of. Those include below investment grade debt, private placements, some derivatives and illiquid investments in general. That's compounded by the move to passive products that maintain near-zero cash levels.

The SEC research found that liquid alts funds face a greater prospect of a liquidity crunch than most, since their investors have a greater tendency to sell en masse. (Data's in the article.)

The SEC proposes requiring that each fund analyze its portfolio, determine the potential magnitude of quick outflows in a crisis and maintain enough "cash or cash-like investments that can be sold within three days" to be able to handle redemption demands without exacerbating a crisis by trying to sell illiquid positions into a market where everyone else is already trying to do the same.

The Investment Company Institute scoffs at the very idea of a challenge to the easy grandeur of the industry they're paid to represent.

Two interesting implications: (

1) liquid alt funds might have to become dramatically more liquid but also (2) ETFs might no longer be able to remain fully invested. One additional implication: an ETF and an index fund mimicking the same index might not be permitted to carry the same cash level if the redemption patterns in the ETF don't mirror the redemption patterns in the fund.

Worth pondering, perhaps.

David