Bond yields leap connected to sell-off For those who don’t know, this is how it is done. DT was backed into a corner and had no choice. He was beaten.

"Let’s talk about the moment Donald Trump blinked. It wasn’t loud. It wasn’t a tweetstorm or a rally rant. When the tariff threats that had the world on edge — 125% on China, 25% on Canada’s autos, a global trade war in the making — suddenly softened. A 'pause,' he called it. A complete turnaround from the chest-thumping of the past week. And the reason? Mark Carney and a slow, deliberate financial maneuver that most people didn’t even notice: the coordinated Treasury bond slow bleed.

This wasn’t about bravado. It was about leverage. Cold, calculated, and devastatingly effective.

Trump’s pause wasn’t because people were getting yippy…

Rewind a bit. While Trump was gearing up his trade war machine, Carney, Canada’s Prime Minister, wasn’t just sitting in Ottawa twiddling his thumbs. He’d been quietly increasing Canada’s holdings of U.S. Treasury bonds—over $350 billion worth by early 2025, part of the $8.53 trillion foreign countries hold in U.S. debt. On the surface, it looked like a safe play, a hedge against economic chaos. But it wasn’t just defense. It was a loaded gun.

Carney didn’t stop there. He took his case to Europe. Not for photo ops, but for closed-door meetings with the EU’s heavy hitters — Germany, France, the Netherlands. Japan was in the room too, listening closely. The pitch was simple: if Trump went too far with tariffs, Canada wouldn’t just retaliate with duties on American cars or steel. It would start offloading those Treasury bonds. Not a fire sale — nothing so crude. A slow, steady bleed. A signal to the markets that the U.S. dollar’s perch wasn’t so secure.

---Dean Blundell, Canadian radio host. Some might say, "shock-jock." But even a broken clock is correct, twice per day.

Tariffs Per Krugman article posted by

@Mark:

Good jobs don’t have to be in manufacturing, and manufacturing jobs aren’t always good“McDonald’s workers in Denmark are paid more than Honda workers in Alabama.” That claim has been showing up in my inbox, so I checked it out. And it’s true. McDonald’s workers in Denmark are paid more than $20 an hour, in addition to receiving substantial benefits. Indeed.com says that “production associates” at Honda’s Alabama plants are paid an average of $

14 an hour.

"There’s a lot of romanticism about what manufacturing jobs in America used to be like. It’s true that some industrial workers were well paid. But that was mainly because they had strong unions. Nonunionized workers in, say, South Carolina’s textile industry had low pay and terrible working conditions. Many came down with brown lung disease caused by breathing in lint. Why should we want to bring those jobs back?"

Tariffs It looks like Trump did China and BYD, a company producing electric cars, a solid. Tesla used to sell most of their cars in the USA, (232,400 from Jan-May in 2024) and China (219,056, same timeframe). Now that nobody will be able to buy Teslas in China, BYD is taking off like a rocket. Their stock is soaring. Elon Musk should personally thank his leader for the thoughtful gift. Combine that will sinking sales, Tesla is in the doghouse. Biden already had a 100% tariff on these cars, so nobody is buying them in the US. They are selling them in Europe.

Tariffs

Let the Exemptions Begin! @Sven said,

I understand that iPhones have very high profit margins

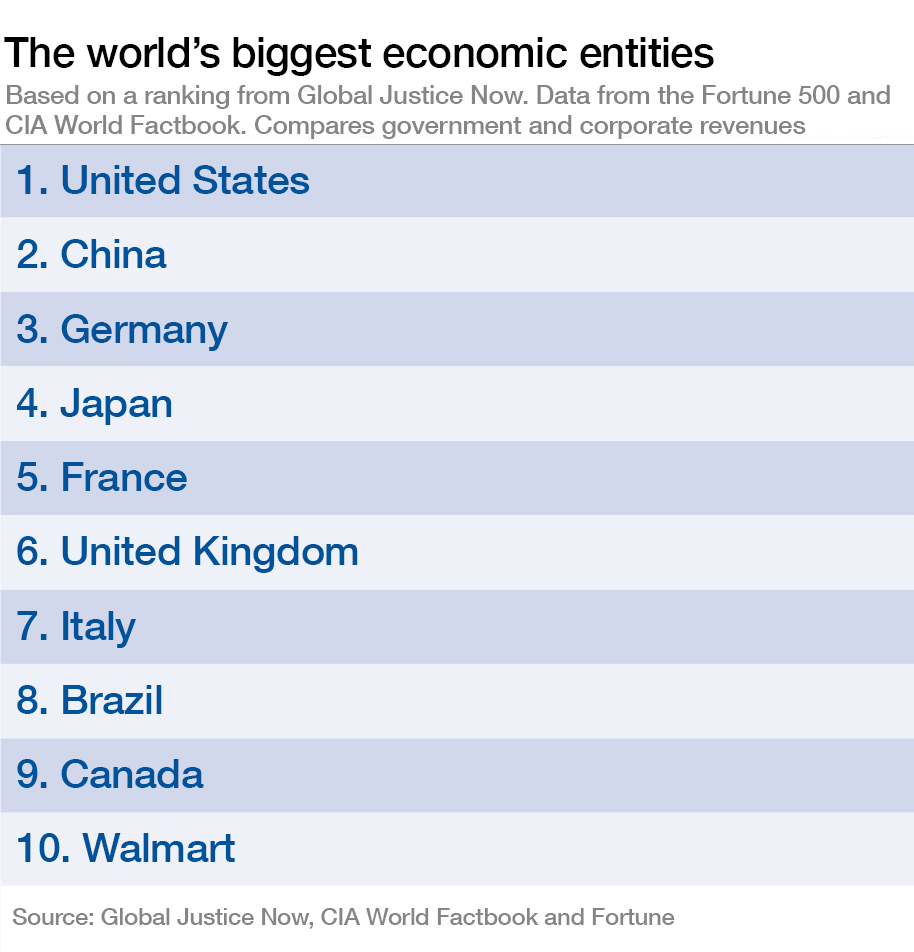

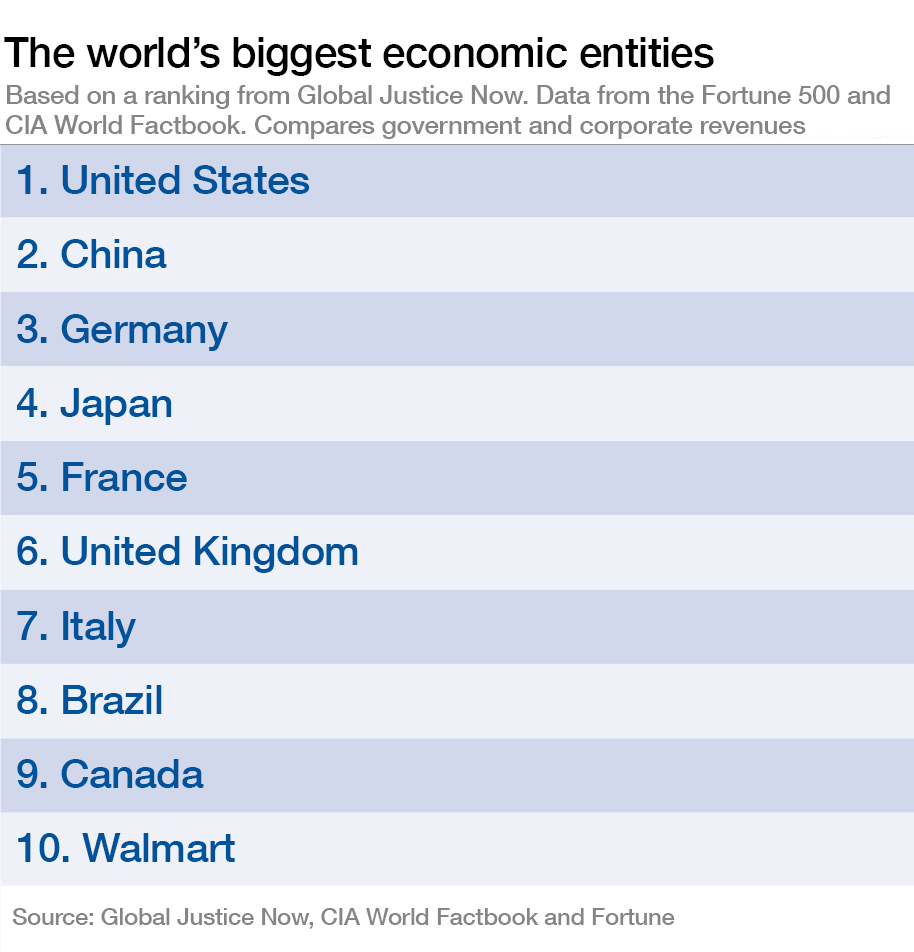

I looked into Apple's "economic footprint" and discovered that Apple exceeds the government revenues of Switzerland, Norway and Russia. Only 9 countries are larger economic entities than Walmart.

Many of the top 25 economic entities are Corporations, not Countries.

Here are a couple of articles for food for thought when it comes to the economic significance of individual countries and individual global corporations. Few have mentioned that these exemptions and tariffs have a huge impact on many global corporations. These global corporations have a different kind of allegiance than do countries. Corporate goals are aligned more closely with shareholders demands than the messy needs of countryman's.

Because their goal don't always align, Corporations operate as odd bed fellows in the Countries they do business as well as the countries they sell to.

Countries vs Corporations - Comparing Economic Entitiescorporations-not-countries-dominate-the-list-of-the-world-s-biggest-economic-entities/Global Manufacturing:global-manufacturing-scorecard-how-the-us-compares-to-18-other-nations

Let the Exemptions Begin! Interesting article

@hank. The revenue difference between the iPad and iPhone

revenue was surprise at first until I considered it a bit more.

Just some of my own observations:

- Many iPads seem to sell for less than the price of an iPhone

- Most of the masses can be found nearly anywhere with a phone in their hands, not so much a tablet.

- The younger generation (

13-25 yr olds) live and die with their phones so it seems. They rarely speak of must having to possess a tablet.

- I own all 4 (phone, pad, iMac and MacBook). I do so mostly for vision related reasons but also seamless integration between them. The phone is primarily just a phone to me. I hate all the scrolling around, enlarging and/or shrinking etc., etc. yet my kids do it with no sweat whatsoever as if they came into this world with a phone in their hands. I had breakfast Sunday morning with a 4yr-old and her parents. She took over my phone and seemed to know what to do with everything. What's funny is that at my home they ask me to assist them with performing a task on the iMac or MacBook. Maybe it's just because they have to use a mouse or curser instead of swiping with their fingers.

Timely T/A for Stock Investors

Bond yields leap connected to sell-off The UST's found basis point increases (higher yields) in the range of .20 - 50 last week, for the shorter duration through the long duration. This Monday morning finds lower yields in the .05 basis point area. So, a small victory as of 9pm, Monday morning. Last week had very large percentage losses for the 'common, non-complex' bond funds ranging from a -3.3% for LQD to -2.5% for plain jane funds as; AGG, FBND, BAGIX and many other 'core or core+' funds. Sadly, one can't rely on what 'announcements' will arrive from DC at any given moment. We're having fun, eh ??? Hang in there. Green in bonds and equity so far, in the pre-markets, at 9:10AM.

Remain curious,

Catch

Tariffs "All 11 S&P 500 sectors are down since the announcement, with energy the hardest hit. That is because oil prices have tumbled to their lowest levels since 2021 on fears that a global recession will curb demand.""The materials and consumer-discretionary sectors are both down sharply because of their reliance on imports, while real estate and financials were hit hard by worries about slowing growth.""A bond selloff that began Monday turned into the biggest weekly climb in the 10-year yield in almost 25 years, alarming traders.""Traders are bracing for more big moves ahead. The Cboe Volatility Index, which tracks expectations for the size of stock swings over the next 30 days, just touched the highest level since March 2020."https://www.msn.com/en-us/money/markets/the-companies-and-markets-hit-hardest-by-trump-s-tariffs/ar-AA1CPk0a

Tariffs

Let the Exemptions Begin! Interesting article. Resharing iPhone manufacturing in the States is impossible (lack of skill labor) and high labor cost. Some calculated that an American-made iPhone 16 would cost at least $2,000.

In 2017 Cook said if there is a tooling meeting being held in US, there may be a handful of workers to be held in a conference room, whereas the same meeting being held in China, it would take several football fields. Foxconn has done a masterful job in mass manufacturing of high valued products. If US wants to compete, where are the training, education and funding for new “skill” workers ?

Apple has attempted to move manufacturing to Vietnam, but the lacking of the number of skilled workers limited its potential. India is more successful but there are more local political hurdles and infrastructure (reliable power grid) to overcome in order to make a full transition from China.

I understand that iPhones have very high profit margins and customers often upgrade their $1,000 phones in 2 years. iPads and Mac computers are more like commodity products having much longer service life. My Mac computers are still running well after 10 years.