Chuck Jaffe: 6 Bad Reasons To Make Changes To Your Portfolio "1. ‘It can’t go up forever,’ or ‘We are overdue for a downturn or a correction.’"

It cannot go up forever, but theoretically, it can go far further than anyone could expect. It really strongly appears to me that Central Banks are absolutely of the view that economic Winter has to be held back at all costs. I'm not saying that they will be successful, but they will push their theories until things get disorderly.

QE (and as I've noted, market didn't even have to go down much and there was a Fed governor the other day talking about the potential for more asset purchases - I thought the market would have to drop 15-20% for that conversation to even start) and ZIRP will not in and of themselves result in a sustainable recovery or fix underlying problems that need to be addressed.

This is not saying that stocks can go up forever, but there's a lot of variables and reflation or bust clearly seems to be the theme of central banks. Again, I'm not saying that stocks go to the moon, I'm simply saying that - for some reason - central banks this time around seem as if they are going to take this to the limit.

If it doesn't work, they'll never admit it - problems are "transitory" and theories don't work because there "wasn't enough". With those views, things will - I think - be taken to the limit until they get disorderly. What that looks like we'll have to see, but I still think this period ends badly. I think in some ways with ZIRP and QE this is the ultimate bubble and it would not surprise me if the global economy looked very different on the other side.

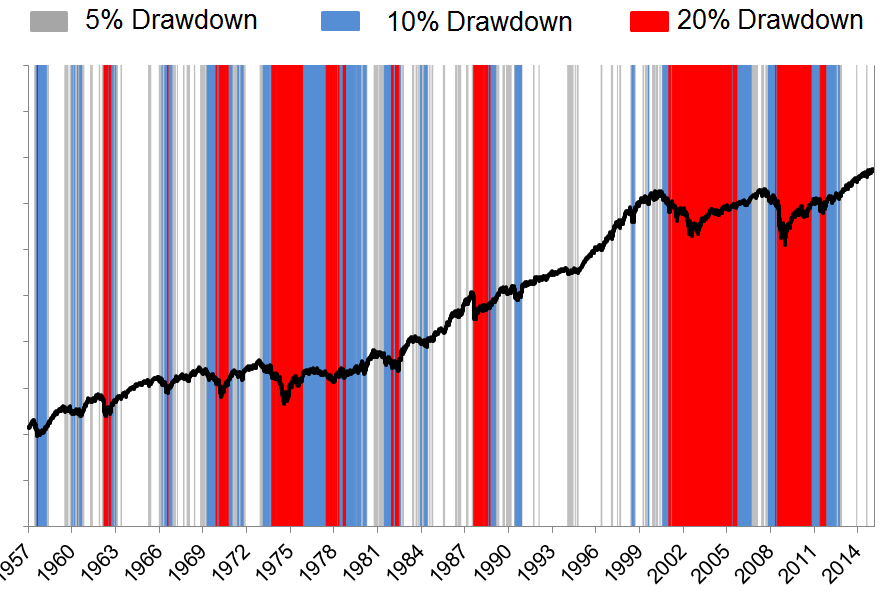

2. ‘Because the bull run has been long, any decline is going to be big, too.’ - This is a patently false premise. Duration of a bull market is not the determining factor in the severity of corrections. Valuations and economic conditions are the primary drivers.

Variables.

3. ‘The Federal Reserve is serious about raising rates now, and that’s going to end the rally.’ - The first part of his statement is probably true. The second part does not necessarily follow.

Who knows what the hell they want. You have different Fed governors saying different things every other day. The Fed can say that they want to raise rates, but they said that a couple of years ago, too. It gets to the point after several years where it looks bad that ZIRP is apparently still a need and does kind of go against their often overly optimistic economic projections. If that looks bad, imagine how it will look if they raise rates 50 basis points and then have to backtrack and lower rates again. That would be a clusterbleep of epic proportions.

The Fed is ultimately "data dependent", but there is a real, strong element of "baffle them with BS" that is becoming more and more apparent with each passing year. As far as I'm concerned, this is a MOPE - management of perspective economy and the Fed is trying to manage the market's view of the economy for as long as they continue to have credibility. You should not be trading based upon what Yellen, Bullard or anyone else says on any given day because guess what? They could very well say something entirely different two days later. And all the discussion about the Fed raising rates might meet resistance with economic reality.

4. ‘The government will screw this up.’ - This is a silly argument. Governments come and go depending on the outcome of elections.

Of course they will. As far as I'm concerned, a lot of what government does these days is simply "hot potato" - hope they can buy time by financial engineering and other garbage in order to get to hand things off to the next person. Or, they hope they can throw enough money at problems that they don't have to actually go through the difficult task of having to solve them. And hey, it's a lot more popular to throw money at problems than to make difficult decisions - until things fall apart again.

5. ‘The market is overpriced.’ - This is probably true in general. However, it's a straw-man so "all-inclusive" that it's easy to knock down.

Meh. It depends on so many factors.

6. ‘You can’t lose money in cash, so I will wait until the next downturn passes.’ -

Well, you can if the government decides that ZIRP and QE aren't enough and decide to step it up to things like NIRP and devaluation.

New Fund Offers Individuals Access To KKR Buyout Deals About LPEFX, with a 5.5% front-end load and a 1.59% ER I personally don't find anything interesting about this fund at all. That'a a 7.09% deficit from the start that an investor w/o access to a load waiver has to jump over to even begin to make any return. Also, assuming M* (and this is one BIG assumption) has this dog placed in the appropriate category, the fund trails it's category badly. I'd pass and just hold a few of the entities outright but to each their own. Disclosure: I own BX & KKR.

I think what concerns me about this fund is that - as you noted - you get everything, and that includes both the good (the A-list, like KKR, BX, OAK and a few others - including Brookfield and Danaher) along with some of the London traded PE funds, as well as some other entities, which are a mixed bag.

Owning the individual entities has issues (K-

1's, although not with all of them - BAM and Danaher, for example) but ultimately that's what I've gone with. The individual names often provide quarterly dividends, too, which is what I'm looking for and I suppose this is just such a tricky and volatile industry that there is something to going with the biggest and best versus the whole thing.

Again though, just me.

Long BX, DHR, OAK and BPY. I've pondered Onex and a few of the other things. However, I'm probably done after making BX a larger position than I'd initially imagined it being. Private equity investments are quite volatile and not for conservative investors.