It looks like you're new here. If you want to get involved, click one of these buttons!

Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W):

U.S. city average, by expenditure category, September 2023

[1982-84=100, unless otherwise noted]

Indent Expenditure category Relative Unadjusted

Level importance percentage change

Aug. 2023 Sept. 2022 -

Sept. 2023

0 All items 100.000 3.6

1 Food 14.894 3.8

2 Food at home 9.391 2.4

3 Cereals and bakery products 1.258 4.8

3 Meats, poultry, fish, and eggs 2.119 0.3

3 Dairy and related products 0.818 -0.3

3 Fruits and vegetables 1.607 0.7

3 Nonalcoholic bevs and beverage materials 1.191 4.0

3 Other food at home 2.397 4.3

2 Food away from home 5.503 6.1

1 Energy 8.797 -0.2

2 Energy commodities 5.102 2.6

3 Fuel oil 0.081 -6.2

3 Motor fuel 4.971 2.8

4 Gasoline (all types) 4.866 3.1

2 Energy services 3.696 -3.7

3 Electricity 2.958 2.1

3 Utility (piped) gas service 0.738 -21.7

1 All items less food and energy 76.309 4.1

2 Commodities less food and energy comm. 21.429 -0.2

3 Apparel 3.028 2.9

3 New vehicles 3.936 2.5

3 Used cars and trucks 2.995 -7.9

3 Medical care commodities 1.292 4.4

3 Alcoholic beverages 0.695 4.8

3 Tobacco and smoking products 0.741 5.7

2 Services less energy services 54.880 5.9

3 Shelter 33.030 7.2

4 Rent of primary residence 10.345 7.6

4 Owners' equivalent rent of residences(1) 21.516 7.0

3 Medical care services 5.454 -3.6

4 Physicians' services 1.439 0.1

4 Hospital services(2) 1.810 4.4

3 Transportation services 6.408 10.9

4 Motor vehicle maintenance and repair 1.214 10.3

4 Motor vehicle insurance 3.463 19.2

4 Airline fares 0.426 -13.2

Footnotes:

(1) Indexes on a December 1982=100 base.

(2) Indexes on a December 1996=100 base.

You would guess wrong. The average monthly increase in SS (based on a 3.2% increase and the average current payment of $1705.59) is $54.58. While we don't have final figures on increases in Medicare Parts B and D, CMS projects them to be $9.90 and $0.64 respectively. That leaves the bulk of the SS increase untouched.My guess is that after the expected Medicare part B and D cost increases for next year this 3.2% will be a joke and more closer to 0%.

a fine imageI just checked with my wife about me possibly being "sophisticated”. She looked at me funny and broke into uncontrollable laughter. I wonder what that meant?

Hi, catch! Pardon the intrusion on your post. FPACX is the correct symbol but it is a no-load fund with a $1500 minimum. Thermostat "A" has a load though those are increasingly nominal. It is, for example, no-load/NTF at Schwab. And there are, indeed, lots of other choices! David

Two notes: (1) they're pretty good at what they do. Their core product is Leuthold Core Investment which is a five-star, Gold rated tactical allocation fund. Neither allocation is 60/40 but they can drop stocks as low as 40%. Since inception in 1995, they've made 7.8% APR; in every trailing period they post higher returns than their peers (0.7-3.5% APR) with noticeably lower volatility. Their portfolio decisions are driven by the output of their quant models, not by their managers' gut. On whole, I would describe them as institutionally cautious.The Major Trend Index slipped into its Negative zone as of the week ended October 6th, after spending the last nine months oscillating within the Neutral zone. Thanks mostly to a falloff in the Technical category, the reading dropped one notch to -2. (Scores of -2 to -5 are considered Negative for stocks in the intermediate term.)

The MTI’s decline prompted us to further reduce equity weightings in our tactical portfolios. In the Leuthold Core Fund, Core private accounts, and Leuthold Global Fund, equity hedges were adjusted to decrease net equity exposure to 44%. The Leuthold Core ETF exposure was also lowered to 44% via a reduction in long equity positions. Prior to yesterday’s changes, these portfolios had been positioned with net equity exposure around 47-48%. ("MTI: Turned Negative, Trimming Equities Further," 10/10/2023)

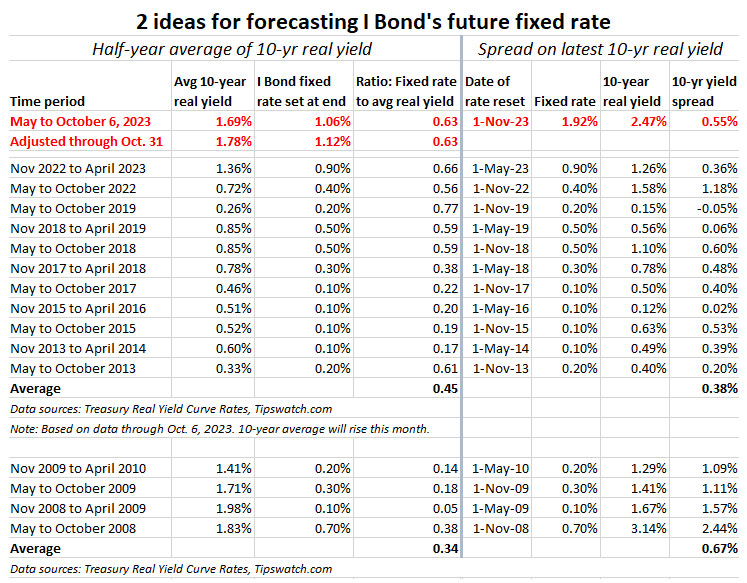

He goes on to suggest two ways of guessing the next rate:TreasuryDirect provides this cryptic information:Translation: The Treasury looks at current real yields (such as market yields on Treasury Inflation-Protected Securities) and adjusts those yields to reflect the advantages of I Bonds: primarily tax-deferred interest and a flexible maturity.The Secretary of the Treasury, or the Secretary’s designee, determines the fixed rate. The rate is based on market rates that have been adjusted to account for the value of components unique to savings bonds. These include the early redemption put option, tax deferral feature, deferred purchase feature, and Treasury’s administrative costs.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla