A Bond ETF With An Equity Feel: (CWB) I find yogibear explanation on recent performance of ANNPX co-related to small cap reasonable.

A three month(or even 1 year) stretch of underperformance does not bother me within the context of solid longer term performance.

Regards benchmarks, while ANNPX has performed well compared to SP500, I see a moderate allocation benchmark as more appropriate (PRWCX, VWELX, VBINX).

Simplistically I see ANNPX performance close enough to PRWCX during periods 1-5 but significantly outperforming PRWCX by 10 points during period 6 which is impressive imo. As cherry on top, ANNPX even outperformed VONE during this period.

Federal Open Mouth Committee Atlanta Federal Reserve Bank President Raphael Bostic told The Financial Times over weekend that the Fed may impose a 50 basis point rate hike in March.

Saw that too in other sites and that could have sizable impact on the long bonds. Mid March is timeframe when it starts.

A Bond ETF With An Equity Feel: (CWB) davidrmoran said,

What do you think has happened the last 3mos to underperform those four so significantly? Not that it matters.

I have zero interest in the fund, but I am interested in the answer to David's question (maybe I missed it?). In fact, over the past 1 year convertibles as a group look horrendous compared to the S&P

500, the bench mark I see it compared to. S&P

500= +19%, ANNPX= -9%. ANNPX is slightly worst than the convertibles category the past year.

In any case, sure looks like one would need a whole lot of conviction and long term staying-power to own this fund. I know I do not.

Cathie Wood Boosts Robinhood Dip Buying With Stock at Record Low What else peaked in February 2021? The EMs. Although ARKK doesn't have any EM stocks, the same speculative fervor that drove the EMs to February 2021 peak also drove ARKK. But then the Nasdaq peaked in early-November and ARKK was crushed again. So, there were 2 selloffs in ARKK, post-February and post-November (still continuing?).

https://stockcharts.com/h-perf/ui?s=ARKK&compare=EEM,QQQ&id=p81561262402

Federal Open Mouth Committee Atlanta Federal Reserve Bank President Raphael Bostic told

The Financial Times over weekend that the Fed may impose a

50 basis point rate hike in March. Bostic is a FOMC participant and would have been covered by the aforementioned blackout.

(Excerpt)

The Federal Reserve could opt to raise its benchmark rate by 50 basis points if a more aggressive approach to taming inflation is needed, Raphael Bostic, president of the Fed’s Atlanta branch, told the Financial Times in an interview. Bostic stuck to his prediction that three quarter-point increases starting in March would be the most likely scenario, though stubbornly high consumer prices could justify a more robust rate rise …

“Every option is on the table for every meeting,” Bostic said on Friday. “If the data say that things have evolved in a way that a 50-basis-point move is required or be appropriate, then I’m going to lean into that . . . If moving in successive meetings makes sense, I’ll be comfortable with that,” he told the newspaper.

Story from Bloomberg

Cathie Wood Boosts Robinhood Dip Buying With Stock at Record Low

Cathie Wood Boosts Robinhood Dip Buying With Stock at Record Low “Wood’s firm ARK Investment Management bought nearly 2.44 million Robinhood shares on Friday, the most since its stock market debut in July, according to trading data from Ark compiled by Bloomberg. The buying came on a day when the firm’s stock at one point dropped below $10, before staging a rebound in line with the broader U.S. market. Robinhood still trades 67% below its initial public offering price and ranks among the worst high-profile global stock market debuts during the pandemic, joining the likes of China’s Didi Global Inc. and London’s THG Plc.”Story

A Bond ETF With An Equity Feel: (CWB) #5 covers quite a bit of the period that Giroux has been running PRWCX so while still lower than PRWCX still a strong performance.

This fund is definitely on my buy list now, just need to figure out an appropriate entry point.

A Bond ETF With An Equity Feel: (CWB) 5 is the coolest of these imo , makes the convertible thing look special in these guys’ hands

A Bond ETF With An Equity Feel: (CWB) Using a few pre-defined periods as per MFO, here are some APR stats

(1)CV19 Bear(Bear 6): 202001 - 202003

FAYZX: -10.9

FPURX: -11.3

ANNPX: -11.5

JABAX: - 11.6

PRWCX: -12.0

(2)GFC Bear(Bear 5): 200711 - 200902

JABAX: - 16.6

ANNPX: -26.0

PRWCX: -28.9

FPURX: -30.0

(3)Dec '18 Selloff: 201812 - 201812

FAYZX: -3.4

ANNPX: -4.4

PRWCX: -4.6

JABAX: - 4.7

(4)Rising Rates: 200406 - 200702

PRWCX: 12.8

ANNPX: 11.7

FPURX: 10.4

JABAX: 9.8

(5)Full Cycle 5: 200711: 201912

PRWCX: 9.1

ANNPX: 8.3

JABAX: 7.9

FPURX: 6.9

(6)Full Cycle 6: 202001: 202112

ANNPX: 28.1

VONE: 23.6

FPURX: 19.7

PRWCX: 18.3

JABAX: 15.6

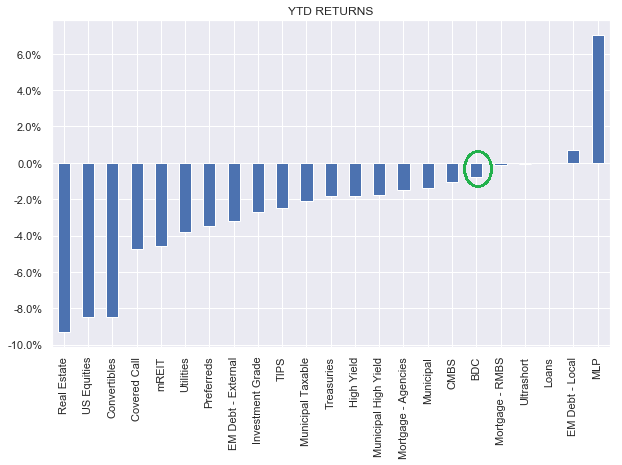

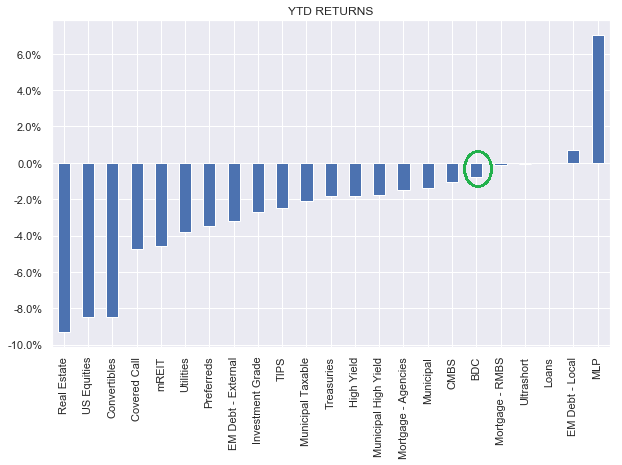

Getting off the sidelines - when? Looking at stock alternatives.....A chart that shows some of what's worked and what hadn't worked through the third week of the year.

From:

BDC Market Weekly Review

A Bond ETF With An Equity Feel: (CWB) Thanks for your response.

Based on your stats, ANNPX performance has indeed been excellent for the 3 Yr. / 5 Yr. periods.