It looks like you're new here. If you want to get involved, click one of these buttons!

Not sure how the exchange rate would impact the yield except for the exchange rate risk at the end of the term.Think that is in Canadian $. With the exchange rate today $1 USD = $1.29 CAD, does it convert to 3.41% yield (4.4% / 1.29 = 3.41%)?

If that is correct, it is higher than 1 yr CD in US, 2.90% as of last week.

Hydrogen-based polymer exchange membrane (PEM) fuel cells have been around since the early days of space program. Apollo 13 had an accident that nearly ended the mission. https://nssdc.gsfc.nasa.gov/planetary/lunar/ap13acc.htmlBilled as a “zero emission” mode of transport, the trains mix hydrogen on board with oxygen present in the ambient air, thanks to a fuel cell installed in the roof. This produces the electricity needed to pull the train.

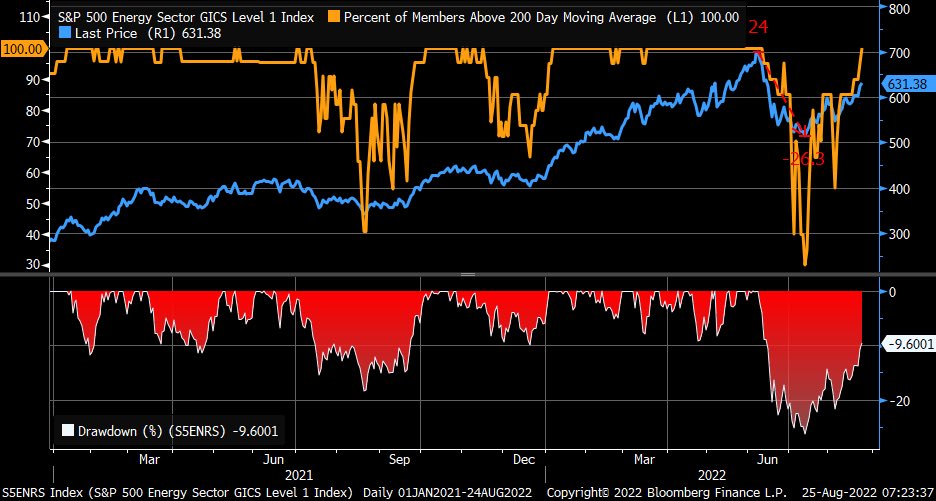

I think they're saying there will be a flight into quality--- Treasuries---- thus raising the price but reducing the yield. As for me, I'm sticking with my stake of 11% of portfolio in Junk. Juicy yield, just now. Reinvesting it all.Not sure I agree with the article posted above. How can bonds rally when the Fed is raising rates until inflation is contained? This can continue until 2023. Powell does not care if the rate height and QT will trigger a recession. Don’t know if the summer rally continues or if that is a bear market rally.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla