It looks like you're new here. If you want to get involved, click one of these buttons!

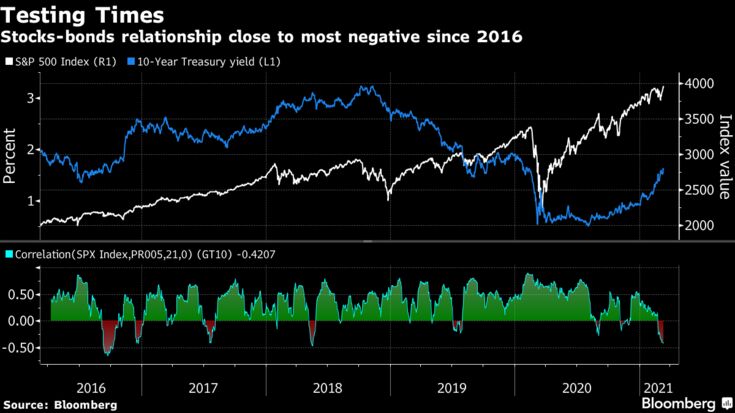

The strategy -- an investing stalwart since it arose from Harry Markowitz’s Modern Portfolio Theory about a half-century ago -- was already under pressure from the historic decline in bond yields. But the sharp move in the opposite direction is a more immediate threat, as recent market volatility has triggered tandem declines in stocks and bonds.

That jeopardizes the relationship at the heart of 60/40, which relies on the smaller, fixed-income allocation cushioning losses when riskier assets slump. The prospect of a faster economic recovery due to vaccines and heavy government stimulus has hit bonds hard, driving yields up at a speed that’s roiled equity markets. The method now faces one of its most severe tests since 2016, when U.S. President Donald Trump’s election raised expectations that lower taxes and lighter regulation would turbo-charge growth.

-report-card-governmentNovogratz indicated that bitcoin is an inflationary hedge and a digital store of value, rather than regular money, which is why institutions, money managers, and retail investors are piling into the digital asset. If people in the US believe Fed Chair Jerome Powell and Treasury Secretary Janet Yellen can facilitate full employment for the economy while avoiding inflation, they will stop buying bitcoin, he said.

I was an investor in Julius Baer Intl Equity (later Artio Intl Equity) from 2003 - 2011.Rudolph-Riad Younes and Richard Pell cost me a few dollars.

A member of the World Health Organization investigative team says wildlife farms in southern China are the most likely source of the COVID-19 pandemic.

China shut down those wildlife farms in February 2020, says Peter Daszak, a disease ecologist with EcoHealth Alliance and a member of the WHO delegation that traveled to China this year. During that trip, Daszak says, the WHO team found new evidence that these wildlife farms were supplying vendors at the Huanan Seafood Wholesale Market in Wuhan with animals.

Daszak told NPR that the government response was a strong signal that the Chinese government thought those farms were the most probable pathway for a coronavirus in bats in southern China to reach humans in Wuhan.

Those wildlife farms, including ones in the Yunnan region, are part of a unique project that the Chinese government has been promoting for 20 years now.

"They take exotic animals, like civets, porcupines, pangolins, raccoon dogs and bamboo rats, and they breed them in captivity," says Daszak.

The agency is expected to release the team's investigative findings in the next two weeks. In the meantime, Daszak gave NPR a highlight of what the team figured out.

"China promoted the farming of wildlife as a way to alleviate rural populations out of poverty," Daszak says. The farms helped the government meet ambitious goals of closing the rural-urban divide, as NPR reported last year.

"It was very successful," Daszak says. "In 2016, they had 14 million people employed in wildlife farms, and it was a $70 billion industry."

Then on Feb. 24, 2020, right when the outbreak in Wuhan was winding down, the Chinese government made a complete about-face about the farms.

"What China did then was very important," Daszak says. "They put out a declaration saying that they were going to stop the farming of wildlife for food."

The government shut down the farms. "They sent out instructions to the farmers about how to safely dispose of the animals — to bury, kill or burn them — in a way that didn't spread disease."

Why would the government do this? Because, Daszak thinks, these farms could be the spot of spillover, where the coronavirus jumped from a bat into another animal and then into people. "I do think that SARS-CoV-2 first got into people in South China. It's looking that way."

First off, many farms are located in or around a southern province, Yunnan, where virologists found a bat virus that's genetically 96% similar to SARS-CoV-2, the coronavirus that causes the disease COVID-19. Second, the farms breed animals that are known to carry coronaviruses, such as civet cats and pangolins.

Finally, during the WHO's mission to China, Daszak said the team found new evidence that these farms were supplying vendors at the Huanan Seafood Wholesale Market in Wuhan, where an early outbreak of COVID-19 occurred.

The market was shut down overnight on Dec. 31, 2019, after it was linked to cases of what was then described as a mysterious pneumonia-like illness.

"There was massive transmission going on at that market for sure," says Linfa Wang, a virologist who studies bat viruses at Duke-NUS Medical School in Singapore. He's also part of the WHO investigative team. Wang says that after the outbreak at the Huanan market, Chinese scientists went there and looked for the virus.

"In the live animal section, they had many positive samples," Wang says. "They even have two samples from which they could isolate live virus."

And so Daszak and others on the WHO team believe that the wildlife farms provided a perfect conduit between a coronavirus-infected bat in Yunnan (or neighboring Myanmar) and a Wuhan animal market.

"China closes that pathway down for a reason," Daszak says. "The reason was, back in February 2020, they believed this was the most likely pathway [for the coronavirus to spread to Wuhan]. And when the WHO report comes out ... we believe it's the most likely pathway too."

The next step, says Daszak, is to figure out specifically which animal carried the virus and at which of the many wildlife farms.

fed-likely-to-pen-rosier-forecasts-but-no-policy-shift-expectedFederal Reserve policymakers are expected this week to forecast that the U.S. economy will grow in 2021 at the fastest rate in decades, with unemployment falling and inflation rising, as the COVID-19 vaccination campaign gathers pace and a $1.9 trillion relief package washes through to households.

Source:Putting this in perspective of today’s equities market, the rebound is a “buy the rumor” event. The rumor is the pandemic is peaking and a rebound is in sight. When and if the market discovers this isn’t true, or not as true as it would like to believe, I think we’ll see a “sell the news” event unfold.

On our last trip to Europe the guy behind me was coughing and hacking for 5000 miles. There was "relatively" enough airflow to do me in. Took me one day to come down with his virus and three weeks to recover. Don't even talk to me about the wonderful ventilation systems on planes."As a ventilation engineer with 40+ years experience in exposure control (including biohazard labs) I find the assertion that general ventilation on an aircraft - as opposed to local exhaust - will effectively control close quarter exposure to "droplets" (or, more technically correct, an aerosol from coughing, sneezing or talking) is questionable."

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla