Man, where did all that BRIC Love go? It seems like only yesterday that we started dancing. Was it just a brief fling? Was that all I meant to you?

http://www.bloomberg.com/news/articles/2015-08-05/lost-decade-in-emerging-markets-investors-already-halfway-there"Just 14 years ago Wall Street fell in love with the BRICs, the tidy acronym for four major emerging economies that, to many, looked like sure winners. Today, after heady runs and abrupt reversals, most of the BRICs -- in fact, most developing nations -- look like big-time losers. The history of emerging markets is a history of booms and busts, but the immediate future may hold something more prosaic: malaise. Investors today confront what could turn out to be a lost decade of returns, with four or five more meager years ahead."

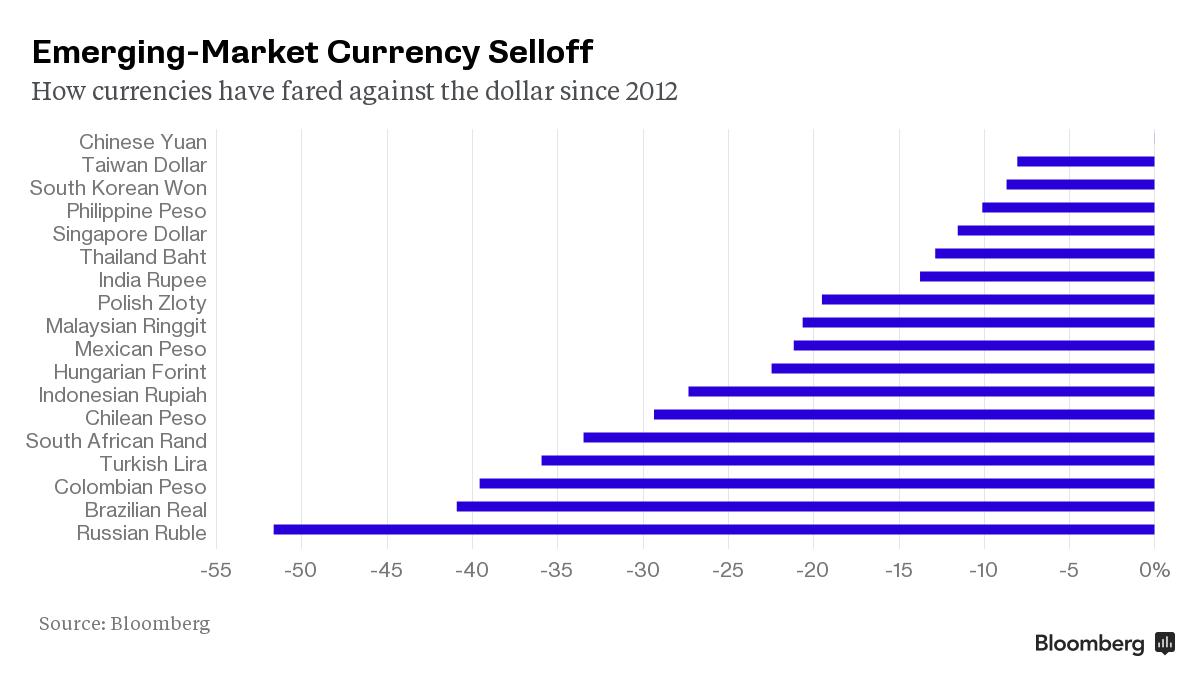

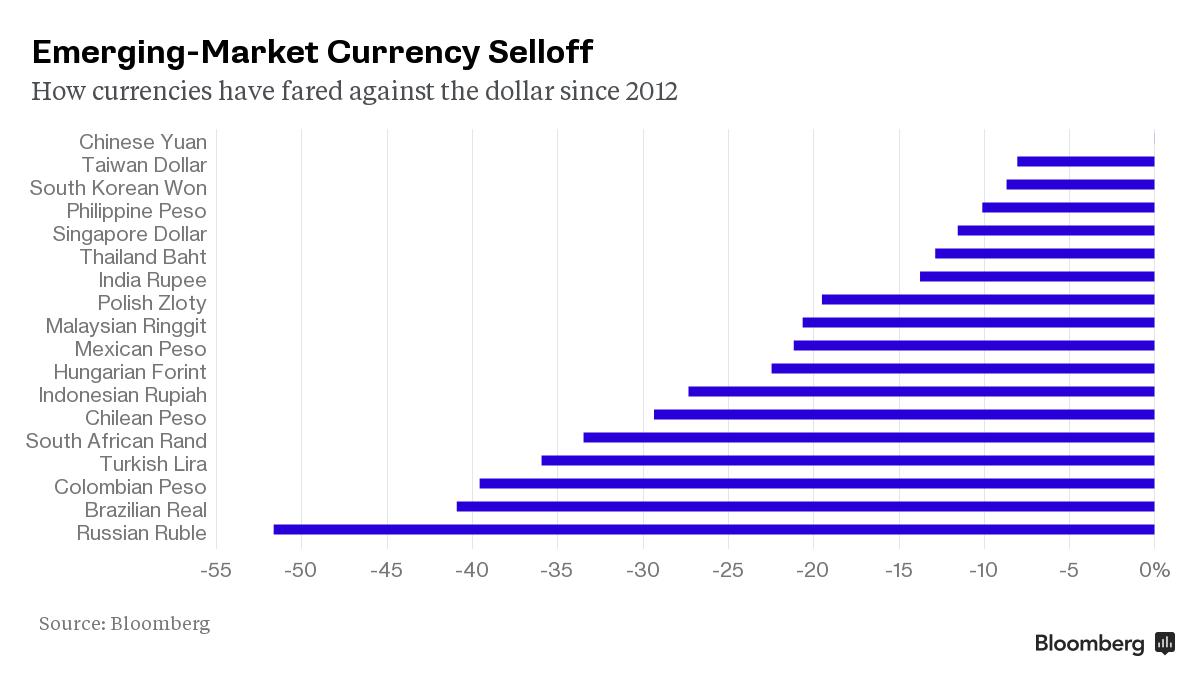

Note especially the figure in this article re. the depreciation of a bunch of EM currencies. Wow, I knew some were in trouble, but I didn't realize it was quite this extensive, and quite this extreme. How do they handle this headwind, particularly the "commodities currencies?" A fight just to stay in the same place, I'd think:

And a little tossing and turning, with some data thrown into a Webcast presentation re. BRICs, from Loomis Sayles analysts:

http://www.loomissayles.com/Internet/Internet.nsf/MediaPopup?ReadForm&MediaFile=&Duration=589&Trans=No&Q=&Topic=Crumbling BRICs&Fund=&Pros=/internet/InternetData.nsf/id/&displayPros=No&displayPerf=No&unid=107061EA45728D9385257E45005C7230&disp=000&