I haven't seen this before. I don't even have an idea what this could mean--- that traders have more confidence in the swap counterparties than in the Treasuries themselves? Weird.

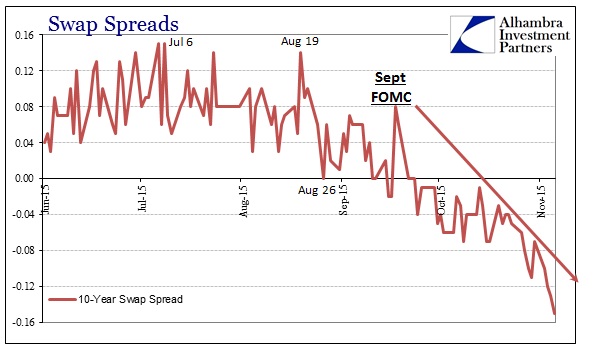

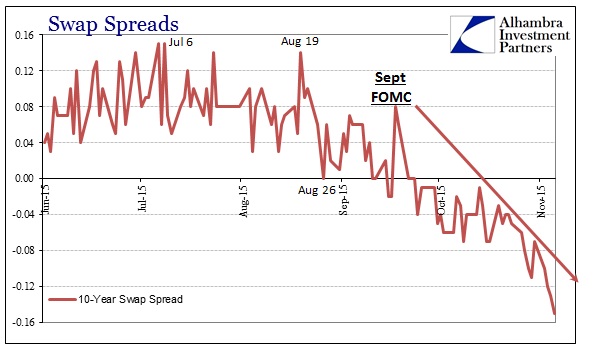

http://www.alhambrapartners.com/2015/11/06/the-quick-burn-of-balance-sheet-capacity-is-the-recoverys-mangled-end/ swap spreads have been sinking fast and to unprecedented levels. Though mainstream commentary will provide plausible-sounding excuses, mostly about corporate or even UST issuance, that is only because these places will not even consider that Janet Yellen has it all wrong; thus, they only search for possibilities that allow that narrative to remain undisturbed even though that narrative itself can never account for negative spreads.the nonsense nature of negative swap spreads is precisely the point – for them to be negative in the first place, let alone highly so (like the 30s again), is a pretty unambiguous signal of malfunction if not full distress. It is only great imbalance that can change the information content of a market price into meaninglessness; therefore we can interpret that case as some great reduction in balance sheet capacity since it is dealer capacity that determines the nature of the spreads.

swap spreads have been sinking fast and to unprecedented levels. Though mainstream commentary will provide plausible-sounding excuses, mostly about corporate or even UST issuance, that is only because these places will not even consider that Janet Yellen has it all wrong; thus, they only search for possibilities that allow that narrative to remain undisturbed even though that narrative itself can never account for negative spreads.the nonsense nature of negative swap spreads is precisely the point – for them to be negative in the first place, let alone highly so (like the 30s again), is a pretty unambiguous signal of malfunction if not full distress. It is only great imbalance that can change the information content of a market price into meaninglessness; therefore we can interpret that case as some great reduction in balance sheet capacity since it is dealer capacity that determines the nature of the spreads.

Comments

I'm thinking this strange spread pattern could mean that the former big market makers are pulling out, big-time, raising once again the question about who will provide liquidity in the event of a pullback spasm if they are completely out of the picture. I know there was a new exchange being developed to serve as kind of a go-to place for bond trading (it has a name, but can't remember it--- Luminex?), but I don't think it's close to being ready for prime time or we'd have heard about it by now.

But I'm just one of those "skittish" retail investors, without any grounding in formal finance, so what do I know?

http://www.ft.com/intl/cms/s/0/e86a211e-847f-11e5-8e80-1574112844fd.html?siteedition=intl

"US interest rate swaps, popular derivatives that track government bond yields, have experienced a spectacular collapse this month with an array of reasons being suggested by traders. [...] Analysts at Deutsche Bank say the recent swap spread tightening reflects 'tighter macro prudential regulation, higher capital requirements and reduced dealer balance sheet capacity.' Also playing a role is swapping activity from companies selling debt.

Some say swaps are a broken market... Under normal market conditions the current inversion should be swiftly reversed, but thanks to tougher bank capital regulation, derivatives trading appears to have entered a new era. Currently, no one appears willing to normalise the relationship between swap rates and Treasury yields.

Trading Treasuries and swaps relies on funding via the repurchase or repo market. Thanks to balance sheet constraints, the use of repo by dealers is shrinking, another factor sustaining negative swap spreads."

So, as I read it, the consequences for us would be that our bond/income fund managers, for the time being, have just had a hedging tool taken out of their toolkit. And, once again, we see that the repo market is involved, a part of the shadow banking system that remains largely under-regulated because of humongous efforts by the global financial players to keep it that way.