I expect most have had quite enough of the Valeant business by now, but for those who haven't, or who have lingering questions re. the nitty-gritty of the matter, here is some number crunching done by a corp finance wonk at the NYU Stern School of Business.It's the weekend. More leisurely hours for musing. Might as well use them.

http://aswathdamodaran.blogspot.com/2015/11/checkmate-or-stalemate-valeants-fall.htmlTeaser:

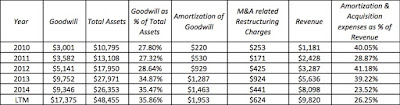

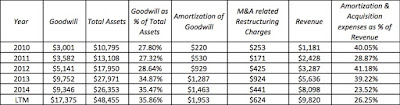

3. Accounting games: Part of Valeant’s rise can be attributed to the laziness of analysts, who apply multiples (that they pull from a cursory assessment of the comparable) on pro forma earnings, and some of it to the debris of acquisition accounting (goodwill, impairment of goodwill and acquisition-related restructuring charges). I have written before about the damage that goodwill does to both accounting statements and to good sense, but the degree to which acquisition accounting has muddied up the numbers at Valeant can be captured by looking at how they have taken over Valeant's financials in the last 5 years:

He also makes his case as to whether Valeant will be a going concern re. its value. He breaks it down pretty well.

Comments