NIH Cuts Create a Lost Generation of Scientists From Bloomberg News Bloomberg News has a succinct summary of the disaster unfolding at the NIH and Biomedical Research around the country.

"The Trump administration’s attacks on science and funding at the National Institutes of Health will set research and training for future scientists back a generation.

This might sound melodramatic to anyone not intimately familiar with the world of academic training and research. But in just two months the administration has cut off opportunities at every phase in a scientist’s career. Unless funding and the freedom to pursue science without political bias are restored, biomedical research in the US will become less ambitious, less competitive and result in fewer breakthroughs.

To recap: In his first days in office, President Donald Trump targeted the NIH, which spends more than 80% of its $48 billion budget on grants and other funding to universities and hospitals around the country. That funding ground to a halt, and damage was amplified two weeks later when the administration excised $4 billion in overhead costs from NIH grants — money that institutions rely on to run their facilities and pay support staff. That was followed by job cuts at the agency — reportedly nearly 1,200 of them, in areas spanning Alzheimer’s research to cancer. (Some of these moves have been halted, at least temporarily, by the courts.)

More recently, scores of NIH grants were terminated because they didn’t align with the administration’s political ideology. Flagged topics include research on LGBT+ health, gender identity, diversity, equity and inclusion; vaccine hesitancy; and mRNA vaccines. Now, Trump seems to be using the NIH to punish universities that he feels have defied him. On Monday, the agency said it was terminating $250 million in grants to Columbia University, a move that will have a seismic impact on study and researchers there.

Summer research programs at NIH and in university labs — experiences that help pull undergraduates into science careers — have been canceled. Graduate school admissions are being paused or cut back. Widespread hiring freezes are leaving postdoctoral researchers, on the cusp of launching their careers, in limbo.

Assistant professors awaiting the NIH’s final approval on their first major grant, known as an R01, a critical step toward securing tenure, are worried their once promising careers are being snuffed out. Even well-established scientists tell me they’ve made lists of people in their labs to cut if the money doesn’t flow soon. I’m told some in the twilight of their careers are cutting back hours to preserve funding or are considering retirement.

The entire pipeline of biomedical scientists, supported in one way or the other by the funding at NIH, is being culled.

Unsurprisingly, morale — both at NIH and at the long list of institutions the agency funds — is in the basement. One researcher at a prominent New York-based cancer hospital told me he hasn’t been sleeping. A health equity researcher at Northwestern University, whose work hits on all of the buzzwords that Trump wants eradicated from federal government, teared up when describing what the situation means for the students she mentors. Making a career in science has always been exceptionally hard, she says, “and in this environment, it’s just making it impossible. I’m afraid we’re going to lose some of the best minds.” (Many researchers asked not to be named out of fear about the status of funding under review at NIH.)

Ashley de Marchena, an autism expert at Drexel University, said the funding uncertainty led one of her trainees to look for a job rather than pursue a doctoral degree. Not only is the time and taxpayer investment in building their research skills lost, but the student, who is neurodivergent, is someone whose unique perspective should be nurtured, not pushed into another career path.

“So many entry points [to research] are gone now,” says Julianne Meisner, an epidemiologist in the University of Washington’s Department of Global Health. She recently advised a student finishing her master’s degree to consider applying to PhD programs abroad. They might offer less money, but they bring more certainty. And those institutes clearly see an opportunity to siphon some of America’s brightest: at least one French university is advertising itself to US students as a “safe place for science.”

Meanwhile, those who persist are shrinking their ambitions to fit a more hostile environment. A theme I heard over and over again is that researchers will do less bold science, ask fewer questions, make fewer discoveries.

There’s little sign that the damage will be repaired once new leadership is in place at NIH. During his Senate confirmation hearing last week, Jay Bhattacharya, Trump’s pick to lead the agency, seemed unruffled by the turmoil. If anything, his equivocation about the upheaval suggests he’s on board with whatever changes those above him demand next.

Bhattacharya dodged questions about restoring funding and instead emphasized the need to restore trust in public health, a project he believes requires “freedom” and “transparency.”

It's hard to imagine a less trustworthy or transparent process, or one less attuned to academic freedom than what’s unfolding. Sidelining and muzzling a generation of scientists, dismantling the nation’s research apparatus and ultimately ceding scientific supremacy to China and Europe does not seem like the right way to restore trust.

For the public, all of this might seem hard to grasp — or even care about. But eventually we will all be affected. It’ll show up as the hit to the local economy when scientists and staff lose their jobs. It’ll take the form of a widening gap in access to equitable health care. It’ll be the Alzheimer’s treatment or cancer vaccine that never quite makes it over the finish line."

Oh BTW Bhattacharya recieved an MD degree but has never practiced medicine ( not even an internship ), has never seen a patient independently and has never done any biological research. He is a health economist. Great choice to lead the world's most formidable biomedical research institution. All because he co-authored "The Great Barrington Declaration"

Not mentioned above, almost 100 senior level NIH investigators have had their salaries suspended and their lab budgets frozen and government credit cards canceled. These are people specifically recruited to the NIH to run cutting edge research, done no where else in the world. There are 16,000 grant proposals waiting for study sections that have been canceled and legally mandatory notice in the Federal Register that has been shut down.

Student internships for thousands of the brightest STEM college kids to work in labs all around the country this summer have been cancelled.

This will have a generational, decades and decades negative impact on the US as a Research mecca and biotech innovator. For what? The Chinese are ecstatic.

Far more significant than the shutdown of the NOAA .

Trump says he’ll raise tariffs on Canadian steel and aluminum to 50%. Or Not. Or Maybe.

brookfield's mark carney is leaving to become Canada's next PM and deal with trump. carney also has experience as Bank Governor for 2 nations ; this is bringing a bazooka to a pillow fight.

on top of that, the Canadian people seem pretty tired of all MAGA\musk agendas. they seem willing to take the pain of keeping their tariffs in place for some time until flops stop and someone (else) is leading serious negotiations and not pimping propaganda.

but hey, at least there is trumpcoin for american retirement. , and~40 fewer lbs of northern fentanyl, which has suddenly become bessent's expertise.

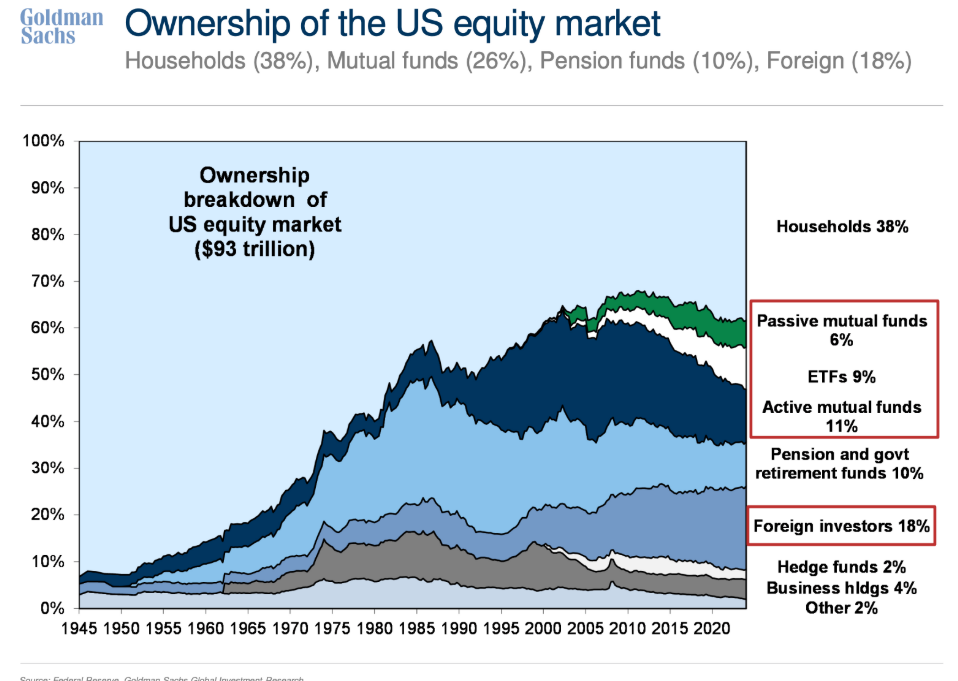

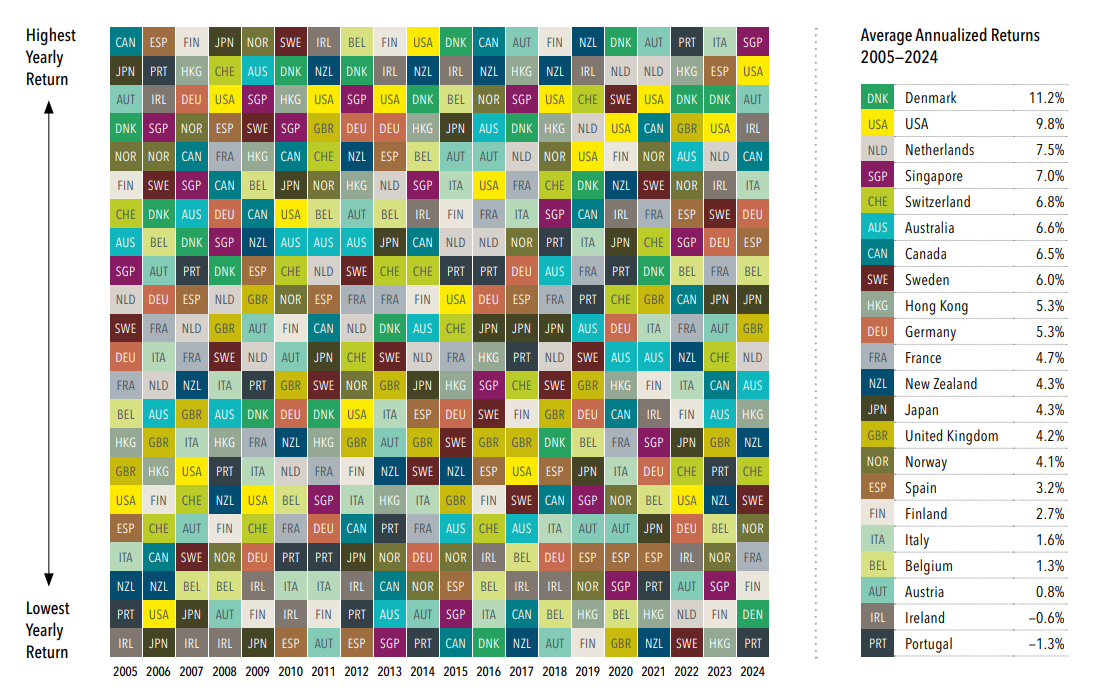

Buy Sell Why: ad infinitum. I had been lamenting not reducing our retirement equity positions from 38% to 33%, but after these last few market drops, I held my nose and made a minor contribution to VTI and VIG. Falling knife? Probably.

tariff bluster from Trump is just that: a pretext I do not want to get into OT but

IMO, there can be more than one goal here. I would not be surprised if one of the goals is regime change. The other could be to announce to the world how mean our government can be - by slapping around a dearest friend. I think

@WABAC said well in one of his recent posts - no point trying to figure out “why.”

Well, that's just me, and my

retirement.

I don't blame the Canadians for taking him, and his minions, at their words, and regarding the threat as existential. Trudeau and Joly have been quite specific about that. We'll see if that changes after the party conference tomorrow. I doubt it.

I couldn't help but notice their recent action against our largest pork processor, that just happens to be owned by the ChiComs. No doubt the paper work will be straightened out eventually.