Hi rjb112,

Thank you for the kind words and your trust in asking help from me. I am hesitant that I can profitably satisfy your request..

I struggle with giving specific investment advice. Please know that I am an amateur in the investment jungle. I truly believe that a number of MFO members are far more qualified than I am to give such advice. It has been my consistent policy not to make specific portfolio recommendations here at MFO and elsewhere. I fear I might do more harm than good.

There is another reason that giving and accepting internet advice is a dangerous thing. That task requires a careful and continuous interchange between the parties involved. That’s difficult to do well with only e-mail exchanges.

Direct contact with professional advisors could be useful. An advisor who uses Index products to implement his approach might serve your needs. There are just too many variables to integrate into final decisions when exchanging posts on the internet.

Since I’m a self-taught investor my financial education has developed in a haphazard manner. Therefore, there are likely some holes in my knowledge base that could compromise the performance of my portfolio as well as any that I choose to help construct with others.

Therefore, I choose to abstain. But I have no reservations about suggesting generic sources and approaches.

For example, I do admire some of the Index portfolios that have been documented by Paul Farrell in his Lazy-Man portfolios. I am especially drawn to several portfolios because they include elements that academic and industry research suggests can modestly increase expected returns while simultaneously reducing portfolio volatility. These portfolios have been frequently discussed on MFO, but here is the Link to Farrell’s ongoing scorekeeping:

http://www.marketwatch.com/lazyportfolioI am attracted to David Swensen’s Yale U’s Unconventional portfolio. It seems to touch most of the necessary bases with a small number of Index products. Here is the sub-link that presents Swensen’s Index choices:

http://www.marketwatch.com/lazyportfolioI also like Bill Bernstein’s slightly more complex Smart Money portfolio as follows:

http://www.marketwatch.com/lazyportfolio/portfolio/bernsteins-smart-moneyUsing the Farrell Lazy portfolios as a point of departure you get to pick from a bunch of respectable options. I know you recognize that this listing gets you to a reasonable starting line. Adjustments in holdings and percentages should be made to accommodate your special circumstances: Your age, wealth, education, experience, risk profile, and end objectives.

Along that line of thought, I have been recently introduced to some mutual fund research conducted by Professor Craig Israelsen. He has expanded his work to formulate an Index-based fund strategy that exploits study findings. For example his portfolios are age dependent. His work is called the

7twelve approach.

The

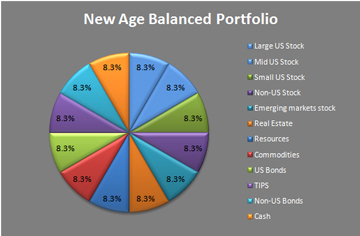

7twelve approach uses 12 fund groups to execute 7 fund asset classes. Eight diversifying fund groups are assigned to 4 equity classes while four fund groups flush out 3 fixed income classes. Here is a Link to this attractive portfolio organizational option:

http://www.7twelveportfolio.com/Downloads/7Twelve-Model-Intro.pdfI suggest you explore the Lazy and the

7twelve candidate portfolio options. These might satisfy your requirements.

Please understand that I still own a substantial mix of active and passive funds (50/50 at this juncture). I do plan to convert to a more passive portfolio (probably like a 20/80 mix) within the next year. That’s a task that awaits execution.

At this juncture, I directly own no gold products, but I just might diversify a little more following general guidelines extracted from the references that I provided..

By now you realize that I am a plain vanilla, meat and potatoes type investor. I believe that simplicity works best, and that complexity kills. My portfolio reflects that philosophy. It works for me; it might not be your cup of tea. This thinking goes a long way to explain my reluctance to participate in specific mutual fund recommendations.

Other very qualified MFO Board participations will enthusiastically fill my void.

Good Luck and Best Wishes.