It looks like you're new here. If you want to get involved, click one of these buttons!

I discussed that as well. His memos have always been long and convoluted, filled with commentary but very little actionable guidance. After years of avoiding a clear stance, he finally called a bubble last January.

marks has never written to offer monthly advice. his main talent has been to deploy loads of committed capital at mkt lows in high tiers of capital structures. that is the only 'signal' one will get, and maybe that is also gone within the maze of brookfield.

where i do fault marks is his ever-insistent emphasis on 'risk' without proving any practical means of assessing such for the self-investor.

@hankBoard was kind of slow so I tossed the Barron's picks out there. Not my recommendations. I'm with @Crash when it comes to looking for less crowded trades.

Re Barron's - better than a 500 batting average. But some of their picks take years to pan out and may drop a lot farther before turning up. Tries anyone's patience.d

Same here, for the most part. I do like to have a list ready for big market pullbacks. Which is how I acquired AMZN at $85 a few years back.I let my mutual funds own that stuff. Or not. Ten names out of 50 bazillion. Sure. In my single-stock collection, I look for less crowded trades. MSGS will surely be a winner, in season and out of season...

Over the years, I’ve posted versions of the above many times. I’ve also pointed out that Marks rarely offers actionable guidance, instead publishing a great deal of commentary and fluff. When he finally did take a stance, I posted that I'm going to wait. It turns out his call for 2025 turned out to be wrong as well.My point for years is that future predictions is a fool errand.

I have never invested based on the future, only based on current markets and they can be illogical and longer than anyone can predict.

The following information was excerpted from Morningstar's Parent Rating (Oct. 14, 2024)Do folks know much about Diamond Hill?

I don't, but do invest with First Eagle.

....."That's what I want.""As of last night, 500 Index (VFIAX) has gained 17.7% this calendar year.

That’s on the heels of returning 26.2% in 2023 and 25.0% in 2024.

Even if 2025’s return doesn’t crack the 20% line, there’s no denying that 500 Index shareholders

have enjoyed a terrific run—compounding at a 22.9% annual pace."

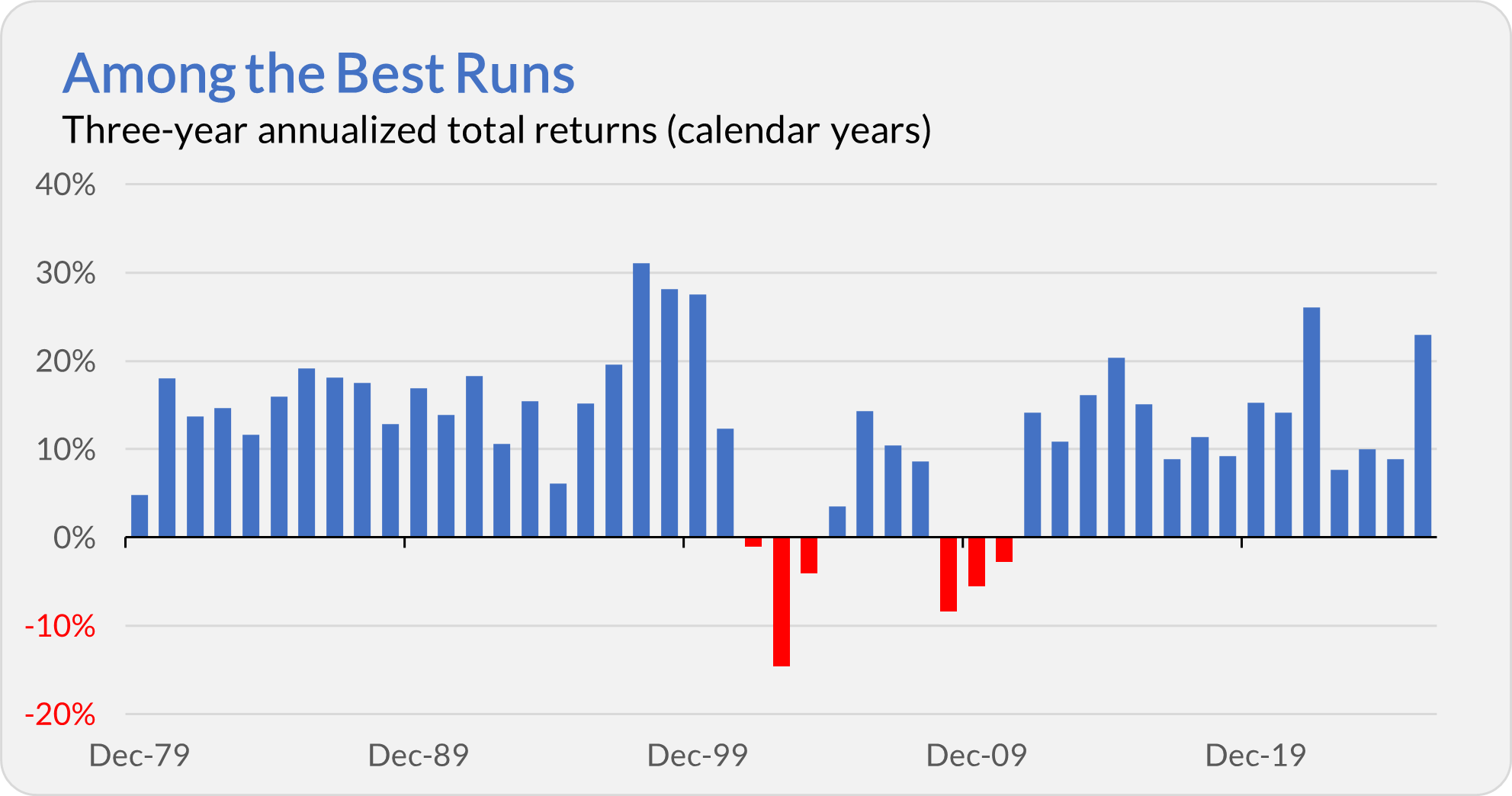

"The chart below shows 500 Index’s rolling three-year annualized returns (based on calendar years).

If 2025 ends around the 22.9% mark, this three-year window would land well above the fund’s 12.2%

long-term average—ranking as the fifth-best three-year stretch since the index fund’s 1976 inception.

The only better periods? The late-1990s tech bubble and 2019–2021."

https://www.independentvanguardadviser.com/weekly-brief-three-great-years-now-keep-expectations-in-check/

I've got no expectations to pass through here again.

https://www.youtube.com/watch?v=URyqGD99Owg

Wow. You need to buy rono a drink.SLVR up 4.82% !

After rono posted a number of weeks ago I bought 30 shares just for the hell of it. It gets really boring with everything in CDs, Treasuries, and MMKTs.

So far ahead $326 on SLVR, and $272 on SILJ. Both have been up and down- fun to watch.

Yes. It is.Hard to lose in stocks for the last 3 years. It is a little spooky.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla