Barron's on Funds & Retirement, 11/18/23 A deductible is the amount you have to pay before any insurance kicks in. The highest deductible a Part D plan is allowed to have is $545; some may have lower deductibles.

https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/yearly-deductible-for-drug-plansAfter you pay the deductible, then you are charged copay (fixed dollar amount) or coinsurance (percentage of the negotiated cost). This is called the "initial phase". Once you've paid $5030 for drugs (including the deductible) you enter the "gap coverage phase" aka the "donut hole".

https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/copaymentcoinsurance-in-drug-plansThese are all 2024 figures. 2023 figures are a bit lower.

Here's an inexpensive (50¢/mo premium) Part D plan in Honolulu. It has a $545 deductible; after that it charges 50% for non-preferred brand name drugs. Assuming you've met your deductible, then for a non-preferred brand name drug that cost $800, you'd pay $400 and the insurer would pay the rest.

Wellcare Value Script

S4802-164-0Another plan might have a $100/mo copay for non-preferred brand name drugs. In such a plan, once you met the deductible, you'd pay $300 for a 90 day supply of the drug.

Is this extortion? That's an economic, a business, and a political question. If you have investments in pharmaceutical companies, you are getting some benefit from this system. Not nearly as much as it is costing you on the consumer side, but this is the system that was set up in 2003.

In a poll taken in the week that President Bush signed the new Medicare law, 47 percent of senior citizens opposed the changes, and only 26 percent voiced their approval. Among people of all ages who said they were closely following the Medicare debate, 56 percent said they disapproved of the legislation, and 39 percent supported it (ABC News/Washington Post Poll 2003).

...

Pharmaceutical manufacturers could now expect a higher demand from their best customers, and they prevailed on all three of their priority issues: no direct administration of benefits by the federal government, no explicit cost control measures, and no legalization of drug reimportation.

A Political History of Medicare and Prescription Drug Coverage, 2004.

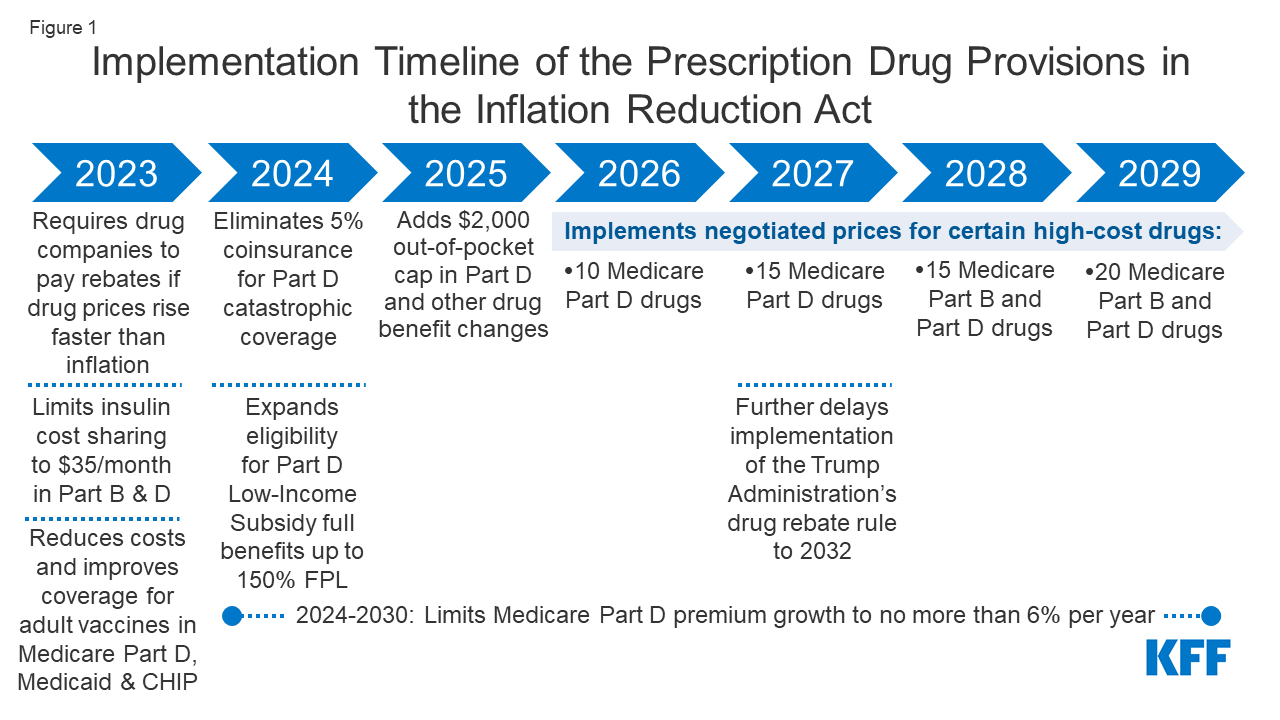

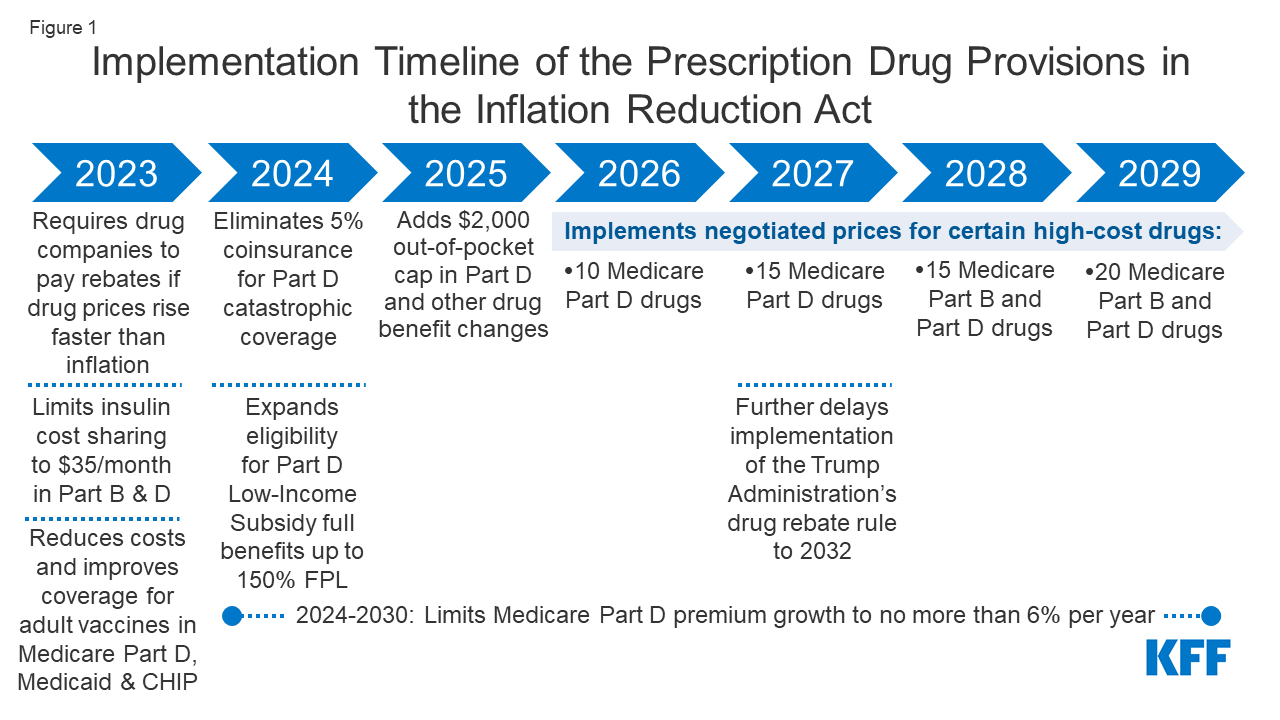

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2690175/Only now, 20

years later, are we beginning to see changes. The $2K out of pocket cap doesn't become effective until 2025.

https://www.kff.org/medicare/issue-brief/how-will-the-prescription-drug-provisions-in-the-inflation-reduction-act-affect-medicare-beneficiaries/

https://www.kff.org/medicare/issue-brief/how-will-the-prescription-drug-provisions-in-the-inflation-reduction-act-affect-medicare-beneficiaries/

Econ conditions & hard-landing inflation again in detail; was other stuff, insurance bundling .... Definitely need to look at the financial strength of the insurance company you go with....what is also whacked is that the insurance business is something like your cable company...the newer customers get the best deals (or so it seems?) You'd have to be naive that someone like me who has been with State Farm for over 46 years..you think they don't have algo's that know exactly how much they can raise me every year and I won't shop them/leave? They tell me I am grandfathered in with my type of coverage and wouldn't get the same policy if I started new with them today. Also as I own 3 homes in different states and 4 automobiles with a rather large umbrella policy, I do like that they have national representation/coverage. Always, always great service with State Farm.

What I don't like is all the monies being spent on the sport ballers/commercials.

What I do recommend, go to a high end body shop and ask the owner of what insurance company provides the best service, doesn't always push for offshore crap part replacement, pays right away etc, sometimes lowest price is not best value. The body shop in my major metro area that works on all the Ferrari's Porsche's etc..told me the best insurance companies were State Farm, Chubb and Amica. Chubb is for ballers/very high worth folks, not for the common folk...

BTW, even more off topic...the guys who work there get to drive all the high end cars...best all time next level I am told is a 2005 Ford GT...blows everything else out of the water...

My wife's ex boss who retired as a very high level executive for a Fortune 500 company always shopped for insurance every year and went with the top rated/lowest quotes every year...he prolly saved a bunch of money doing that...insurance companies must know that human nature has inertia built into it and take advantage.

I do think I'm going to get a quote from Erie just out of curiousity...

Best Regards,

Baseball Fan

Buy Sell Why: ad infinitum. Sold my 3 stocks yesterday. Too damned much volatility for this OF. Dumped the money into Franklin’s new conservative / moderate risk multi-asset ETF - INCM. .38% ER. Untested. But the 3 person team running it has had pretty good success operating FKIQX for several years.

Econ conditions & hard-landing inflation again in detail; was other stuff, insurance bundling .... Yeah. It’s a state by state issue. I like my local insurance agent with 5-day a week walk in or call service. Took great care of me after a big truck rear ended my rented car in Florida 10 years ago. (“No-fault” state). I never add the optional rental insurance. Was glad they stepped in and covered the full cost of the car which was totaled. If you wreck a rental, the company really inflates that “cost” thru various gimmicks.

I was in the office with her as we walked through the various deductibles & savings. Struck a happy medium. Helped in my case. The ‘18 hybrid has higher rates due in large measure to: (1) being more expensive to repair and (2) higher incidence of pedestrian related deaths / injuries due to how quiet they are at low speeds. Goodness. Electric cars must have the same problem.

Econ conditions & hard-landing inflation again in detail; was other stuff, insurance bundling .... I increased auto deductible to reduce premium at the last big increase.

I went from $1,000 to $2500 collision deductible to save when bought my last new car in 2018. The agent seemed to think that’s high.

@Devo said “Cumulative inflation”. That’s how I look at it too. Similar to how interest compounds year to year. Didn’t Einstein call

compound interest the 8th wonder of the world?

I don’t want to

pee rain on anybody’s parade. Views differ on this.

@msf has documented very well the actual inflation rate based on the CPI index and has explained in past threads how that index is maintained / calculated. I wouldn’t argue with him.

I think we do tend to react more to

increases on prices of items we buy more than we do to

reduced prices on what we buy. From what I hear there’s a glut of chicken & pork right now. Prices are down from a year ago. On the other hand, what in #@*# has happened to the cost of a bag of coffee? As an occasional scotch drinker, I’ve noticed that prices have remained very stable in my state for the past 5+

years. A bottle of JWB can still be had here for under $40, where it’s been for most of the past decade. Maybe drink more scotch and less coffee?

Econ conditions & hard-landing inflation again in detail; was other stuff, insurance bundling .... I am keen to have this lived experience and see how it works out over the next few years. Cummulative inflation has been huge, money has been debased by 20% and we are talking about fed rate cuts. Lots to learn.

Amazon to sell cars in 2024 starting with Hyundai @hank : I have to ask , did you get your toilet at amazon ?

@Derf - You remember the

toilet saga from about 2

years ago? Yes, after 2 arrived smashed up in boxes (one from Amazon and one from Lowe’s I drove to an area dealer and picked up an unbroken one. Amazon told me

not to return theirs, but refunded the money. The UPS driver detected the sound of broken glass on the one from Lowe’s and returned it.

@WABC - Yes. Have had good luck with EBay.

From the halls at Schwab @Baseball_Fan - Yep. Saw a bunch go over my home after dark 2-3

years ago. Just stunning. Never seen anything like it. That’s usually a day or two after launch when they’re relatively low and bunched together. Over time they disperse and, I believe, get higher up. Kripes - He sends up 60 or more at a time. Glad you got to see them.

Lots of images on the internet. I’ve linked an especially brilliant one filmed over India. There’s also a

thread running in the OT section on “

Starship”, Musk’s latest technological amusement.

Also

Also -

How to Buy SpaceX Stock

Amazon to sell cars in 2024 starting with Hyundai @hank, next time,

give ebay a shot.

Easier to read. Better user-protection. I don't work for ebay. And I have no idea if I own any of their stock. Just been shopping with them for

years trouble-free.

From the halls at Schwab @Derf. Earliest now would be 8 AM Saturday. CNN and others should carry it. Or find a site on the web. (Postponed from Friday.)

”Update for 3 pm ET: SpaceX CEO Elon Musk says the second Starship launch is postponed to no earlier than Saturday, Nov. 18 to replace a grid fin actuator on the launch stack, according to an update Musk posted on X, formerly Twitter. It's been nearly seven months since SpaceX's first Starship megarocket exploded in a brilliant fireball over South Texas in a failed launch test, but the company is ready to try again. If you're hoping to watch SpaceX's second Starship test flight, you'll need to know when to tune in, and for that, we've got you covered.

SpaceX's second Starship and Super Heavy booster test flight is currently scheduled to launch from the company's Starbase site near Boca Chica, Texas no earlier than Saturday, Nov. 18, at 8 a.m. EST (1300 GMT). It will be 7 a.m. local time at liftoff time. The launch was originally set for Nov. 17, but SpaceX delayed it by 24 hours to replace a grid fin actuator on the launch stack.”https://www.space.com/spacex-second-starship-launch-what-time@Derf - Apologies if I misunderstood your post. I thought you were seeking opinions on the fixed income matter and just tossed out what I’ve been taking in. Not surprised Schwab feels that way. It’s a pretty common theme now and the uptick in rates has been astounding the past 2

years, Thanks for clarifying that.

Amazon to sell cars in 2024 starting with Hyundai 10-15 years ago that would have been heartening to hear. These days I try to stay as far away as I can from Amazon. But I digress. Somebody can start an OT thread if so inclined on the subject.

Thanks for the story. No problem. Most of us own Amazon through 1 fund or another.

High Yearend Distributions

The BOND KING says The why (Y) question. I had plenty when I started my Plumbing apprenticeship many years ago. As for starting to shave in the same spot, I don't fit the question.

Why, Derf

Small Caps I also own NEAGX/NEAIX for SCG coverage. ER is high, especially for retail shares. Otherwise, no reservations. SCV is a head-scratcher. CALF has a lot going for it and Pacer Funds, which include COWZ, are exemplary in explaining their free-cashflow methodology. DSMC has a similar approach but with a screen to weed out companies that carry too much debt, a concern for SCs when interest rates are high. DSMC does not have as long a track record as CALF, but I've overlooked that factor in my personal choice. AVUV holds too many positions for my money.

I like the funds following the cash these days. I'll add DSMC to my watch list, for as long as it might last at M*. But I generally like to see the thesis in action for at least five

years in this up-and-down era.

People

can checkout DSMC's overlaps here. It's not what I expected.

After

years of bloated Vanguard indexes, I get what you're saying about

too many holdings.