I was wondering if other MFO's users were have problems with different devices that use Apple ? Yep. Just hit me. For 20

years I’ve relied on

DejaOffice on ipad to maintain all my records (contacts, colander & much more) It’s been easy to email backup files every few days to my icloud mail account which is strictly employed for nothing else. Good backup & a way to synchronize all my devices.

Today, after installing the latest IOS 13 the emailed backup files won’t load onto the Deja app. Seems to be something inherent in the new IOS. So those backups are useless. There’s a second way to do this: Create a “Dropbox” account and backup and retrieve Deja files on that. So far. So good. But a lot of hassle.

My ipads also back up their entire content to Apple’s cloud automatically. So Deja files should be there. But using that method would require replacing

everything on the ipad, rather than just the Deja files. I suppose Apple would prefer I use their own in house apps for record keeping. But I like Deja and it would be a mamouth undertaking to transfer all those files to Apple’s own system.

@Old_Joe is right about not fixing what ain’t broken. But if I followed that advice all the time my devices would all be running the same software they were using 20

years ago and probably wouldn’t even support most of today’s applications.

RLSFX I still own some gold and silver, IAU and SLV, but I believe they are both slightly negative YTD. I swore off miners years ago.

Jimmy Boy Thanks for the reminder about PURIX.

"Publicly available information on Fisher's funds and strategies showed mixed performance.

The Purisima Total Return Fund, for example, returned well under half of the S&P 500 Index

in its final 10 years before it was liquidated in 2016, according to data compiled by Bloomberg."Link

While I'm hardly defending Fisher here, comparing PURIX (Purisima Total Return Fund) with the S&P 500, as done in the cited article, is misleading.

From the fund's

final prospectus, dated Dec 31, 2015:

"The Fund seeks to achieve its objective by investing in a portfolio allocated between domestic and foreign common stocks and other equity-like securities ..."

The benchmark given in the prospectus is the MSCI World Index. The fund still significantly underperformed that benchmark (by around 0%-25% depending on timeframe). Lackluster at best, but nowhere near as great an underperformance as the article asserted in comparing the fund with the wrong benchmark.

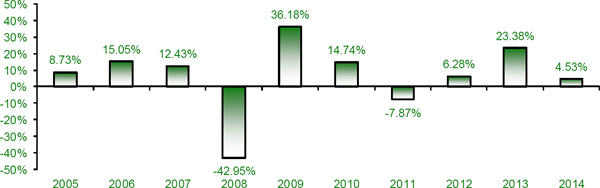

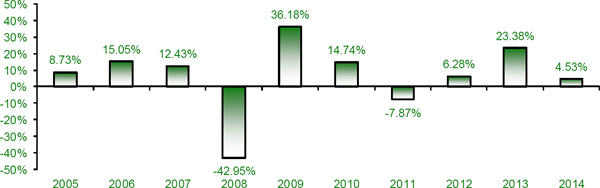

FWIW, from that prospectus, the performance of PURIX ("The Fund’s year-to-date return as of September 30, 2015 was -5.43%"):

Liquidation was about six months after the prospectus:

https://www.sec.gov/Archives/edgar/data/1019946/000089418916009530/purisma_497e.htm

Worst day for bonds I’ve seen in a while I'm buying VGSH and VGIT each time they hit 52 week lows. Looking to capture decent yield for the first time in years, and treasury's will still be inverse to equities in a real crises as opposed to just rising rates. Feeling good about this, short-term pain for long term gain. I'll start nibbling at EDV when the 10 year crosses over 2%.

Jimmy Boy Good entertainment but dreadful substance. I watch CNBC every morning and have for years. Before the big run in energy Cramer was calling big oil dead money and uninvestable, said that ESG meant these could not be in mutual fund portfolios. This week he was praising Exxon like it's Apple from 15 years ago.

Jimmy Boy Thanks for the reminder about PURIX.

"Publicly available information on Fisher's funds and strategies showed mixed performance.

The Purisima Total Return Fund, for example, returned well under half of the S&P 500 Index

in its final 10 years before it was liquidated in 2016, according to data compiled by Bloomberg."Link

Jimmy Boy He's offered some decent prognostication commentaries regarding markets and investing over the years but I would bever trade or make specific investment decisions from his show, which he even admits is entertainment first.

Jimmy Boy @Mark,

Thanks for the link.

Market prognosticators make predictions that are often forgotten by investors.

These individuals' past prediction history can be very revealing.

The majority of "gurus" listed on the

Guru Grades site have an accuracy rating of less than 50%*.

I was surprised to learn that Ken Fisher had the second highest accuracy rating (66.4%).

I've been bombarded with ads from his firm, Fisher Investments, over the

years.

*I haven't researched

Guru Grades' grading methodolgy.

Global Bonds Rally as Meta, Growth Concern Fan Demand for Havens "For years Meta has been one of the largest stocks by market cap and one of the most widely held names by mutual funds, and a handful of them have particularly large weightings in the company in their portfolio.

We looked at which funds invested the most in Meta, and which had the highest exposure within their portfolio."Link

Worst day for bonds I’ve seen in a while This job report released today is the main cause of the spike in rates.

StoryISTM the Fed’s control farther out (10

years) is minimal. Simply jacking up the overnight lending rate (which has been signaled in advance) could have the opposite impact on the 10-year bond if it causes investors to think the economy is about to slow. They might actually sell equities and buy bonds for protection. On the other hand, if the Federal Reserve stops buying bonds or begins to sell off their huge existing balance sheet that should cause longer rates to rise, as there’d be a larger supply of bonds looking for new owners.

It’s worth considering the effect on various types of hybrid funds. Balanced or allocation funds holding longer dated bonds will suffer inordinately. So will many hedge-type funds. Funds like TAIL (I own), SWAN, and DRSK invest mainly in bonds (around 90% of their assets). The remaining roughly 10% is used for options trading designed to protect against equity market downside.

International Version of PRWCX If one could reliably

predict that variance (1.51%) 10

years in advance (as in the case of fixed rate mortgages) I’d be moved.

But I don’t know how to forecast that far out. I find the two funds’ returns over a full decade remarkably similar considering all the unknowns that exist over that long a period. I’ll continue to hedge my bets by holding both in roughly equal amounts. Should those past numbers hold into the future, I’ll see a difference (loss) of roughy $2,150 over the next decade for every $10,000 invested. Averaged out over 10

years that’s

approximately $215 per year or 60-cents a day on a combined $10,000 investment - the added cost of spreading out risk.

Great number crunching from everyone. The visual from

@Observant1 is very impressive.

Afraid I couldn’t even name the current manager of DODBX today. (Low in celebrity status). Am aware that fund may soon be undergoing some revision by D&C.

International Version of PRWCX The ten year numbers are also the difference between a 197% cumulative return and a 240% one. Both calculations are correct, just a difference in perspective, one cumulatively from the initial investment, and one the percentage of difference—14.4%—between the end investment numbers. For a $10,000 investment, it would be the difference between a $34,000 end investment after ten years and a $29,700 one. The more money you invest, the worse those differences seem.

International Version of PRWCX Thanks for the fact checking. Remember the old Avis commercial from the 70s?

“We’re #2. So we try harder!”

In another year after DODBX has pulled ahead for 10 years, please run those numbers again.

International Version of PRWCX

International Version of PRWCX To say “Over 10 years, it leads DODBX by only 1.5%” annualized and assume that is a small amount I would suspect misunderstands the power of compounding. But I haven’t done the math in this case.

International Version of PRWCX For 15 years PRWCX outperforms DODBX by 2.44% PER YEAR, that's a substantial difference.

9.87% vs 7.43%.

Fund Screener Results One of the things I’ve noticed on MFO Premium and Morningstar results is anything with technology held up well in 2020 and has skewed volatility rankings when searching for something less volatile lately. It’s probably skewed things for 10 years, but doesn’t look like it will work going forward if this trend continues.

International Version of PRWCX :(

PRWCX down -1.16% today.

I don’t care if PRWCX is up or down. Just tired of Giroux being worshiped at the alter!

Over 10

years, it leads DODBX by only 1.5%. The gap has been narrowing for a year or more. And DODBX did slightly better today.

10 year performance from Lipper as of yesterday:

PRWCX +13.01%

DODBX +11.50%

Not to trash PRWCX (I own it). Just don’t believe in hero (or fund) worship.

No Distributions, Genuine Declines, 2/3/22 Yes but think of how much they've gone UP over the past many years.....

But sadly mass-market psychology (and/or lack of experience) doesn't always understand that context.