It looks like you're new here. If you want to get involved, click one of these buttons!

On our last trip to Europe the guy behind me was coughing and hacking for 5000 miles. There was "relatively" enough airflow to do me in. Took me one day to come down with his virus and three weeks to recover. Don't even talk to me about the wonderful ventilation systems on planes."As a ventilation engineer with 40+ years experience in exposure control (including biohazard labs) I find the assertion that general ventilation on an aircraft - as opposed to local exhaust - will effectively control close quarter exposure to "droplets" (or, more technically correct, an aerosol from coughing, sneezing or talking) is questionable."

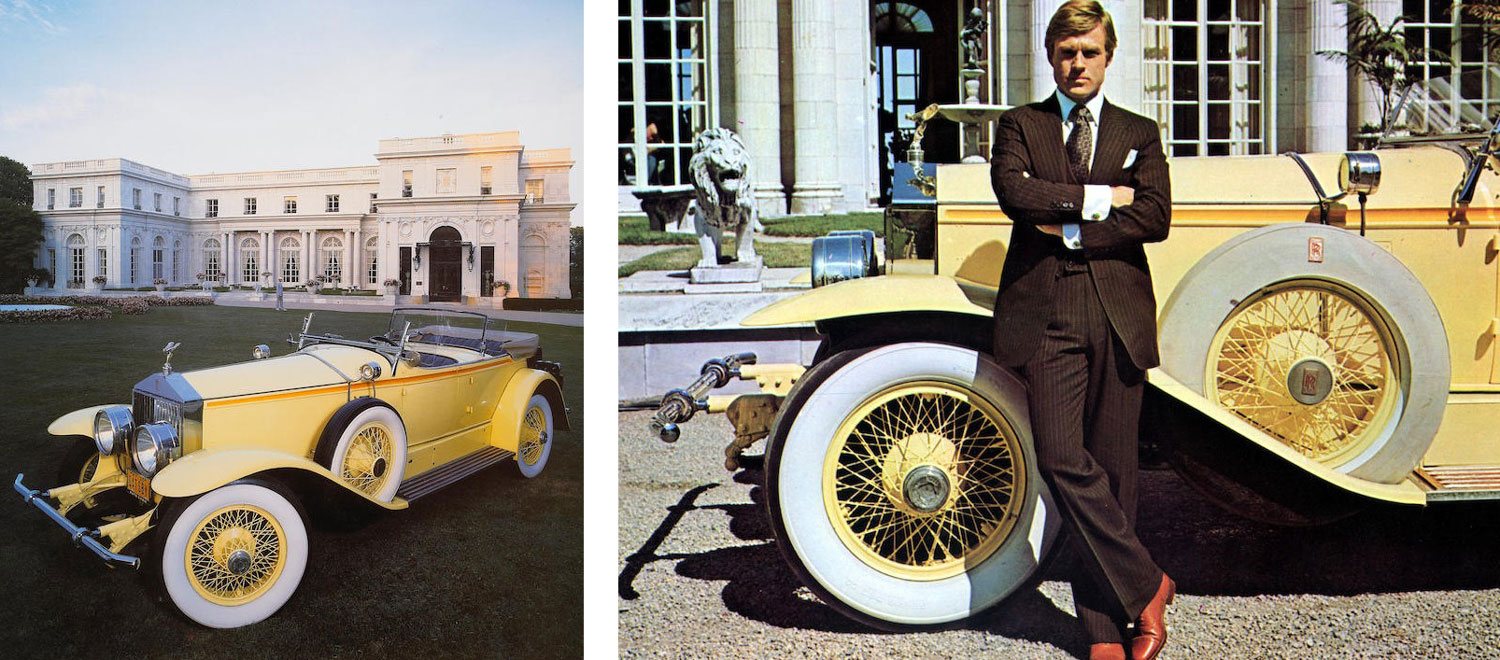

https://usfunds.com/investor-library/investor-alertA little over a hundred years ago, the United States emerged from the double whammy of a world war and deadly pandemic. Eager to get back to “normal” life, Americans went on a decade-long spending splurge, buying cars and radios and stocks.

Although we all know how it ended, the Roaring Twenties was largely a product of pent-up demand.

This summer, I believe we could see the start of a similar demand-driven economic boom as millions of Americans, newly vaccinated and $1,400 richer, make up for lost time by booking flights and vacations, going on cruises, visiting family out of state and more.

As I shared with you earlier this month, close to $18 trillion sit in Americans’ savings accounts right now—a record amount. Much of this cash is just waiting to be unleased into the U.S. economy.

and,In a world where the conventional wisdom is that retirees should reduce their equity exposure throughout retirement as their time horizon shortens, this research suggests that in reality, the ideal may actually be the exact opposite.

I have often thought...if the portfolio is depleted too severely by withdrawals and bad returns in the early years, there won’t be enough (or any) money left for when the good returns finally arrive. And notably, the truly dire situations are not merely severe market crashes that occur shortly after retirement, but instead the extended periods of “merely mediocre” returns that last for more than a decade, which are far too long to “wait out” just using some cash and intermediate bond buckets. Conversely, when the equity glidepath is rising and the retiree adds to equities throughout retirement (and/or especially in the first half of retirement), then by the time the market reaches a bottom and the next big bull market finally begins, equity exposure is greater and the retiree can participate even more!

US News runs third party numbers through its algorithm to produce its rankings. In this sense it's similar to M*'s star ratings, except M* doesn't exclusively use third party data, so M* has a small but non-zero ability to jigger its figures.RE: US News Rankings...

You really don't need to go any further than looking at their #1 ranked SCV fund, DFFVX.

...

Seriously, ONCE in the Top Ten percentile in 11 years, and it's magically the #1 ranked SCV fund?

...

Kind of reminds me of some of the old stock "Supervised Lists" from back in the 80's, some of which required the company to fund the inclusion of their stock on the list, if you get my drift

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla