@Old_SkeetIf this down draft continues,you might have to revive these threads.Your observations and insights were appreciated and well recieved by many of us.

From January 2016...............

Day Six & Day Seven ... Recent Selling Stampede Might Soon Be Ending

It's Day Eight /// Surprise ... Surprise ... Surprise!!

It's Day Nine ... Selling Stampede Continues ... Perhaps Plunge Protection Team Will Step In

Market Day Eleven ... It's Off to the Races

http://www.mutualfundobserver.com/discuss/profile/discussions/472/Old_SkeetARBITRAGE CREDIT OPPORTUNITIES ACFIX

Q3 2016 COMMENTARY

With several quarters of positive market performance

behind us, the fourth quarter could introduce new

volatility and opportunities given the upcoming US

elections, increased news flow detailing the UK’s plan

to exit from the EU, and the specter of December

interest rate hikes. As we saw during 2014 and 2015,

market gains can quickly reverse as investor

sentiment and direction rapidly change. While we may

not be able to predict political or economic outcomes

with certainty, we are aware of the risks and

outcomes that can result from changing events

https://arbitragefunds.com/restricted/get/Credit_Opportunities_Commentary.pdfThe death of retail isn't a problem for StarbucksNov. 4, 2016 3:50 PM ET By: Clark Schultz, Seeking Alpha News Editor

Starbucks (NASDAQ:SBUX) CEO Howard Schultz delved into some interesting large-scale retail issues during the company's earnings call yesterday.Schultz first noted that FedEx CEO Fred Smith shared some research with him confirming the significant drop in store traffic globally amid the 'Amazon Effect" across industries -- before

he really turned up the retail bear rhetoric.Q and A from SBUX conference call. Earnings Call Transcript (page 14-15)

John William Ivankoe - JPMorgan Securities LLC

Hi. Thank you. Howard, I was going to ask you to maybe apply the current environment in terms of what we're seeing both in the U.S. and around the world in the consumer environment,

Howard S. Schultz - Starbucks Corp.3rd Q

I was talking to Fred Smith just a couple of weeks ago about his situation at FedEx and he shared with me a piece of research which showed a significant drop in foot traffic on Main Street and in malls, not only domestically and around the world, as a result of e-commerce, the Web, and what I'll loosely describe as the Amazon effect. As a result of that, you're certainly seeing large companies and small companies not only not open new stores, but announce closures.

And let me just speak to that. I know this is a little long-winded but I think it's important. There's no doubt that

over the next five years or so, we are going to see a dramatic level of retailers not be able to sustain their level of core business as a traditional bricks-and-mortar retailer, and their omni-channel approach is not going to be sustainable to maintain their cost of their infrastructure. And as a result of that, there's going to be tremendous amount of changes with regard to the retail landscape.We believe, as we look down that pipe and look at the future, that our ability to maintain our growth in terms of new stores domestically and internationally, coupled with the fact that Starbucks still maintains a very special place in terms of a sense of community, the third place environment, and people looking for and seeking out human contact and a place to go, that as these store closures occur, and they will, that we are going to be in a very unique position five

years, 10

years down the road because there's going to be a lot less people competing for those customers. I'm not talking about the coffee category; I'm talking overall.

But we are in the very, very early stages of a tremendous change in the bricks-and-mortar footprint of retailers domestically and internationally as a result of the sea change in how

people are buying things, and that's going to have, I think, a negative effect on all of retail.

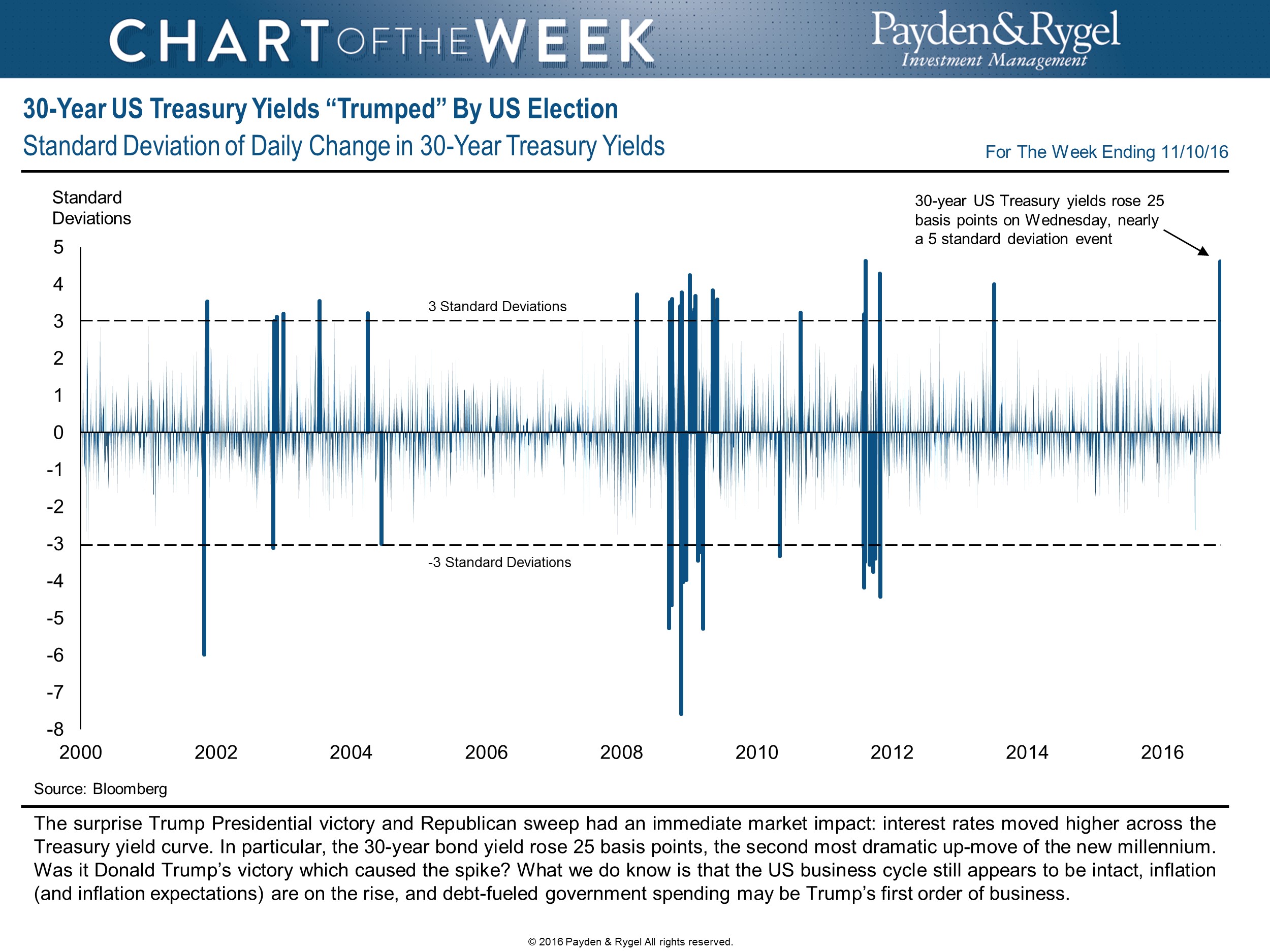

http://seekingalpha.com/article/4019416-starbucks-sbux-q4-2016-results-earnings-call-transcript?page=15Highlights of the Week:© 2016 Payden & Rygel

Equities Investors have been risk averse in light of the macro uncertainties, ignoring the first positive quarterly earnings growth in seven quarters.

Corporates: Corporate fund flows had a $2 billion out flow from mutual funds and ETFs

Securitized highlight of the week’s deal flow was the

$1 billion refinance of the Cosmopolitan Hotel in Las Vegas by Blackstone Real Estate

High Yield despite short-term volatility, the economic fundamentals that drive capital markets’ performance remain solid.

Municipals: Municipal issuance in October totaled approximately $53 billion, the largest total in 30

years and up 57% year-over-year...demand remained robust and municipal funds received approximately $1.7 billion of inflows during the month

.

https://www.payden.com/weekly/wir110416.pdf