Robert Cochran's column, in its use of mean reversion and inflation/real return, has left me befuddled.

"

Reversion to the mean" simply expresses the tendency of next year's returns to be closer to the long term mean than the current year's returns are.

Underlying mean reversion is the assumption that each year's performance is independent of the previous one's. That is, mean reversion applies to random variables.

Assuming a long term mean of 9-10% for stocks (as stated in the opening sentence), and assuming 2016's return comes out about 12% (extrapolating from 8% YTD), mean reversion suggests that it is more likely next year's returns will be lower (closer to the mean of 10%) than higher (further from the mean). That's all.

Many prognosticators suggest that stock returns going forward will average around 4-5% (with an assortment of solid reasons backing this up). Mean reversion would seem to cut against this, as it implies, quite literally, reversion (coming closer) to the mean of 10%. IMHO this just shows that mean reversion doesn't apply here - yearly returns are not random variables.

Regarding real returns and inflation - if inflation is assumed to run at 2-3% (it isn't now, but it is expected to increase), then SS should also increase in nominal terms 2-3%, not the 1% projected. In real terms (

as measured by CPI-W), SS payments do not decrease.

The 5% average figure for bonds over the past 15

years suggests that "bonds" means 10 year bonds. See

here (geometric average over past ten

years was 4.71% for 10 year bonds). That same source also shows an average near 5% (4.96%) for the past 85

years. Arithmetic averages are similar, though slightly higher (a small fraction above 5%).

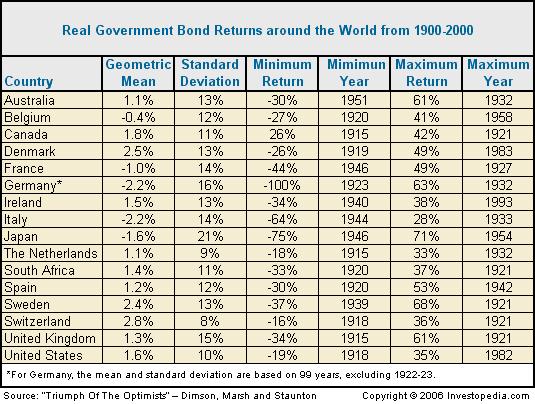

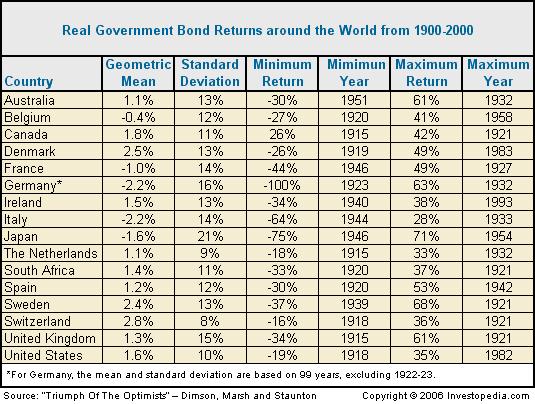

So it seems fair to use last century's (100 year) average

real returns for 10 year bonds as "normal" returns. That average real return was around 1.6% in the US:

If you prefer,

1.7% real return for 1900-2002 (based on Shiller data)

So I don't understand what the big deal is about a 0-2% real return going forward. That sounds about normal.

If anything, achieving typical real returns with lower nominal returns and lower inflation is beneficial to fixed income investors. That's because taxes are based on nominal returns, not real returns. So achieving the same real returns and paying less in taxes (lower nominal returns) seems like a plus.

In the broad picture, I agree with the expectation that both stock and bond returns will be lower going forward. But not as explained. Stocks may violate mean reversion (i.e. overshoot the mean on the low side, rather than simply dropping closer to the mean). Parallel increases in prices and rates would keep bond real returns closer to zero.