It looks like you're new here. If you want to get involved, click one of these buttons!

True the equity/bond asset allocations are a bit different. Still, the equity profiles are similar:The equity profiles are quite similar, .....Important to note significant differences between the two funds in equity holdings: VWINX 36% with HBLYX holding 44%.

https://dodgeandcox.com/pdf/shareholder_reports/dc_income_semi_annual_report.pdfIn the first six months of 2020, we established new positions in over a dozen corporate issuers at what we believe were exceptionally attractive valuations. These purchases, along with many additions to existing corporate issuers, increased the Fund’s Corporate sector weighting by 11 percentage points to 45%.

To fund these purchases, we sold certain Agency MBS and U.S. Treasuries, which now make up 31% and 8% of the Fund, respectively. We lengthened the Fund’s duration modestly through the aforementioned corporate bond purchases, though we remain defensively positioned with respect to interest rate risk.

Are riskier-hedges-are-displacing-u-s-debtMany investors have no choice but to stick with Treasuries because of fund mandates, or they do so since they’re unconvinced it’s worth taking a chance on something else. Yet others are exploring riskier assets -- from options to currencies -- to supplement or fill the role of portfolio protection that U.S. government debt played for decades, a trend that highlights the dangers that the Fed’s rates policy can create.

and,

Options Hedge

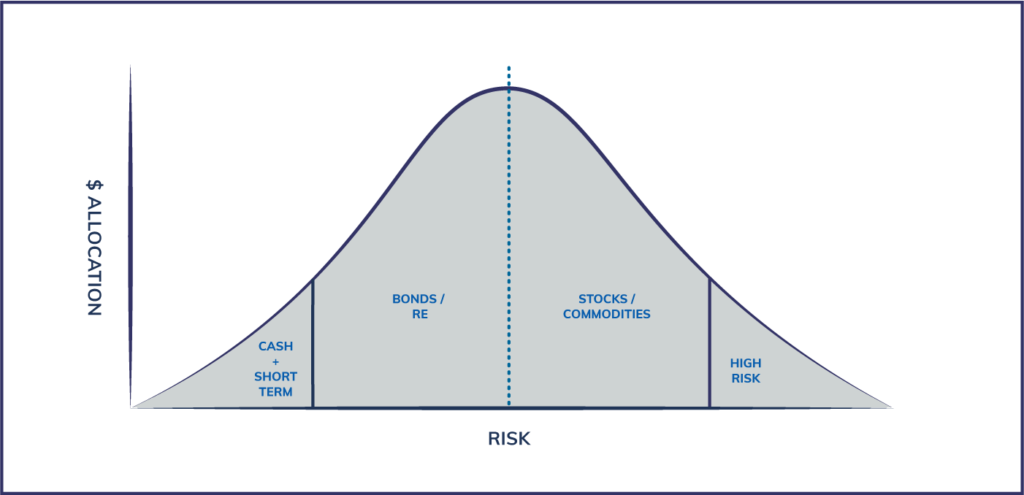

Swan is a longtime skeptic of Modern Portfolio Theory, which was made famous by economist Harry Markowitz in the 1950s and is the thinking upon which the 60/40 mix is based. Two decades ago, Swan created a strategy of using long-term put options plus buy-and-hold positions in the S&P 500 to limit huge losses during economic downturns.

That approach has since been expanded to include positions in exchange-traded funds indexed to small cap stocks, and developed and emerging markets. It relies on constant allocations of 90% to equities and 10% to put options purchased on the underlying ETF portfolio.

Several officials at the Fed are beginning to worry about asset bubbles and excessive risk-taking as a result of their extraordinary policy interventions, James Politi writes for the Financial Times, citing interviews with multiple Fed presidents and members of the Board of Governors.

Details: Some are now pushing for "tougher financial regulation" as concerns grow that monetary policy is "encouraging behavior detrimental to economic recovery and creating pressure for additional bailouts."

What they're saying: “I don’t know what the best policy solution is, but I know we can’t just keep doing what we’ve been doing,” Minneapolis Fed president Neel Kashkari told the FT.

“As soon as there’s a risk that hits, everybody flees and the Federal Reserve has to step in and bail out that market, and that’s crazy. And we need to take a hard look at that.”

Boston Fed president Eric Rosengren called for a “rethink” of “financial stability” issues in the U.S., and Fed governor Lael Brainard said in a speech last month that expectations of extended low-interest rates were boosting “imbalances” in the U.S. financial system, Politi reported.

Why it matters: Economists, strategists and fund managers on Wall Street have said for months that the Fed has effectively killed price discovery by "nationalizing" the bond market with its actions and is artificially holding up the price of financial assets.

That has elevated U.S. economic inequality, and while market participants have cheered, the Fed's popularity has sunk among most Americans.

Much of the U.S. economy, including jobs and spending at small businesses and firms not dedicated to e-commerce, continues to be weak.

The big picture: The latest comments from Brainard, Rosengren, Kashkari and others suggest that influential members of the Fed's policy-setting committee may be pushing back against the so-called Fed put — a belief among investors that if stock prices fall enough, the Fed will bail them out by lowering interest rates or by pushing trillions of dollars in liquidity into financial markets through quantitative easing.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla