It looks like you're new here. If you want to get involved, click one of these buttons!

See 15 years of risk/reward(link).I think you got the mandate wrong there. D&C is not required to beat the S&P 500. They are acting to select value stocks which they deem safer and worthy of their clients money. It's obvious to me that many investors do, judging by the AUM. For many of them it's not just all about who has the biggest pile of money at the end of the day. Not everyone can make trades after the fact.

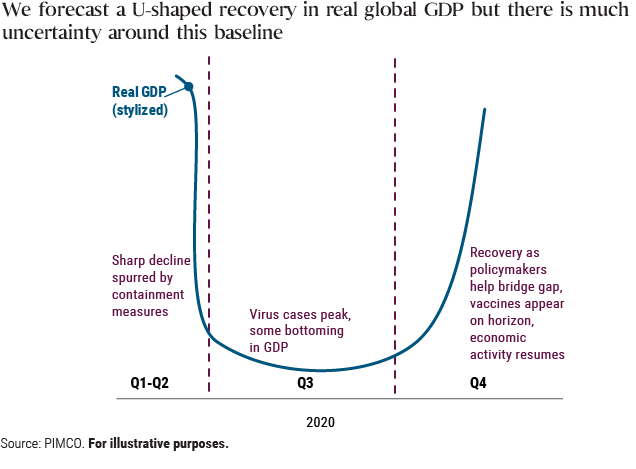

We are seeing the first-ever recession by government decree – a necessary, temporary, partial shutdown of the economy aimed at preventing an even larger humanitarian crisis. What is also different this time is the unprecedented speed and size of the monetary and fiscal response, as policymakers and monetary authorities try to prevent a recession turning into a lasting depression.

We believe this crisis is likely to leave three long-term scars:

Globalization may be dialed back

More private and public debt

Shift in household saving behavior

We believe a caution-first approach is warranted in an effort to protect against permanent capital impairment.

https://finance.yahoo.com/news/investor-who-predicted-the-start-of-the-2009-bull-market-were-not-in-the-clear-yet-104234346.htmlLegendary investor Mark Mobius.....was asked Monday if the recent 20% rally off the bottom of the quickest bear market in history signaled an all-clear for investors...Mobius cautioned investors....“I think it's a little early to predict that because given the lockdown that we have seen globally in so many countries around the world, the impact of this lockdown on businesses, it's not going to be seen immediately..... I believe that once the numbers start coming in, people will be somewhat disappointed.”

...historical bear markets on a global scale have averaged a larger 30% to 50% drawdown spread out over the span of roughly two years. “The most expensive words in the world are ‘This time is different.’ I don't think this time it's different,” he said. “I think we’re probably maybe going to do a double bottom, jumping down again and pushing up again.”

“The recovery may take longer than people expect,” he predicted, barring any absence of a New Deal-like work program. “It's going to be a real challenge to get these people back to work.

how-pandemic-proof-globalizationAs airports, factories, and shops slow down or shut down, the novel coronavirus pandemic is testing the international supply chains that define the current era of globalization. And the multi-factory and often multi-country manufacturing processes used by companies around the world are proving more fragile than anticipated. If the virus and the economic wreckage it is causing aren’t contained soon, blueberries and avocados won’t be the only things missing from market shelves across the still chilly Midwest and Northeast United States. Cars, clothes, electronics, and basic medicines will run short as far-off factories disconnect.

Do the best companies always get to the top? That is the $10,000 question. Saying they do is basically an argument for efficient markets, that only the best companies rise to the top and are priced as they should be. If you believe that, fine. Many people do. But then there's no reason to be on a board devoted to undiscovered actively managed funds like this one. In fact, your investment decision is relatively simple. Buy Vanguard Total Stock Market ETF (VTI) and be done with your equity allocation. No need to consider factor active funds D&C's or factor index ones like VTV because the market is always right in such a view.The whole idea of the SP500 is the fact that the best companies get to the top and why this simple "stupid" cheap brilliant idea works

Can't claim the expense ratio card when VTV beat DODGXI do sometimes wonder when there are contentious posters who rarely comment on this board and then suddenly do to insult folks if some people don't have multiple identities here. I know it's happened before.

D&C has a number of positive traits analysts like--low fees, low turnover or trading costs, long tenured managers, carefully thought out products without an excess of launches, a lack of celebrity jerk managers from the team approach and consistency of style. All of that said, value has been a terrible place to be since the end of the 2008 crash. D&C are value managers and ones that sometimes take on more risk than they should, investing in particular in financial stocks that can suffer from leverage problems for instance. That is a value managers' bread and butter, but some competing value managers have done better with more of a quality overlay. High quality value--with less leverage and more consistent earnings--is not as cheap as "value classic," but it tends to hold up better in downturns.

Oh, regarding the S&P 500 fund(s), it most definitely isn't a value fund. The way it works is at the beginning of a bull market it has value characteristics and at the end of one it has growth characteristics as the largest most popular stocks dominate it. What it really is is a momentum fund, and when the momentum is positive as it has been for a long time until now, the most popular stocks get an increasingly large weighting and they are invariably the growthiest names. Comparing it to D&C most definitely is wrong.

The larger question that seems to get asked repeatedly on this board is is value investing dead? A better question I think is do you think the tech sector darlings that comprise the lion's share of growth indexes will continue to dominate the world forever or will other less popular sectors eventually make a comeback? The academics would have us believe that as the ur-factor bigger than JC in finance, it must eventually come back. But much of what constitutes financial academia is really weak science at best. There is a lot more evidence for anthropogenic climate change, and a significant portion of failed scientists/poor mathematicians and snakeoil salesmen in finance don't believe in that, yet do believe in the value factor or say they do to sell their actively managed higher cost products.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla